The Profit Margin: April 15, 2024

Statistic of the Week

Are you willing to go into debt to have fun? In a recent survey, it was found that the Millennials are the generation most willing to borrow to finance fun experiences: travel, attending live entertainment, and dining out. Across age groups, 30% would finance their travel, while 14% would go into debt to eat out. Gen Z was the age group most willing to borrow to travel, with around 45% willing to do so. Boomers were more willing than Gen Xers to borrow for travel expenses.

Global Perspective

In a sweeping anti-corruption campaign, the Vietnamese government sentenced property tycoon, Truong My Lan to death in a $12.5 billion financial fraud case. The scale of the crime is roughly equal to 3% of the country’s economy, where funds were syphoned away from a bank. While she was the mastermind, 84 other defendants in the case have received sentences so far, from three years probation to life in prison.

Market Moving Events

Monday: Retail Sales, Homebuilder Confidence

Tuesday: Housing Starts, Building Permits, Industrial Production,

Wednesday: Beige Book

Thursday: Jobless Claims, Existing Home Sales, Leading Economic Indicators

Commentary

Strong inflation figures and boiling geopolitical tensions combined to push the markets around last week. In the equity markets, all three major averages finished in the red. The DJIA was the week’s worst performer, dropping 2.37%.1 The most diversified of the indices, the S&P 500, dipped 1.56%.2 And while it is now on a three-week losing streak, the Nasdaq held up relatively well, falling only 0.45%.3 Those seeking a safe haven helped move gold prices to a new, all-time high. And while anxiety over geopolitical tensions was felt in the markets, it was not strong enough to push bond yields lower on the week. The 10-year Treasury hit fresh 2024 highs during the week’s trading and finished Friday with a yield of 4.53%, up 0.09% from the week prior.4

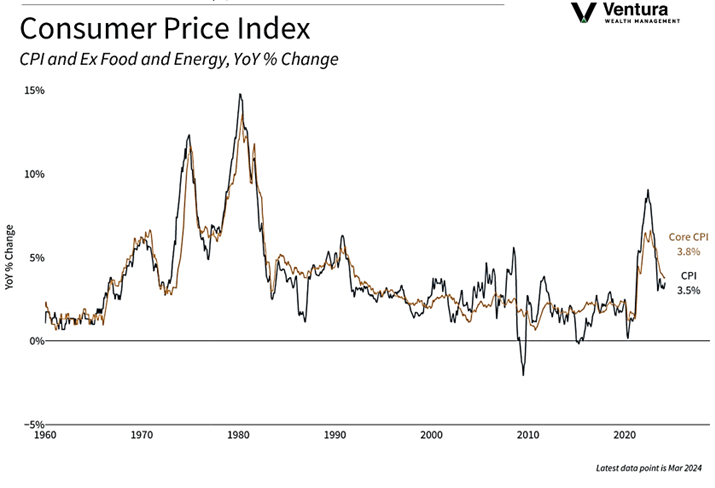

While the CPI readings (chart right) were higher than expected (for the third month in a row), the PPI reading came in slightly under analyst expectations. We will hear from multiple Federal Reserve officials this week, including a public address by Chair Powell. As a result of the hot inflation readings, the futures markets are now only placing a 50/50 chance of a rate cut in the July meeting – June looks to be off the table.5 There is a strong likelihood that the comments by the Fed officials could move an already antsy market.

The week ahead is peppered with key earnings reports and economic data releases. While these are important, we cannot, however, ignore the escalating conflict between Israel and Iran. Geopolitics may play a bigger role in market action this week than regularly scheduled programming.

Chart of the Week

Prices, as measured by the Consumer Price Index, rose 3.5% from one year ago. The figure was an uptick from February’s year-over-year reading of 3.2%. Both CPI and Core CPI readings came in hotter-than-expected over the month and on an annualized basis.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Investor’s Business Daily, Bankrate.com

Global Perspective:

CNN.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.MarketWatch.com

5. Investor’s Business Daily