The Profit Margin: April 8, 2024

Statistic of the Week

Today’s solar eclipse across North America has many notable components. One of which is the economic impact it is expected to have. 30 million people live directly in the path of the solar eclipse. A study by The Perryman Group noted that the total economic impact of the eclipse, including downstream effects, could be a boost of $6 billion to the U.S. economy – similar to having a Taylor Swift concert in each of the cities along the total eclipse path.

Global Perspective

While global oil prices hit a five-month high as Middle East tensions continue and Ukraine attacked Russian refineries, the price of natural gas in Europe fell as it was reported that the EU had its storage tanks about 60% full – a record for this time of year. The price of the TFF, Europe’s benchmark gas contract, is less than half its value compared one year ago.

Market Moving Events

Wednesday: Consumer Price Index, FOMC Meeting Minutes, Wholesale Inventories

Thursday: Jobless Claims, Producer Price Index

Friday: Import Prices, Consumer Sentiment

Commentary

It was not the prettiest week on Wall Street… and we are not talking about Friday’s earthquake. All three major U.S. averages finished the week in the red. The Nasdaq held up the best, retreating 0.80%.1 The S&P 500 fell 0.95%.2 And the DJIA had its worst week of the year, dropping 2.77%.3 Bond yields rose( meaning prices fel)l. The yield on the 10-year Treasury jumped 0.09% to finish Friday at 4.40%.4 We are hovering around the highest yields on the 10-year Treasury since November of last year.5 In a case for diversification, gold closed the week up over 3% and hit a record high during the week’s trading.6

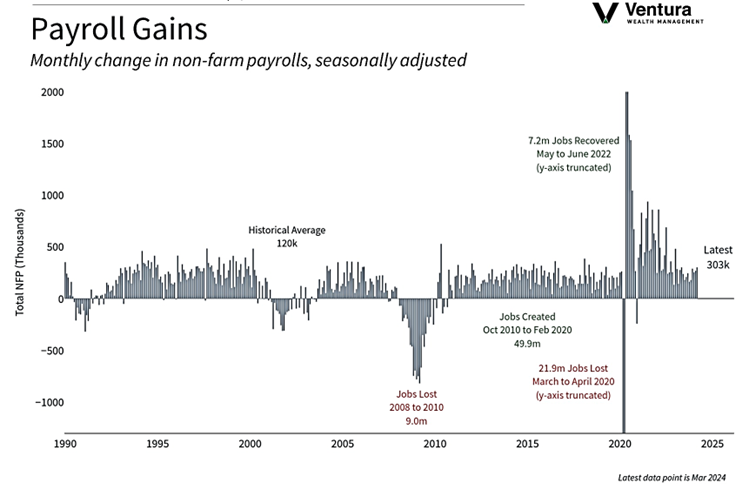

Markets had a negative bias for most of last week, and became more dour on comments made by Neel Kashkari, president of the Federal Reserve Bank of Minneapolis. He indicated that he thought it was a possibility that the Fed would not reduce rates at all during 2024.7 Yet, as of Friday’s close, the futures markets were placing about a 50/50 likelihood of the FOMC beginning the rate cut cycle at the June meeting.8 We should learn more this week as numerous FOMC officials are scheduled to give public remarks, and the minutes from the March FOMC meeting will be released on Wednesday. Last Friday’s nonfarm payrolls report (chart right) makes it difficult to argue that the labor market is on anything but solid ground. Good employment figures lean inflationary. Investors will be monitoring both Wednesday’s CPI reading and Thursday’s PPI reading to get a better idea on the recent trajectory of inflation. Earnings season will also kick off with several of the major financial institutions reporting first quarter results.

Chart of the Week

The U.S. economy added 303,000 jobs in the month of March, far surpassing analyst estimates of a gain of 200,000. The unemployment rate fell from 3.9% to 3.8% and wage growth cooled slightly to a year-over-year change of 4.1%.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Investopedia.com

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Barron’s

6. Barron’s

7. CNBC.com

8. Investor’s Business Daily