The Financial Advocate: Summer 2024

“Two Soft Landings…”

The Economic Soft Landing

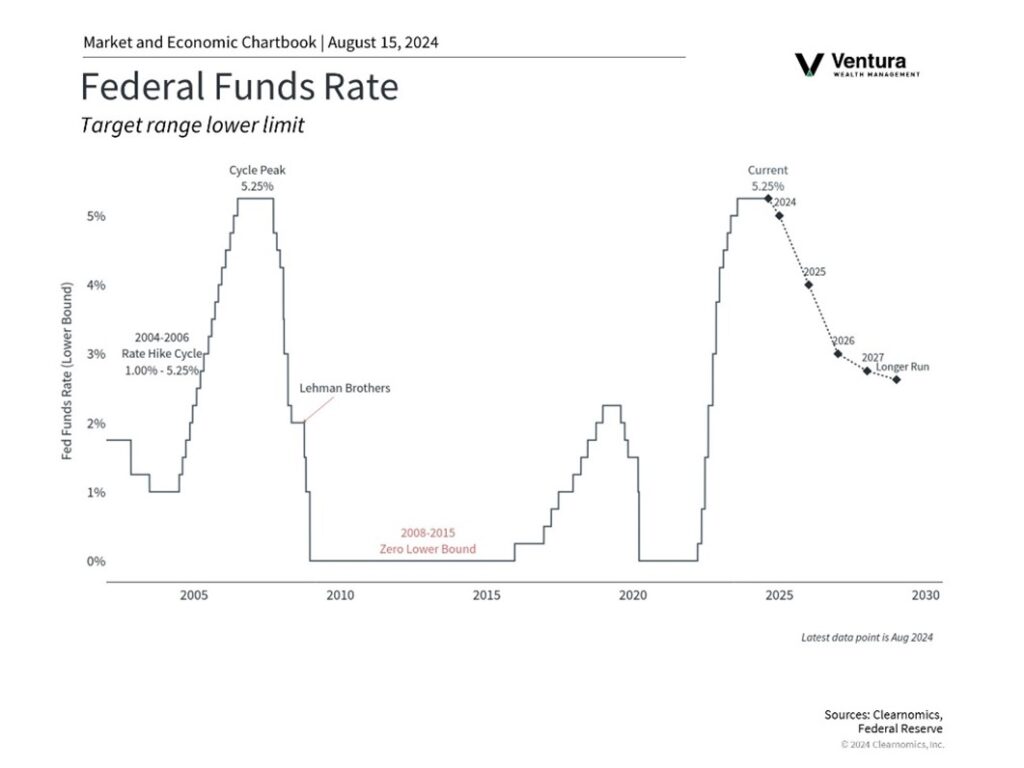

As of the writing of this newsletter, the economy is steadily growing at a solid rate of 3.1% year over year. Simultaneously, wage growth is moderating, unemployment is increasing, and inflation is cooling. As a result, interest rates are gradually declining, and calls for the Federal Reserve to lower the federal funds rate, currently at 5.25 – 5.50%, are growing louder. While the Federal Reserve will not meet in August, rate reduction will likely be a primary focus for the September FOMC meeting.

It’s worth recapping that the Fed underestimated inflation two years ago, necessitating aggressive rate hikes from 0% to 5.50%. These increases aimed to curb inflation by slowing the economy. Importantly, it takes some time after the initial rate hike for the effects of these interest rate increases to translate to the economy. We’re seeing these effects now.

Now the question is: Can the economy slow enough to tame inflation without tipping into recession? We believe a soft landing is achievable.

Post-pandemic, consumers splurged on travel and experiences. Cruise lines, airlines, hotels, and theme parks benefited greatly. Fueled by government stimulus checks, this spending spree is now winding down. Credit card balances are climbing, and consumers are changing their spending habits. Many companies that had previously raised prices are now having sales. Because of increased wages, prices are unlikely to fall to pre-pandemic levels. Importantly, the era of soaring prices is likely behind us.

With consumer spending moderating and inflation cooling, the Fed has discontinued interest rate hikes and now faces the challenge of lowering interest rates to align with economic growth. Moving too slowly risks recession, while moving too quickly could reignite inflation. It’s a delicate balancing act.

While we anticipate avoiding a recession, recession remains a possibility. Fortunately, several factors are working in our favor. Declining mortgage rates should stimulate the housing market. Automobile market demand remains healthy. Unemployment at 4.3%, though rising, is well below historical averages. The burgeoning AI market, data center construction, and semiconductor demand are fueling job growth. Additionally, the government passed several large spending bills during the Biden administration to provide funds for infrastructure spending and reshoring of manufacturing, providing further economic support.

The Baby Boomer generation is retiring en-mass, and the aging population is driving an increase in healthcare. The anti-obesity market is growing rapidly and could support an increased life span. This means more spending for a longer duration.

The Other Soft Landing?

