The Profit Margin April 10, 2023

Statistic of the Week

After the collapse of Silicon Valley Bank, it is estimated that 16% of American adults moved at least some of their money – approximately 10% moved “all” of their funds. Of those moving funds, 73% were men and 58% are members of the Millennial generation.

Global Perspective

In a growing wave, seven US states now plan on banning all gasoline powered cars by 2035. Maryland was the latest to join to trend. While previously owned gasoline powered vehicles would still be permitted on the roads, automakers and dealerships would only be allowed to sell zero-emission vehicles including electric and some plug-in hybrids.

Market Moving Events

Monday: Wholesale Inventories

Wednesday: CPI, FOMC Meeting Minutes

Thursday: Jobless Claims, PPI

Friday: Retail Sales, Industrial Production, Consumer Credit

Commentary

Domestic markets were mixed in last week’s shortened trading. The DJIA was able to log a gain of 0.63%.1 Both the S&P 500 and Nasdaq retreated, 0.10% and 1.10%, respectively.2 While equities were mixed, fixed income yields moved decidedly lower. The yield on the 10-year Treasury fell 0.20% on the week to finish Friday at 3.29%.3

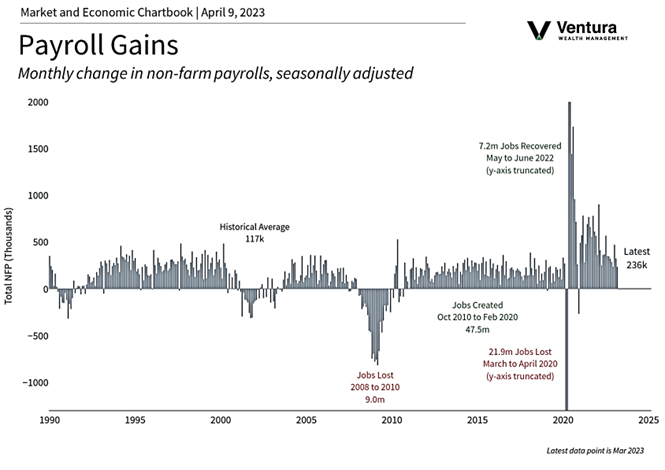

Last week’s “big” economic release came on Friday. March’s non-farm payrolls report (chart right) showed the economy continuing to add jobs, the unemployment rate dipping to 3.5%, and wage growth moving up 0.3%.4 While there are continued headlines of layoffs (employers have cut about 270,500 jobs this year, a 396% year-over-year increase),5 the economy has yet to show one month of aggregate job losses in this period of economic expansion. That’s not the stuff of recessions. Notably, job openings have been contracting, another sign corporate America is behaving more cautiously than a year ago.

The week ahead has only a few key economic releases, but they will be significant. Both the CPI and PPI inflation readings will shed better light on the Fed’s next move, along the release of the last meeting minutes from the FOMC. These data points, taken with last Friday’s job’s report, will likely indicate whether the Fed has another 0.25% hike in store. Bank earnings will start in full. They are more consequential this quarter because of the recent bank failures. Caution is warranted

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Statistics

Statistic of the Week:

Forbes

Global Perspective:

Money

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bureau of Labor Statistics, Barron’s

5.Forbes