The Profit Margin: August 15, 2022

Statistic of the Week

While many employees switched jobs during the pandemic and corresponding “Great Resignation,” a large number have been discovering that the grass is not always greener on the other side. In a survey with more than 15,000 respondents, 26% regret their decision to switch jobs and some are asking previous employers if they are able to return.

Global Perspective

Finding itself largely isolated in the global currency markets, Russia is seeking to add new currencies into its national wealth fund. The Russian sovereign wealth fund had just under $200 billion in assets in July. It is considering adding the Indian rupee, the Chinese yuan, and the Turkish lira to its holdings.

Market Moving Events

Monday: Empire State Manufacturing, NAHB Homebuilder’s Index

Tuesday: Building Permits, Housing Starts, Industrial Production

Wednesday: Retail Sales, FOMC Meeting Minutes

Thursday: Jobless Claims, Philadelphia Fed Manufacturing, Existing Home Sales, Leading Economic Indicators

Commentary

A series of better-than-expected inflation readings for the month of July helped the recent rally in equities continue last week. All three major domestic indices marched higher. The most diversified of the three, the S&P 500, put in the largest move higher, rallying 3.26%.1 The Nasdaq rose 3.08%.2 While the DJIA brought up the rear, moving up 2.92%.3 These were solid results across the board. Notably, the Nasdaq, which has born the brunt of this year’s market action, has now risen more than 20% from its lows at the end of June.4 The inflation readings had little impact on fixed income yields. The 10-year Treasury yield rose 0.01% on the week, finishing Friday at 2.85%.5

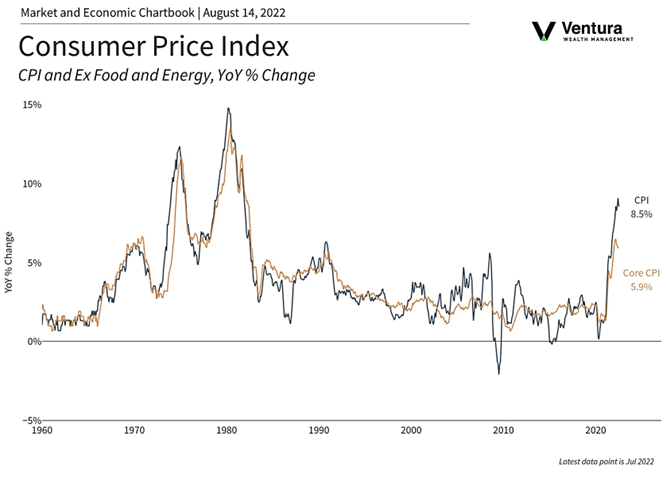

The CPI (chart right) and PPI inflation reports from last week are suggesting a decent possibility that the economy is now past “peak” inflation. Both reports came in below analyst estimates and show cooling, despite stubbornly remaining at elevated levels. This Wednesday the meeting minutes from the July FOMC meeting will be released; the market will be looking for insight as to whether the Fed will hike target rates by 0.50% or 0.75% in September.6 Also, several notable retailers will be reporting earnings this week including Home Depot, Walmart, and Target (among others). They will give a critical glimpse into the resilience of the consumer. This will happen at a time when markets have put in a strong move higher and approach critical resistance levels. It would be prudent to expect volatility.

Chart of the Week

Sources

Statistic of the Week:

CNBC.com, Joblist.com

Global Perspective:

BusinessInsider.com

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

Bureau of Labor Statistics

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4.Bloomberg 5.Bloomberg 6. Investor’s Business Daily