The political landscape is less clear than that of the economy, and we anticipate turbulent waters leading up to the November election. Both candidates propose policies that could be inflationary. The U.S. debt, now at $35 trillion, is a pressing concern. Neither candidate has outlined a clear plan to address it. In June, more money was spent on interest payments for the Federal debt than the U.S. defense budget. With increased spending for both Social Security and Medicare, the need for structural and financial changes within these and other federal programs becomes that much more important. Unfortunately, partisan gridlock hinders effective compromise.

Global conflicts add another layer of complexity, with escalation being a constant threat. Beyond the human toll, these conflicts inflate prices for goods, disrupt supply chains, and increase energy costs. The “war premium” on energy comes from the current threat to energy infrastructure. While we hope for a quick resolution to multiple conflicts, the economic implications cannot be ignored.

The political climate is complex, and there are no easy solutions. Even still, our portfolio management approach involves carefully monitoring risks, evaluating their impact, and adjusting accordingly. We remain committed to finding the optimal portfolio mix for your investment goals despite the economic and political backdrop. Our commitment to safeguarding your capital remains unwavering.

“Economist’s Corner,” by Roger Klein, Ph.D.

The Federal Open Market Committee (FOMC) met on July 31st and made no change in the target federal funds rate. There was a growing chorus of economists telling the FOMC that the time for an interest rate cut was here, but the FOMC said “No.” The next FOMC meeting is on September 18th, and it is expected that there will be at least a 0.25% cut and perhaps a 0.50% cut. The current target federal funds rate is between 5.25% and 5.50%.

Labor market conditions have deteriorated. The total nonfarm payroll increased by 114,000 in July, below the average monthly gain of 215,000 over the prior 12 months. The unemployment rate rose by 0.2 percentage points in July to 4.3 percent and the number of unemployed people increased by 352,000 to 7.2 million. These measures are higher than one year earlier, when the jobless rate was 3.5 percent, and the number of unemployed people was 5.9 million.

The Federal Reserve has a dual mandate, price stability and a high level of employment. Over the past year, the Fed has focused on the price stability mandate. The Federal Reserve has defined price stability as a 2 percent inflation rate, as measured by the core-PCE price index. In June, the year-over-year increase in the core-PCE price index was 2.6 percent.

The deterioration in labor market conditions may be signaling an inflection point in the economy. Historically, when the unemployment rate has increased by 0.5 percent from its cycle low, the economy is already in recession. The cycle low unemployment rate was 3.4 percent, so the unemployment rate has increased by 0.9 percentage points. The macro data does not yet indicate recession, as real GDP grew at a 2.5 seasonally adjusted annual rate in Q2 and the Federal Reserve Bank of Atlanta’s GDPNOW projection for Q3 is at 2.0 percent. That projection will change as more data for Q3 becomes available, but the big picture does not currently support the case for recession now.

Managed Model Strategy

Global Alpha

Global Alpha remains focused on primary growth trends in AI, software, communications, and technology in general. We have a focus on the industrial revolution in the U.S. fueled by the political bills designed to re-shore manufacturing and the build-out of data centers throughout the country. There is growing demand for our entire electrical grid to be enhanced and re-built. We also maintain an interest in the obesity drug evolution, select biotechnology companies, and medical device investments.

Global Balanced

Global Balanced is positioned for potential volatility. Quality is our first line of defense. The portfolio remains focused on high-quality American stocks, diversified international equities, unique alternative assets, and an array of fixed-income holdings. The strategy continues to incorporate stocks with good market share and consistent earnings’ growth. The international equity component has centered on economies benefiting from shifting supply chains as well as a continued, post-Covid recovery. The alternatives sleeve remains in a “hedged” posture. We recently reduced diversified commodity exposure but have maintained a position in gold. We may add to gold in the near future. Managed futures, which are incorporated as a volatility buffer, continue to play a role. The bond component of the portfolio has been repositioned in an attempt to capture higher yields for a longer period of time in anticipation of a “normalization” of the yield curve. For taxable accounts, we recently purchased a municipal bond ETF, while for tax-deferred accounts, we purchased Inflation-Protected Securities.

Moderate Allocation

The Moderate Allocation Portfolio continues to maintain an asset allocation close to its strategic benchmark of 60% equities, 35% fixed income, and 5% cash. We have continued to benefit from our tactical positions in gold and emerging market bonds. Additionally, we used recent weakness in the markets to add positions in solar, A.I., and utilities. We are encouraged by new interest from activist hedge fund managers in core holdings such as Nike Inc. and Starbucks Corp. We feel that there are several holdings in the portfolio that are undervalued and, in time, will more fully reflect fair value. We anticipate that the Federal Reserve will begin cutting policy rates at its upcoming meetings, provided that inflation continues to decelerate. This should be a positive for risk assets given that the current economic backdrop is far from recessionary.

