The Financial Advocate: Winter 2024

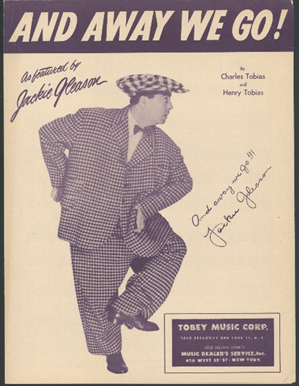

“And Away We Go!”

Party Like It’s 1999

“And Away We Go!” Those iconic words launched the Jackie Gleason show back when I was a kid. I loved the comedy and watched it religiously. The words had energy, and you knew you were in for a good time! That’s kind of the same feeling as the January 2024 stock market. After a strong 2023, the stock market decided to party like it’s 1999! However, let’s be clear: 2022 was a difficult year, and most investors are happy to see their accounts recover from those losses. The S&P 500 even broke past 5,000 for the first time ever. Despite the recent surge, some remain skeptical, with money fund balances exceeding $6 trillion. Right now, many investors are not following the FOMO (Fear of Missing Out) philosophy, as cash is finally offering a decent return of around 5% for the first time in years. This presents an opportunity.

The VWM Approach

As you know, we at Ventura Wealth have remained positive throughout the past two tumultuous years. Even when the market pulled back in 2022, our internal economic studies indicated that the underlying economy was performing adequately. While we implemented some defensive measures, the data simply did not support a complete withdrawal from the equity markets. Yes, the Fed has been restrictive and inflation has posed a threat, but corporate profits have held up, and profits are what primarily drive the stock market. Several widely followed strategists predicted a 20% drop in corporate profits, leading to a potential decline in the stock market (bringing the S&P to 3500). However, this did not occur, just as our economic research suggested it wouldn’t. As a result, we maintained a mostly constructive outlook on the stock market. Earnings for 2023 remained roughly flat compared to 2022, avoiding the predicted decline. Now, earnings appear to be headed for double-digit growth in 2024, followed by another increase in 2025. Strategists are even revising their S&P targets upwards, with some predicting a range of 5500 to 6000!

Inflation and the Fed’s Dual Mandate

The recent market optimism can be attributed to a combination of factors: better-than-expected earnings results, easing inflation, a strong job market, and a generally more resilient economy. Following declining inflation will be a decrease in interest rates, managed by the Federal Reserve. Stable prices and full employment are the Fed’s dual mandate. Inflation continues to fall this year, with the stickiest component being housing costs. Rents remain high, and houses are expensive. The Fed aims for inflation of 2% (currently around 3%) and a stable labor market. We believe both objectives are achievable in the intermediate term. Remember, inflation was running at 9% a year ago! We have come a long way, but the final mile is often the most challenging. Inflation numbers are notoriously volatile, as measured by the CPI (Consumer Price Index) and the PPI (Producer Price Index). We encourage you to follow the PCE (Personal Consumption Expenditures Index), which the Fed prioritizes, as this index reflects how consumers actually spend money. For example, if steak becomes too expensive, consumers might switch to chicken. The PCE is currently at 2.6%, nearing the Fed’s target of 2%.

Investment Outlook and Risk Management

To summarize, profits are good and growing, inflation is moderating, and labor markets are strong. While we acknowledge the inherent complexity of investing in stocks and bonds, we believe the current environment is favorable and will likely improve further as interest rates fall. Although there is always the potential for pullbacks in both stocks and bonds, we believe they should be viewed as buying opportunities. It is important to remember that risks are ever-present, including geopolitical tensions, political uncertainties, and even threats to the banking sector from commercial real estate. It is our responsibility to manage these risks effectively.

A Note on Comparisons

Recent comparisons between the current market and the late 1990s are misleading. The market crash of that era took years to recover from, and the situation today is fundamentally different. Companies are not nearly as overvalued as they were then. Today’s stocks are backed by sound earnings, strong management, and reasonable valuations. If we want a better historical comparison, perhaps 1995 is more appropriate. Back then, the Fed engineered a “soft landing” for the economy, leading to one of the greatest bull market runs in history – the “dot-com” bubble of 1999! This feels more like 1995, with AI leading the technology craze. We may be just getting going! Remember that $6 trillion that we mentioned sitting on the sidelines? When do falling rates lure that money back in? Who knows? Maybe we’re kicking off the “Roaring Twenties” all over again!

“Economists Corner,” by Roger Klein, Ph.D.

We are monitoring the relative performance of all assets and recognize that some, like small cap stocks, foreign stocks, and emerging market stocks are at historically cheap valuations. They have been cheap for a long time and may remain cheap. They may also get cheaper. We are looking for evidence that a turn in their relative performance is beginning and thus far there is little evidence of that.

