The Profit Margin: April 21, 2025

Statistic of the Week

For the first time since tracking began, 50% of parents are offering at least some financial assistance to their adult children aged 18 and older. This percentage was previously recorded at 47% in 2024 and 45% in 2023. On average, parents spend $1,474 monthly, marking a three-year peak. The report from Savings.com highlighted that “adulting is expensive.” Additionally, 1 in 3 adults between the ages of 18 to 34 still live in their parents’ home.

Global Perspective

China’s GDP experienced a reported increase of 5.4% in the first quarter. This growth can be partially linked to a spike in exports as American companies sought to mitigate the impact of impending tariffs. Recently, China imposed restrictions on the export of rare-earth metals, which are essential for electric vehicles. Furthermore, the central government instructed Chinese airlines to halt the acceptance of new Boeing aircraft deliveries.

Market Moving Events

Wednesday: New Home Sales, Beige Book

Thursday: Jobless Claims, Durable Goods Orders, Existing Home Sales

Friday: Consumer Sentiment

Commentary

Following a surge the week prior, equity markets pulled back last week amid persistent volatility. All three major domestic indices ended the week in the red. The S&P 500 declined 1.5%.1 The Nasdaq dropped 2.6%, and the DJIA decreased by 2.7%.2 Key themes remained consistent, with trade and tariffs dominating discussions. Treasury yields fell during the week. The 10-year Treasury closed Friday with a yield of 4.33%, a decrease of 0.16% from the week prior.3

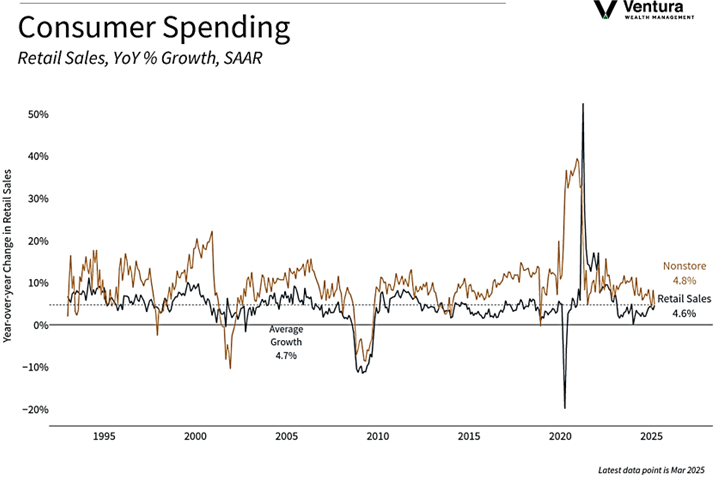

Retail sales (chart right) surprised to the upside.4 In contrast, consumer sentiment, reported by the University of Michigan, remains extremely low. The latest reading marked the second lowest since the survey’s inception in 1952.5 The report highlighted that the decline in sentiment is“ pervasive and unanimous across age, income, education, geographic region and political affiliation.”6 Importantly, this report was generated prior to the administration’s implementation of the 90-day tariff pause. Sour sentiment has not yet led to a decrease in consumer spending.

Investors will be watching for signs of progress on trade deals. Last week, President Trump said that he had a “very productive” call with Mexico’s president.7 Additionally, he said that the U.S. should have a deal with China in three to four weeks.8 Tariffs on Chinese goods stand at 145%.9 Negotiations with the EU are also of high importance. The EU has delayed retaliatory tariffs until July 14th.10 The U.S. has a tariff rate of 10% on goods from the economic zone. The week ahead is packed with earnings reports and comments from Fed officials.

Chart of the Week

In March, retail sales experienced their largest increase in two years, driven by households making significant purchases ahead of impending tariffs. The monthly increase of 1.4% marked the highest growth since January 2003, exceeding forecasts. Sales of motor vehicles and other “big ticket” items were key contributors to this rise.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Census Bureau, Reuter’s

Statistic of the Week:

CNBC.com, Savings.com

Global Perspective:

The Economist

Investor’s Business Daily

Commentary:

1. Bloomberg

2. Bloomberg

3. MarketWatch.com

4. MarketWatch.com

5. The Economist

6. The Economist

7. Investor’s Business Daily

8. MarketWatch.com

9. MarketWatch.com

10. MarketWatch.com