The Profit Margin: April 1, 2024

Statistic of the Week

Legal sports betting continues to spread across the country. Currently, 38 states and Washington D.C. have legalized the activity. There are six states where there is pending legislation to make sports betting legal. Six states, including California and Texas, have no active legislation in place to legalize sports betting.

Global Perspective

Utilizing the new Digital Markets Act, the European Union is placing major technology firms under stricter scrutiny. Both Apple and Alphabet are being investigated regarding how they manage their app stores while Meta is being investigated for how it uses personal information in advertising. The EU’s antitrust commissioner believes that the issues being looked into should have been previously resolved.

Market Moving Events

Monday: Construction Spending, ISM Manufacturing

Tuesday: Factory Orders, Job Openings

Wednesday: ISM Services, ADP Employment Report

Thursday: Jobless Claims, Trade Balance

Friday: Nonfarm Payrolls, Consumer Credit

Commentary

The first quarter is now in the rear-view mirror and investors looking at their quarterly statements have much to be happy about. Both the DJIA and S&P 500 finished the quarter on a positive note, while the Nasdaq took a breather last week. The DJIA was up 0.84%, the S&P 500 rallied 0.39%, while the Nasdaq fell 0.30%.1 Notably, the S&P 500 had its best first quarter performance since 2019,2 with only its fourth double-digit start to the year since 2000.3 For those hoping that history will repeat itself, the S&P 500 has had 16 double-digit Q1 starts since 1950, and only finished in the red in one of those instances (1987). Of those 16 years, the S&P had an average additional gain of 9.7%.4 Bond yields were relatively unchanged last week. The 10-year Treasury finished Friday with a yield of 4.21%.5

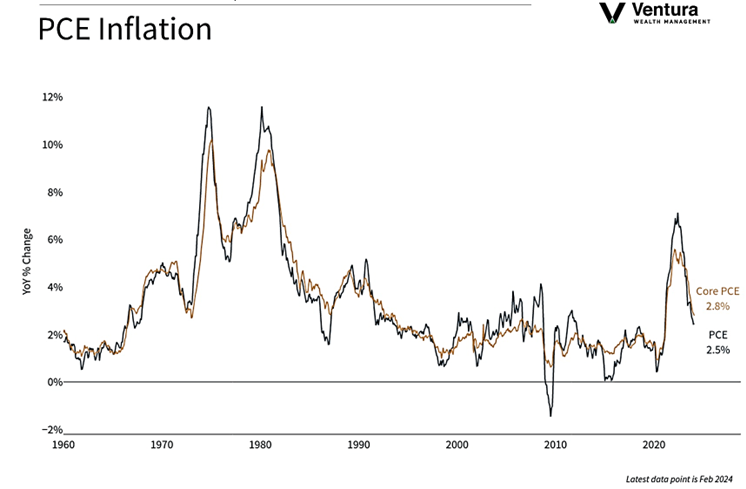

Last week’s major economic news item arrived while markets were closed for the Easter holiday. The PCE report (chart right) was in line with analyst estimates. This week’s nonfarm payrolls report on Friday is expected to show that the economy added about 180,000 jobs in March, that the unemployment rate ticked down to 3.8%, and that wage growth slowed modestly to 4.1%.6 Those economic indicators, among others, coupled with the inflationary impact of the Baltimore bridge collapse, will provide the numerous Federal Reserve officials making statements this week ample material. As earnings season has yet to kick off, investors will likely focus their attention on the economic indicators and parse these statements – particularly Chair Powell’s scheduled speech Friday. An uptick in volatility would not be unwarranted.

Chart of the Week

Personal Consumption Expenditures Price Index (PCE) report was in line with analyst expectations. Year-over-year, the PCE registered a reading of 2.5%. Core (excluding food and energy) was 2.8%. The PCE is known as the Fed’s “favorite” inflation measure.

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

Yahoo! Finance

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2. Investor’s Business Daily

3. Barron’s

4. Barron’s

5.MarketWatch.com

6. Investor’s Business Daily