Milestone360

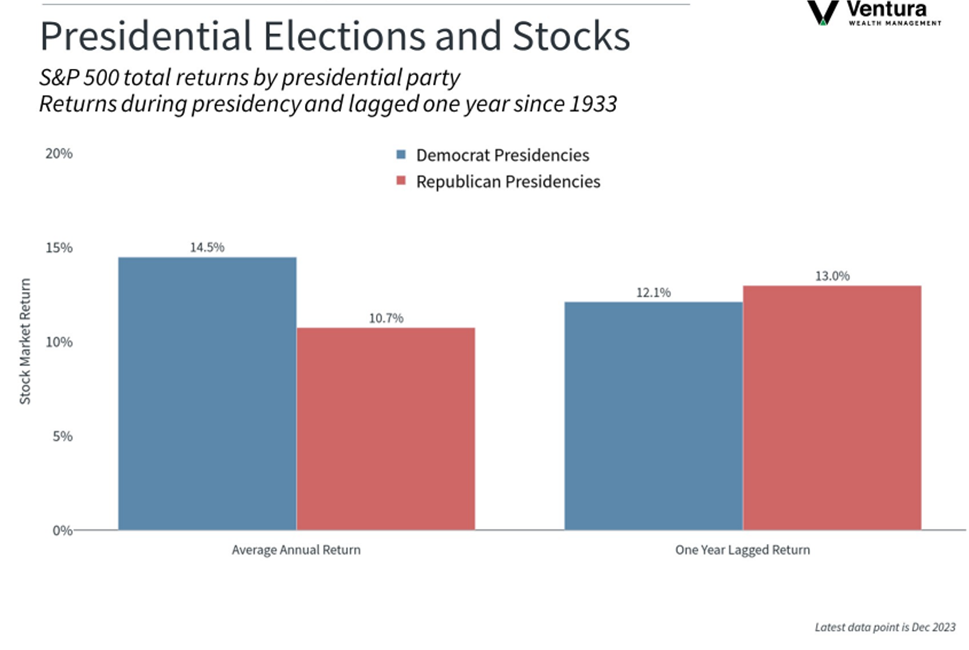

We acknowledge that in election years, especially presidential election years, it is difficult to separate personal political opinions from your personal financial affairs. Different political platforms will have various economic impacts. An increase or decrease in regulation can slow down or speed up the business cycle. Tariff policy influences inflation and can spur or stall domestic production. Higher or lower taxes are felt by households and corporations alike. There is absolutely an intersection of the political and economic spheres. As portfolio managers, we recognize that there are sectors and industries that are more likely to prosper or struggle under a Republican presidency, and that there are sectors and industries that are more likely to prosper or struggle under a Democratic presidency.

However, as financial planners, we must be careful when making planning decisions during times when emotions are heightened by electoral politics. And, we must avoid “all or nothing” decision making. It is highly unlikely that the economy will be “doom and gloom” should one party take the White House and “sunshine and rainbows” should the other carry the day. In previous presidential election years, we have had clients request to “sit on the sidelines” until the next election when they believe their party will return to power. Four years is a long time to not participate in the investment markets.

Below, we examine how the stock market performs under both Democratic and Republican presidencies. By looking at the data on the left, it would appear as though the market prefers a Democratic president. But looking at the data on the right, which lags the data by one year, it would appear as though the market prefers a Republican president. What does this mean? Objectively, we would argue that the party in control of the White House does not have a significant impact on the rate of return of the stock market over a presidential term. Historically, the composition of government that has yielded the best equity market return has been a president from one party and Congress controlled by the opposition.

Your financial plan and portfolio are designed to operate in a broad variety of economic and political environments. Portfolios managed by the team at VWM are actively managed, meaning we adjust risk up and down based on macroeconomic conditions. We believe that by focusing on quality investments, having regular conversations about your financial affairs, and sticking to well-established financial planning principles, we can help guide you through the political turbulence we may face in the period ahead. Remember, “all or nothing” decisions are almost always the wrong decision.

VWM Update

Mailing from Osaic / American Portfolios

As many of you know, Ventura Wealth Management has had a longstanding relationship with American Portfolios, a broker-dealer. Historically, when clients needed a specific product like a variable annuity or 529 plan, legacy product sales were placed through American Portfolios. Behind the scenes, VWM pays American Portfolios to help fulfil our regulatory and compliance obligations as an independent, SEC-registered RIA firm. They are a vendor to VWM.

Recently, American Portfolios was acquired by another broker-dealer firm, Osaic. We have been informed that the majority of our clients will not be receiving any communications from Osaic – only clients who own a legacy product will receive a mailer. However, with transitions being transitions, we wanted to inform all our clients that there is a chance you will receive mail from Osaic. Please note – there is no action you need to take, and this external transition will have no impact on your relationship with VWM.

New Team Member

We are excited to announce that Lucas Morreale has joined our team as a Wealth Manager. Lucas was an intern at VWM when he attended college at American University. He studied for a degree in Political Science and completed a minor in Finance. After college, Lucas worked at Ameriprise Financial for several years where he attained several industry licenses. He plans on completing the Certified Financial Planner designation in the near future. Please help us welcome Lucas.

As always, we want to say “Thank you” for your business and continued trust in our firm.

Enjoy the rest of the summer!

Nick Ventura

Founder and CEO