The Profit Margin: August 14, 2023

Statistic of the Week

Bankrate recently published their list of the “best” and “worst” states to retire, and some of the results might surprise you. The top state for retirement? Iowa – largely because of the affordable cost of housing. It was followed by Delaware, West Virginia, Missouri, and Mississippi. The worst state? Alaska, with New York as #49. The analysis looked at five categories and weighted them: affordability, well-being, health care quality and cost, weather, and crime.

Global Perspective

By issuing an executive order banning future venture-capital (VC) and private-equity (PE) investments in specific advanced technologies in China, the Biden administration escalated the technology cold war with China. The ban specifically targeted the fields of artificial intelligence, quantum computing, and semiconductors. All U.S. companies investing in those industries in China will have to inform the U.S. federal government.

Market Moving Events

Tuesday: Retail Sales, Import Prices

Wednesday: Housing Starts, Industrial Production, FOMC Meeting Minutes

Thursday: Jobless Claims, Leading Economic Indicators

Commentary

The return figures do not necessarily reflect the intra-week swings we experienced in last week’s trading action. The major averages were mixed. The DJIA was able to log a positive return, up 0.62%.1 Notably, it has the worst year-to-date performance of the major averages, up only 6.44%.2 The S&P 500 retreated 0.31%.3 And the Nasdaq fell 1.90%.4 The Nasdaq has dipped 4.9% thus far in August5 as investors have taken profits while corporate earnings’ guidance for some has missed expectations. Yields rose on the week amid mixed inflation data. The 10-year Treasury finished Friday with a yield of 4.16%.6

Much of this week’s focus will be centered on the consumer. June’s retail sales number (reported in July) was weaker than expected. This week, we will receive retail sales for the month of July where analysts expect an uptick in activity.7 A strong consumer is central to the health of the U.S. economy. Back-to-school spending is starting to ramp up. That spend is projected to total $41.5 billion this year.8 The problem? Parents are expecting to spend about 10% less in 2023 than 2022 – the first downshift since 2014.9 Beyond the retail sales reports, a number of large retailers will be reporting second quarter earnings.10

Economic data from China will also be watched carefully. A recent report showed that China is now experiencing deflation, and that exports fell 14.5% year-over-year in July.11 With tensions high, many will be watching the world’s second-largest economy.

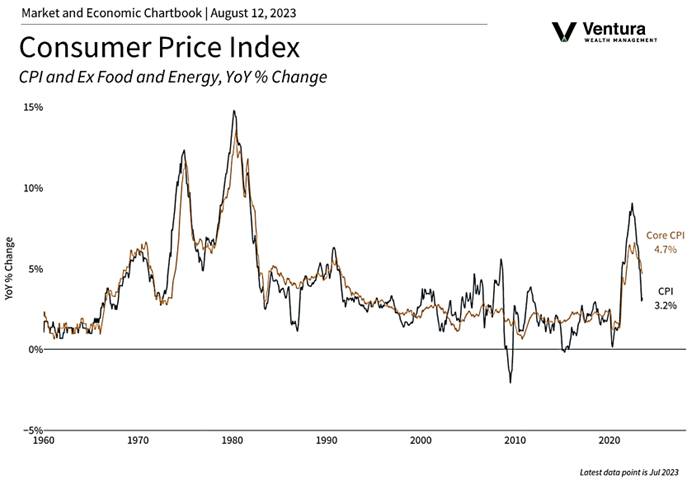

Chart of the Week

Inflation data for the month of July was slightly less than analyst expectations. Inflation rose 0.2% during the month and 3.2% for the trailing 12-month period. July’s data represents the first uptick in inflation in 13 months.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics, Barron’s

Statistic of the Week:

Bankrate.com, CNBC.com

Global Perspective: The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5.Bloomberg, Barron’s

6.Bloomberg

7. Investor’s Business Daily

8. Barron’s

9. Barron’s

10. Investor’s Business Daily

11. Barron’s