The Profit Margin: August 21, 2023

Statistic of the Week

While it is clear we are not in a recession at this point, some economists are arguing that the U.S. economy is experiencing a “richcession.” As the unemployment rate sits near a 50-year low of 3.5%, many of the layoffs in 2022 and 2023 targeted white-collar workers. This is impacting consumer spending habits. 61% of American households are now living paycheck to paycheck and credit card debt is near an all-time high. With consumer spending making up about 70% of domestic economic activity, this bares watching.

Global Perspective

Asian credit markets posted one of their worst weeks of the year despite Chinese officials increasing their efforts to strengthen their domestic financial markets. Both stocks and the yuan have had recent declines as Chinese property developers (state owned) have warned of potential losses. This is occurring as the shadow banking system is being reported to be showing signs of cracks.

Market Moving Events

Tuesday: Existing Home Sales

Wednesday: New Home Sales

Thursday: Jobless Claims, Durable Goods Orders, Jackson Hole Summit Federal Reserve Interviews

Friday: Consumer Sentiment, Chair Powell Jackson Hole Speech

Commentary

Summer doldrums, concerns surrounding the fragility of the Chinese financial system (see Global Perspective), and rising yields conspired to push equity prices lower for the week. All three major averages finished the week in the red. The S&P 500 was the week’s best performer, dropping 2.11%.1 It was followed by the DJIA, which retreated 2.21%.2 The Nasdaq, which is still the best performing major domestic index on a year-to-date basis, fared the worst, dipping 2.59%.3 Notably, the Nasdaq fell into correction territory last week.

The 10-year Treasury yield hit a 15-year high last week and finished Friday with a yield of 4.25%.4 Investors have been pushing longer-term bond yields higher while shorter-term bond yields have remained fairly consistent. This is making the much-discussed yield curve look more “normal” and less “inverted.” As interest rates rise, growth assets (like those represented in the Nasdaq) are likely to remain under pressure. Recent economic reports, like last week’s retail sales figures, continue to show that the U.S. economy is staying out of recession. (The Atlanta Fed’s “GDP Now” indicator is flashing a third quarter growth rate of the U.S. economy at 5.8%. Yes, you read that correctly).5 This week, the Federal Reserve will meet at their annual Jackson Hole conference. Fed Governors have had mixed commentary on what course they believe future policy actions should follow6 – all eyes will be on Chair Powell who will make public comments on Friday.

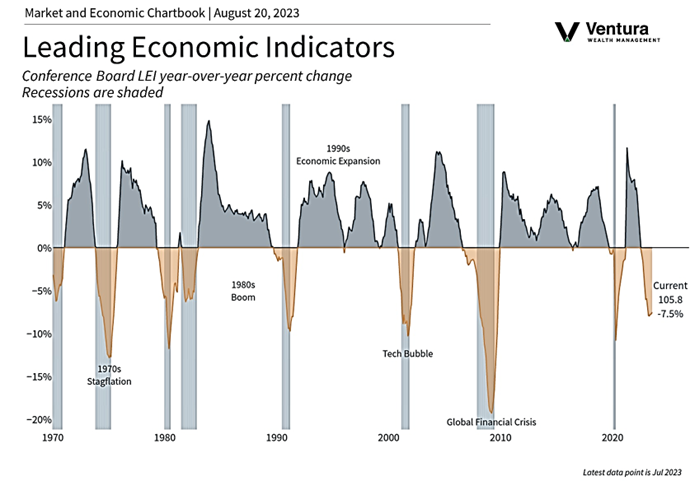

Chart of the Week

For the 16th consecutive month, the Conference Board’s Index of Leading Economic Indicators registered a negative reading. In July, the indicator fell 0.4%. The Conference Board is predicting a recession at the end of this year into early 2024.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, The Conference Board, MarketWatch.com

Statistic of the Week:

CNBC.com

Global Perspective: Bloomberg.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4. Investor’s Business Daily

5. The Federal Reserve Bank of Atlanta

6. Barron’s