The Profit Margin April 24, 2023

Statistic of the Week

While we frequently discuss average retirement savings, it is important to point out that approximately one in four American has no money set aside for retirement. 27% of those aged 59 and over were found to have zero retirement savings in a study by Credit Karma. The study also found that older Americans are actually less prepared (by some measures) than their younger counterparts.

Global Perspective

The globe is set to have its largest rice shortage in 20 years. Across the world, production is falling and driving up prices for more than 3.5 billion people. This is especially true for those living in the Asia-Pacific region, who consume more than 90% of global output. The shortage is expected to last until 2024.

Market Moving Events

Tuesday: New Home Sales, Consumer Confidence

Wednesday: Durable Goods Orders

Thursday: Jobless Claims, GDP, Pending Home Sales

Friday: Personal Income and Spending, PCE, Consumer Sentiment

Commentary

Corporate earnings reports, a fair number of economic releases, and many Federal Reserve Governors giving public commentary set the scene last week and markets were relatively… tame. While both equity and bond prices fell, the top-level action was relatively flat. (The same cannot be said for some moves below the surface). The Nasdaq faired the worst of the major averages, retreating 0.42%.1 The DJIA fell 0.23%.2 And the S&P 500 was the week’s best performing major average, dipping just 0.10%.3 The yield on the 10-year Treasury ticked up 0.05% from the week prior to close Friday at 3.57%.4

The week ahead has several significant scheduled events. First, it will be the heaviest reporting week for the DJIA this earning’s season.5 So far, we would characterize this season as “ok,” but it is still very early for a definitive call. Second, there are multiple key economic reports to be released. Beyond readings on consumer sentiment and confidence, we are due a GDP report on Thursday (expected to show annualized growth of 1.8%),6 and the Fed’s “favorite inflation gauge,” the PCE, Friday.7 These reports are set against the backdrop of a strong, but weakening, labor market. Initial jobless claims have been rising and are expected to come in at 250,000.8 Simultaneously, continuing claims hit the highest level since November 2021.9 Earnings, inflation, employment, a debt ceiling vote, and GDP may turn last week’s relative calm into something more in the week ahead.

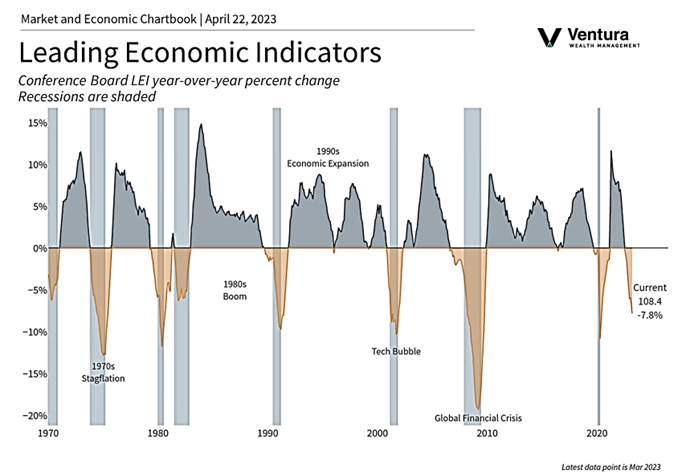

Chart of the Week

The Index of Leading Economic Indicators, produced by The Conference Board, came in with a weaker-than-expected reading last week for the month of March. Continued weakness will largely be interpreted as forecasting a recession by economists and market participants.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, The Conference Board

Statistic of the Week:

BloombergBusiness

Global Perspective:

CNBC.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Investor’s Business Daily

6.MarketWatch.com

7.MarketWatch.com

8.MarketWatch.com

9. Investor’s Business Daily