The Profit Margin: April 7, 2025

Statistic of the Week

In recent years, switching jobs enabled employees to boost their salaries. However, this trend seems to have stalled in February. During January and February, employees who remained in their positions experienced an income increase of approximately 4.6% compared to the prior year, while those who sought new opportunities enjoyed a marginally higher rise of 4.8%. In 2023, job seekers received significant salary increases averaging 7.7%, whereas individuals who stayed in their current roles saw an average raise of 5.5%.

Global Perspective

On April 4th, the Chinese government responded to the recently announced tariffs by the Trump administration. China declared its intention to implement an additional 34% tariff on all goods entering from the United States. This new tariff is scheduled to take effect on April 10th, the day after the U.S. tariffs on imported Chinese goods are set to begin. The economies of the United States and China are the world’s largest and are significantly interconnected.

Market Moving Events

Tuesday: NFIB Optimism Index

Wednesday: Wholesale Inventories, FOMC Meeting Minutes

Thursday: Jobless Claims, CPI, Federal Budget

Friday: PPI, Consumer Sentiment

Commentary

It was a brutal week on Wall Street as investors adjusted to a far more extensive than anticipated tariff policy from the Trump administration. All three major indices suffered swift declines, marking the largest weekly loses since the pandemic. The DJIA and S&P 500 remain in correction while the Nasdaq slipped into bear market territory. Global stocks, which have been outperforming domestic equities, also suffered on the announcement. Conversely, fixed income and alternative assets like gold have been a bright spot for investors. In the fixed income markets, prices rallied as yields fell. The 10-year Treasury finished Friday with a yield of 4.01%, down 0.23% from the week prior.1

In 2024, the effective tariff rate imposed by the U.S. on imports was 2.5%. Estimates vary, but the result of the new tariff policy will move the effective rate into the low 20% range.2 This will likely put pressure on both business and consumer spending. Additionally, it complicates policy for the Federal Reserve. In public comments Friday, Chair Powell said that the tariffs, which will be the highest in the U.S. since the 1930s if fully implemented, are likely to cause “higher inflation and slower growth.”3 We anticipate some negotiation regarding the tariffs, but the timeline is unclear. Markets are eager for clarity.

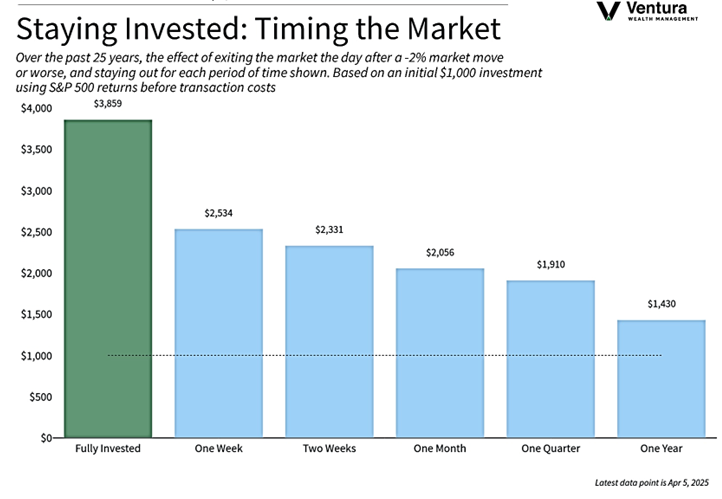

In periods of market uncertainty, it is essential to avoid panic and refrain from trying to time the market (chart right). In oversold conditions, like those we are in now, a small news item could spark a fierce rally. Patience and caution are warranted.

Chart of the Week

Timing the market can be very risky. The chart above illustrates the potential outcomes for a portfolio over the last 25 years if one chose to exit equities and switch to cash each time the market experienced a decline of -2% or greater. Such actions can considerably diminish long-term results.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Standard and Poor’s

Statistic of the Week:

The Wall Street Journal

Global Perspective:

The Economist

Commentary:

1. MarketWatch.com

2. Investor’s Business Daily, Barron’s, MarketWatch.com

3. Investor’s Business Daily, Barron’s