The Profit Margin: April 29, 2024

Statistic of the Week

Congress approved and President Biden signed a new aid package to assist Ukraine, Israel, and the Indo-Pacific (Taiwan). At $95 billion, the majority of the funds will flow through the U.S. before making their way overseas. There are 117 production lines in 71 American cities that will produce the weapons systems being shipped abroad. Some of these cities are in substantial need of industrial revitalization.

Global Perspective

France’s agricultural exports are no longer the nation’s leading export. Items from the luxury goods conglomerate, LVMH, consisting of bags, perfumes, watches, and jewelry, accounted for 4% of French exports in 2023. These goods comprised about $25 billion in export activity. Agricultural goods accounted for 3.2%.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: ISM Manufacturing, FOMC Rate Decision, Auto Sales

Thursday: Jobless Claims, Trade Deficit, Factory Orders

Friday: Nonfarm Payrolls Report, ISM Services Index

Commentary

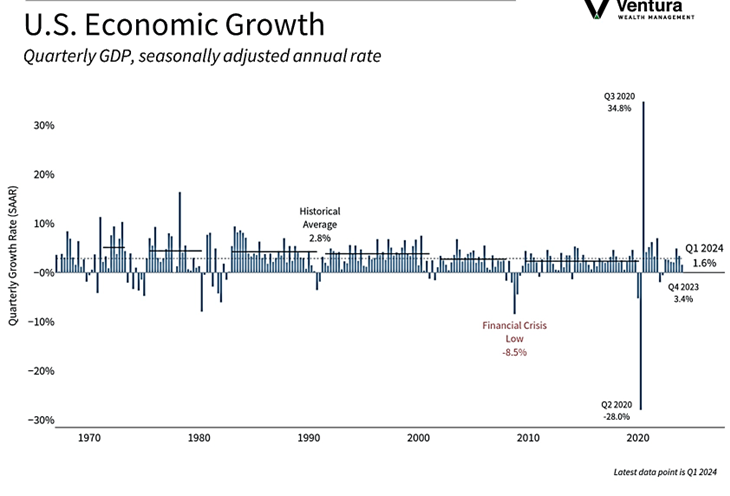

Markets reversed a string of losses and posted positive figures last week. All three major domestic indices finished the week in the black. The DJIA ticked up slightly, climbing 0.67%.1 The S&P 500 had its best weekly performance since last November, rallying 2.67%.2 And not to be outdone, the Nasdaq posted its first weekly gain in over a month, jumping 4.23%.3 The cause for the broad rally? Inflation, measured by the PCE Index came in “as expected,” with core PCE annualizing at a rate of 2.8%.4 After a string of reports that were hotter-than-expected, a reading without a surprise to the upside was welcome news. Additionally, the U.S. economy grew at a rate of 1.6% in the first quarter (GDP chart right).5 This was a soft figure and slower than the fourth quarter reading of 3.4%.6 Yet when the internal figures were picked apart, there were upbeat data points. Fixed income yields were relatively unchanged on the week. The 10-year Treasury finished Friday with a yield of 4.67%, up 0.04% from the week prior.7 Yields remain close to their 2024 highs.

The week ahead will not be for the faint of heart. The FOMC has a two-day meeting which will conclude with a rate announcement on Wednesday. Those looking for a “tell” as to when the Fed will begin cutting rates will focus on Chair Powell’s press conference Wednesday. Some would argue that inflation has not abated enough for Chair Powell to signal an imminent cut. We will also receive news on the state of the labor markets and wages with Friday’s critical Nonfarm Payrolls Report. And… major earnings reports remain in focus, with several key DJIA components reporting.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: ISM Manufacturing, FOMC Rate Decision, Auto Sales

Thursday: Jobless Claims, Trade Deficit, Factory Orders

Friday: Nonfarm Payrolls Report, ISM Services Index

Chart of the Week

Gross Domestic Product (GDP) grew at an annualized rate of 1.6%, below analyst expectations. Exports were particularly weak and inventories were spent down, while many of the other internal components showed solid growth.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

Yahoo! Finance

Global Perspective:

The Financial Times

Commentary:

1.Bloomberg

2.Bloomberg, Investor’s Business Daily

3. Bloomberg, Investor’s Business Daily

4. Barron’s

5.Bureau of Economic Analysis

6. Barron’s

7. MarketWatch.com