The Profit Margin: August 22, 2022

Statistic of the Week

As the “will we or won’t we have a recession” debate rages, the health of the consumer remains a focal point. Inflation is clearly impacting this critical component of the economy. 23% of Americans have made “drastic changes” to their spending, while an additional 61% have cut back in some areas. 50% of respondents made some changes to their driving habits. Also, 38% postponed major purchases as a result of inflationary pressures.

Global Perspective

While the US has a labor shortage, the globe continues to have an unemployment problem for late teens and young adults. There are approximately 73 million unemployed young people (aged 15-24) across the globe. This number is expected to fall slightly over the course of the next twelve months. Notably, the unemployment rate for this age cohort remains higher than pre-pandemic levels.

Market Moving Events

Tuesday: New Home Sales

Wednesday: Durable Goods Orders, Pending Home Sales

Thursday: Jobless Claims, GDP Revision

Friday: PCE Index, Income and Spending, Consumer Sentiment

Commentary

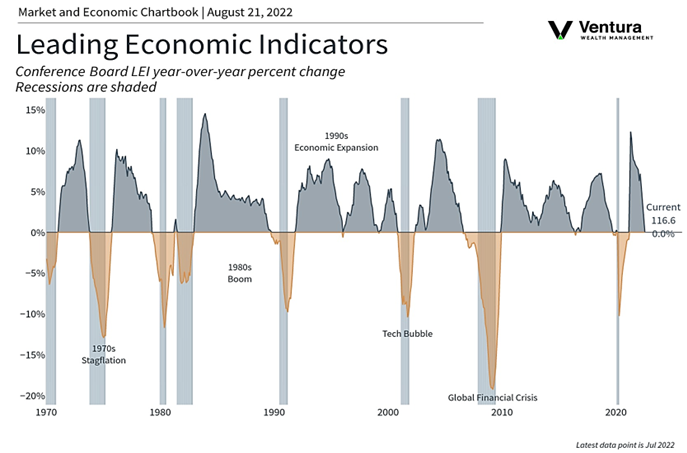

The Profit Margin turns 10 years old today. And just like 10 years ago, the global economy is at a crossroads. Today we are in a continuous tug-of-war between inflationary pressures and the Federal Reserve. This tug-of-war leaves many investors concerned that the Fed’s restrictive actions to cool inflation will ultimately cause the economy to stall, creating a recession. This fear is well-grounded. The Index of Leading Economic Indicators (chart right) registered a negative monthly change for the fifth consecutive reading in a row. At the same time, business confidence is waning. A recent survey by Stifel found that 97% of executives believe we are already in a recession or will enter a recession within the next 18 months.1 Concurrently, inflation is taking its toll on the psyche of the consumer (see the “Statistic of the Week”).

In days ahead, the Federal Reserve will have its annual Jackson Hole Economic Symposium. Investors will be looking for cues from the Fed to see if they are planning a “pivot” away from more restrictive monetary policy. (We believe the answer to this question will be “no”). Since the equity market lows in June, optimistic investors have been looking for the Federal Reserve to start to ease off the brakes; this week’s conference will signal if this is likely. On Friday the Fed’s favorite inflation indicator, the PCE, will be released. It is not unreasonable to expect markets to be responsive to headlines this week – there will be plenty of them.

Chart of the Week

Sources

Statistic of the Week:

Kiplinger’s Magazine

Global Perspective:

Forbes.com

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

The Conference Board

Commentary: 1.Yahoo!Finance