The economic indicators for the United States continue to surprise. The surprise is in their strength. For example, the advanced GDP growth estimate for Q4 is 3.3%. That follows a GDP growth rate of 4.9% in Q3. The GDP Now projection from the Federal Reserve Bank of Atlanta for Q1 2024 is 2.9%. GDP, gross domestic product, is an estimate of the total expenditure in the domestic economy. It measures total spending in real terms, adjusted for inflation. Its long-term trend rate is about 2%. So, these recent numbers show that the economy is growing fast, faster than its long-term potential.

The Federal Open Market Committee (FOMC) met and kept its target interest rate between 5.25% and 5.5%. The big guessing game among the talking heads is all about when the Fed will begin reducing its target interest rate? March is the next FOMC meeting and given the strong economic numbers, the odds of a March rate cut have been reduced. There is little pressure on the Fed to change course. The economy and the labor market are strong and inflation is decelerating, but not yet back to the Fed’s long-term target of 2%. Sitting and doing nothing appears to be working. Finally keeping interest rates higher for longer will compensate savers for the long period when interest rates were zero and they lost purchasing power on their savings.

Managed Model Strategy

Global Alpha

Global Alpha started the year strong with big gains in consumer discretionary, technology, medical, and industrial sectors. We see continued advances in AI, cyber security, e-commerce, anti-obesity (GLP-1) treatments and spending on infrastructure. Add to that the reshoring of semi-conductor manufacturing, as well as many other manufacturing industries, and we expect continued growth. We will be mindful of Fed policy and the possible “rotation” of industry groups as the current rally ages. But, for now we see continued progress from our current holdings.

Global Balanced

Global Balanced is off to a solid start in 2024. After a strong recovery year in 2023, the portfolio remains focused on high-quality American stocks, well-positioned international equities, unique alternative assets, and diversified fixed-income holdings. Domestic equities are spread across all major sectors with emphasis on companies that are beneficiaries of infrastructure spending in the form of the Chips Act and Inflation Reduction Act. The portfolio continues to hold companies with firm market share and consistent earnings’ growth. International equities are focused on capturing the movement of supply chains. Mexico, Canada, India, South Korea, Japan, and Vietnam all fall into this category. USMCA (the old NAFTA agreement) is very much in play. The alternatives sleeve is in a “hedged” posture. A basket of commodities, liquid hedge funds, gold, and oil are all incorporated. The oil position is a specific response to geopolitical tensions. We are in the process of gradually extending duration on the portfolio’s bond component as we believe the Federal Reserve has finished their rate hike cycle. Overall, the portfolio is positioned for growth in 2024 with hedges and fixed income positions deployed to help mitigate downside risk.

Moderate Allocation

The Moderate Allocation portfolio maintains an offensive posture as we begin the new year. We are neutral equity allocations versus the 60% equity 40% fixed income benchmark, appropriate for this strategy. We continue to trim core holdings as they rise in advance of fundamentals and will use any significant pullback in the market to upgrade our holdings. Overall, we are very comfortable with our stock positions. Our fixed income investments are largely focused on high-quality bonds and Treasuries. We maintain our non-core positions in gold and emerging market bonds. The economy is growing, inflation is decelerating, and company earnings are exiting a mild recession. However, domestic valuations are generous. Against this backdrop, we believe we are appropriately positioned.

Milestone360

This quarter’s financial planning topic is Estate Document review and Life Insurance planning.

Complete estate documents are an important piece of your overall financial plan. Your estate documents should include your Power of Attorney, Living Will / Medical Directive, and your Last Will and Testament. Today, many estate documents also incorporate various types of trusts. From time to time, we believe it is beneficial to review your estate documents to ensure that your documents still best represent your wishes. It is important to remember that estate tax laws vary by state. Federal laws are likely to change in the coming years. Unfortunately, we do not know how they are going to change! That does not mean that a review or update of your documents should be put on “hold.” Your documents should reflect the present reality.

As we discuss your estate documents, it is an opportune time to review your life insurance. For many of our younger clients, we believe cost-effective term life insurance policies are the best way to make sure you are adequately insured and your family is protected from an unexpected passing. For more mature clients, in many scenarios, cash value has accumulated in whole or variable / universal life policies. It is a good time to evaluate whether that insurance is still necessary, and if the cash value can be used for other types of insurance (like Long-Term Care). That cash value presents interesting planning opportunities for you.

Estate documents and life insurance are key components of your financial plan – even if none of us like talking about death. Please feel free to bring us any questions you may have on these topics in your quarterly review.

As always, we appreciate your continued support. If you have questions or concerns about your portfolio or financial plan, please do not hesitate to reach out to a member of the team. We are happy to help.

Nick Ventura

Founder and CEO