The Profit Margin: April 25, 2022

Statistic of the Week

The Department of Education said that it will grant student loan borrowers further support as there is a coordinated move towards additional forgiveness for income-based payers. 3.6 million borrowers will be closer to forgiveness as a result of the move – 40,000 people will be immediately eligible. About half of the $1 trillion in outstanding loans owed to the Federal Government is being paid on income-driven schedules.

Global Perspective

The nation of Sri Lanka has halted payments on its foreign debt and has warned that it may default. Earlier this month, a newly appointed Finance Minister lasted less than 24 hours before resigning. Inflation is running at 19% in the country and the central bank recently doubled its benchmark interest rate.

Market Moving Events

Tuesday: Durable Goods Orders, Case-Shiller Home Price Index, Consumer Confidence, New Home Sales Wednesday: Pending Home Sales Thursday: Jobless Claims Friday: PCE Price Index, Personal Income and Spending

Commentary

Investors were seeking further clarification from the Federal Reserve as to what the central bank’s next steps might look like – however, they did not like the answers they found. All three major US equity indices finished the week firmly in the red after a reversal day on Thursday and follow through lower on Friday. The DJIA was the best performer of the three, down -1.86%.1 The S&P 500 retreated -2.75% for the week,2 while the Nasdaq gave up -3.83%.3 Adding to investor woes, interest rates continued their march higher. The yield on the 10-year Treasury rose 0.10% to finish Friday at 2.91%.4

What soured investor sentiment so quickly? Comments by Federal Reserve officials played a key role. While there were multiple officials providing public commentary last week, Chair Powell’s comments conveyed a near certainty that the target Fed Funds rate will increase 0.50% as a result of the next meeting (May 3-4) and Governor Bullard was advocating for a 0.75% hike in June.5 As a result, the futures markets are pricing in rate hikes of 0.50%, 0.75%, and 0.50% over the next three meetings – May, June, and July.6

The hawkish commentary out of the Fed will be playing right alongside key earnings reports this week. 165 companies in the S&P 500 will report along with half of the components of the DJIA.7 Expect these figures and speculation over policy decisions to overshadow a busy economic data release schedule.

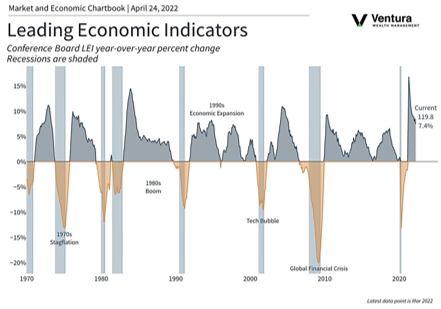

Chart of the Week

Sources

Statistic of the Week:

The Washington Post

Global Perspective:

Bloomberg Opinion

Market Moving Events:

MarketWatch.com

Chart of the Week:

Haver, Clearnomics, Conference Board

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4.Bloomberg 5. Barron’s 6. Barron’s 7. Investor’s Business Daily