The Profit Margin: April 22, 2024

Statistic of the Week

Older Americans are not downsizing or moving out of their multibedroom homes, contributing to the housing crunch felt by the younger demographic. 28% of U.S. homes with three or more bedrooms are owed by people between the ages of 60 and 78 who currently live alone or with one other adult. Looking at the same group of homes, only 14% are owned by Millennials living with children. The majority of Americans aged 60 and older have no intention of ever moving from their current residence.

Global Perspective

The International Monetary Fund recently upgraded its forecast for global gross domestic product growth in 2024. The organization now estimates that the global economy will grow 3.2% this year and stated that it “remains remarkably resilient” and that the pandemic created “less economic scarring” than previously believed.

Market Moving Events

Tuesday: New Homes Sales

Wednesday: Durable Goods Orders

Thursday: Jobless Claims, GDP, Pending Home Sales

Friday: Personal Income and Spending, PCE Index, Consumer Sentiment

Commentary

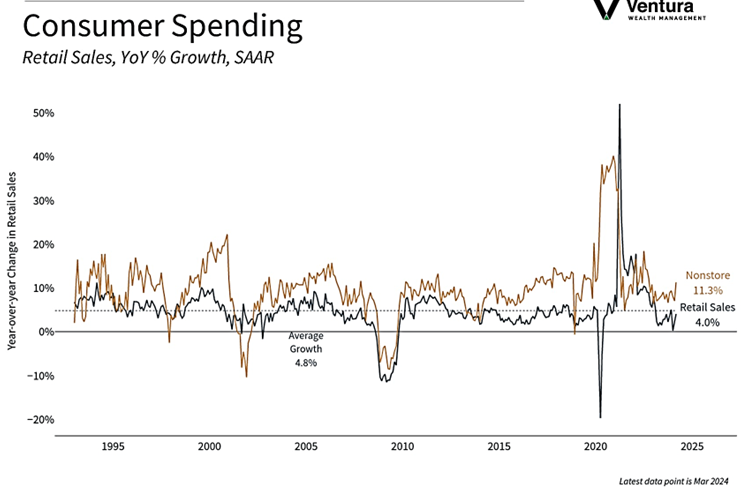

Geopolitical concerns and strong consumer data conspired to push equity prices down and fixed income yields higher on the week. The conflict between Israel and Iran has investors bracing for higher commodity prices, which reads as higher inflation (and Federal Reserve policy rates) for longer. At the same time, it seems as though nothing will stand in the way of the U.S. consumer. Retail sales (chart right) came in much stronger-than-expected. While the DJIA was able to eek out a 0.01% gain on the week,1 both the S&P 500 and Nasdaq finished firmly in the red. The S&P 500 retreated 3.05%, cutting its year-to-date gain nearly in half, and the Nasdaq fell 5.52% on the week.2 While the Nasdaq is still in the black for the year, last week’s losses were broad. Treasury yields hit a five-month high.3 The 10-year Treasury finished Friday with a yield of 4.63%, up 0.09% on the week and 0.75% on a year-to-date basis.4

This week we will learn whether economic growth has been mirroring the strength of the consumer. On Friday we will receive the first quarter’s GDP report. Analysts expect to see annualized growth of 2.1% to 2.2%.5 The Atlanta Fed’s “GDP Now” tracker is more optimistic, showing growth of approximately 2.9%.6 While these figures are slower than the fourth quarter’s growth rate of 3.4%,7 they are still healthy. Also to be released this week is the release of the PCE Index on Friday. Analysts expect that this inflation gauge will show slight cooling, and that the core reading will come in at an annualized rate of 2.7%.8 And, tech earnings continue. It would be nice to get out of “good news is bad news” territory. If anything, this week will not be boring.

Chart of the Week

U.S. Retail Sales grew faster-than-expected in the month of March, jumping 0.7%. Year-over-year, sales were up 4%. Data for February was also revised higher.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Census Bureau

Statistic of the Week:

The Wall Street Journal

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3. Investor’s Business Daily

4.MarketWatch.com

5. Investor’s Business Daily, MarketWatch.com

6.Atlanta Federal Reserve

7. Investor’s Business Daily