The Profit Margin: August 26, 2024

Statistic of the Week

For the first time ever, a standard gold bar is worth more than $1 million. The average gold bar weighs 400 troy ounces. With gold now trading above $2,500 / troy ounce, that puts the price per bar above $1 million. Gold prices are up over 20% year to date. Central banks and investors around the globe have been accumulating the precious metal.

Global Perspective

Global millionaires are on the move – and where are they are moving from and headed to may surprise you. China is expected to have the largest departure of millionaires this year, followed by the United Kingdom and India. South Korea is also expected to have a net outflow. The United Arab Emirates is expected to have the largest inflow of millionaires, followed by the United States, Singapore, and Canada.

Market Moving Events

Tuesday: Consumer Confidence

Thursday: Jobless Claims, Trade Balance, Pending Home Sales, GDP Revision

Friday: Personal Income and Spending, PCE Index, Consumer Sentiment

Commentary

Equity markets continued their recovery rally last week, with all three major averages finishing in positive territory. The DJIA was the week’s weakest performer, moving 1.27% higher.1 The Nasdaq climbed 1.40%.2 And the S&P 500 was the leader, rallying 1.45%.3 On the week, yields declined as bond prices rose. The 10-year Treasury bond yield hit a 52-week closing low on Wednesday.4 It finished Friday with a yield of 3.80%, down 0.08% from the week prior.5

The most significant price action in both the equity and fixed income markets came on Friday as the market responded to Federal Reserve Chair Powell’s remarks at the Jackson Hole Economic Symposium. The speech was largely interpreted as being “dovish,”6 signaling to the markets that rate cuts were on the way. In his remarks, Powell said, “The time has come for policy to adjust.”7 The FOMC is focusing on the stability of the labor markets. Powell noted that further deterioration of the labor markets would be “unwelcome”8 and that “downside risks to employment have increased.”9 Currently, markets are placing the odds of a 0.25% rate cut at 63.5%, and odds of a 0.50% rate cut at 36.5%.10 Friday’s PCE data, along with the August Nonfarm Payrolls report will play a central role in determining the magnitude of the cut at the September meeting.

While earnings season is mostly behind us, investors will be focused on Nvidia’s report Wednesday. Expectations are high for the market darling. Tensions in the Middle East rose over the weekend, and we will receive a key inflation reading on Friday. Odds are, it won’t be a boring week.

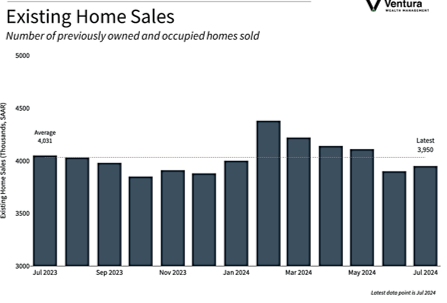

Chart of the Week

Existing home sales for the month of July were reported to be in-line with analyst estimates. July’s reading of 3.95 million annualized was an improvement from June, but still below the average annualized rate of 4.01 million.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

National Association of Realtors

Statistic of the Week:

CNN.com

Global Perspective:

Financial Times

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Investor’s Business Daily

5.MarketWatch.com

6. Goldman Sachs Asset Management

7. Investor’s Business Daily

8. Goldman Sachs Asset Management

9. Investor’s Business Daily

10. Investor’s Business Daily