The Profit Margin: August 28, 2023

Statistic of the Week

The finance industry has been gradually leaving industry centers in New York and California. As companies move their headquarters (primarily to the South), the financial assets that they manage move with them. Since the end of 2019, both states have lost approximately $1 trillion in liquid assets.

Global Perspective

Rice prices hit their highest level in nearly 12 years and are stoking fears of food inflation in Asia. Poor growing conditions caused by the weather coupled with India’s rice export ban are being blamed as the primary drivers. Analysts believe that the Philippines is the most vulnerable nation to a surge in food prices

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: GDP Revision, Pending Home Sales, ADP Employment Report

Thursday: Jobless Claims, PCE Index, Personal Income and Spending

Friday: Nonfarm Payrolls, ISM Manufacturing

Commentary

Domestic equities showed mixed performance last week amidst volatile trading. The Nasdaq and the S&P 500 were both able to snap three week losing streaks while the DJIA finished in negative territory.1 The DJIA fell 0.45%, the S&P rallied 0.82%, and the Nasdaq jumped 2.26%.2 Despite the volatility in equities, bond yields were nearly unchanged. The 10-year Treasury finished Friday with a yield of 4.23%, down 0.02% from the week prior.3

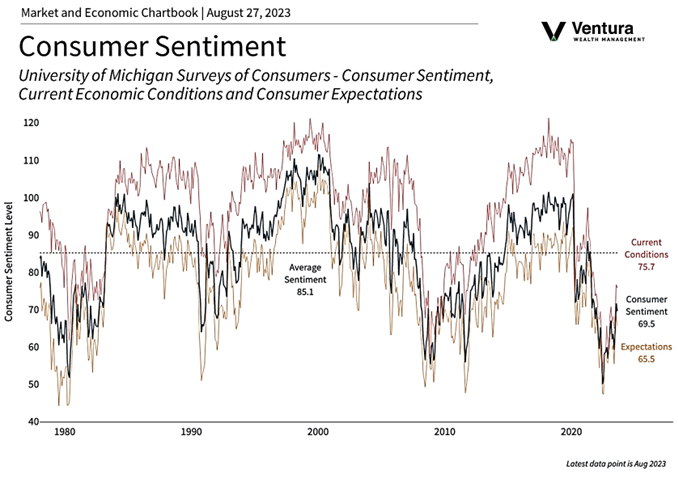

Entering the last few trading days of the month, investors are once again focused on Federal Reserve policy, inflation, and the strength of the consumer. Chair Powell’s speech at the Jackson Hole conference last week had a slightly more hawkish tone than investors had anticipated,4 but not so much so that it spooked the equity or fixed income markets. Right now, there is a low probability of a rate hike at the September FOMC meeting, but markets show a 50/50 chance at the November meeting.5 Two data points we will receive this week, the PCE Index (inflation) and Nonfarm Payrolls (employment / consumer), will inform the FOMC’s decision. Notably, with “back to school” shopping in full swing, some retailers are cautioning that the consumer is slowing. Others are reporting very strong demand. Consumer Sentiment (chart right) survey data suggests that the ongoing tax of inflation is causing consumers to evaluate their purchase decisions. The week ahead could be choppy.

Chart of the Week

Consumer Sentiment, based on survey data from the University of Michigan, dipped in August. Concerns about short and long term inflation expectations were largely to blame. The reading was below analyst forecasts.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, University of Michigan, Reuter’s

Statistic of the Week:

Bloomberg Opinion

Global Perspective: CNBC International

Commentary:

1. Investor’s Business Daily

2.Bloomberg

3.Bloomberg

4. Investor’s Business Daily

5. Investor’s Business Daily