The Profit Margin April 3, 2023

Statistic of the Week

A recent study by WalletHub ranked the “2023 Best States to Retire” by examining three primary categories: quality of life, healthcare, and affordability. In the study, they found that the five most expensive states to retire all were on the East Coast, primarily the Northeast. In order, they are: New York, New Jersey, Vermont, Massachusetts, and Maryland.

Global Perspective

Protests and riots in France have been growing over the past week against the government’s plans regarding pension reforms, which raises the pension age to 64 from 62. President Emmanuel Macron forced the measures through against much opposition. Fewer births and longer lifespans are increasing the “old-age dependency ratio,” a fate that will befall many developed countries in the coming years.

Market Moving Events

Monday: ISM Manufacturing

Tuesday: Factory Orders

Wednesday: ISM Services

Thursday: Jobless Claims

Friday: US Markets Closed, Nonfarm Payrolls, Consumer Credit

Commentary

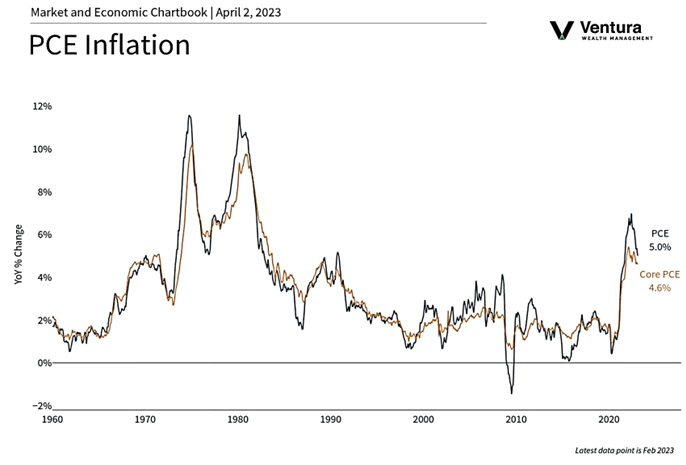

Equity markets drifted higher last week and closed the quarter on a positive note. Banking crisis concerns ebbed, and inflation data (chart right) showed measured improvement. All three indices finished the week in the black. The S&P 500 was the week’s leader, rallying 3.48%.. The Nasdaq put in a gain of 3.37%.. And the DJIA moved 3.22% higher, pushing that index into the positive territory on a year-to-date basis.3 While stocks rose, bond prices fell as yields inched up. The 10-year Treasury finished the week with a yield of 3.49%, up 0.11% from the week prior.

Friday’s PCE inflation report coupled with seemingly less stress in the banking system are setting up a potential problem. Investors are struggling to predict the Fed’s next steps. With the banking crisis apparently cooling (it is too soon to tell for sure), and inflation not quite cooling enough, the futures market is showing a 50/50 chance of the central bank hiking rates 0.25% in their next meeting on May 3rd.5 This coming Friday’s Nonfarm Payrolls report will have a significant influence on that decision and will be watched closely. Analysts are expecting that the economy added 235,000 jobs in March.6 A “hot” reading that includes solid wage growth would likely indicate that the Fed will raise the target rate once again. With multiple Fed governors speaking and several key pieces of economic data being released, the bulls may have their work cut out for themselves in the week ahead.

Chart of the Week

The Federal Reserve’s “favorite inflation measure,” the PCE, came in lower than expected for the month of February. In the reading, the core rate is now annualizing at 4.6%. While still above the Fed’s target, it is trending in the right direction.

Sources

arket Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Economic Analysis

Statistic of the Week:

CNBC.com, WalletHub

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s

6.MarketWatch.com