The Profit Margin April 17, 2023

Statistic of the Week

Against the backdrop of the failure of Silicon Valley Bank, four of the nation’s largest banks reported significant net income and revenue increases for the first quarter. This differentiates the mega banks from their regional and community counterparts. JP Morgan’s profit was up 52% year over year. Wells Fargo reported a jump of 25%. PNC and Citi put in notable net income (profit) increases as well

Global Perspective

The International Monetary Fund (IMF) issued a new forecast for global growth in 2023 which was slightly below their previous estimate. The organization revised their estimate to 2.8% from 2.9%, citing increased recession risk in many advanced economies (read: US and Europe) because of recent bank failures and “geopolitical fragmentation.”

Market Moving Events

Monday: Empire State Manufacturing

Tuesday: Housing Starts, Building Permits

Wednesday: Beige Book

Thursday: Jobless Claims, Existing Home Sales, Leading Economic Indicators

Commentary

Against a fairly busy backdrop, stock prices rose and bond prices fell last week. All three major averages finished the week in the black. The DJIA was the week’s leader, rallying 1.20%.1 The S&P 500 logged a solid gain of 0.79%;2 the Nasdaq, this year’s leader, brought up the rear climbing 0.29%.3 Fixed income markets remained volatile. The yield on the 10-year Treasury ticked up 0.23% on the week to finish Friday at 3.52%.4

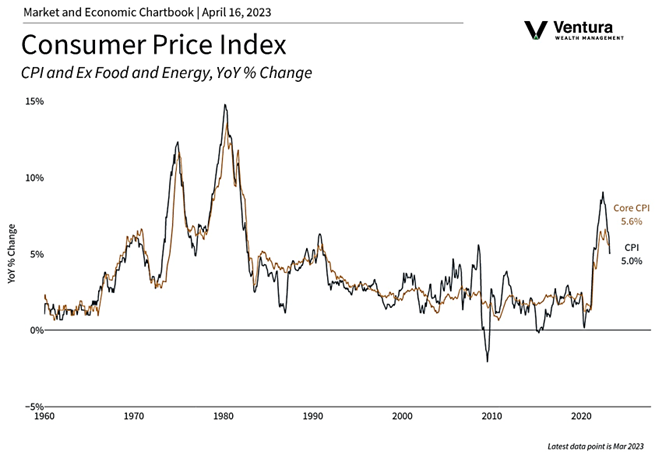

Two key inflation readings confirmed that inflation is still heading in the right direction. The Consumer Price Index (chart right) and Producer Price Index both came in below analyst expectations. However, Core CPI (gold line, chart right) remains stubbornly high. The overall deceleration should give the Federal Reserve some optionality in their rate hike decisions moving forward. While the futures markets show a hike of 0.25% as a near lock for the May meeting,5 they also reflect rate cuts in the second half of the year. Perhaps the economic softening we are seeing in retail sales (falling 1% in March, more than analysts estimated)6 and initial jobless claims (moving higher to 239,000 in the last weekly reading)7 are the cause. Even the staff at the Federal Reserve is forecasting a “mild recession” late in the year.8 There are several Federal Reserve Governors speaking this week who will likely give us their interpretation of these events along with a good number of earnings calls and economic releases.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics, Investor’s Business Daily

Statistic of the Week:

Yahoo! Finance

Global Perspective:

Yahoo! Finance

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s

6. Investor’s Business Daily

7. Investor’s Business Daily

8. Investor’s Business Daily