The Financial Advocate: Spring 2025

“Uncertainty”

The buzzword of the year is “uncertainty.” The general level of anxiety over the economy and financial matters is high and prevalent. About 225,000 American companies import goods from overseas. Due to recently imposed tariffs on imported goods, many companies remain unsure of input costs. So, how do they price their products? Even retirees are questioning their portfolio structure, healthcare options, and spending plans. The crux of uncertainty for your portfolio management team is this: uncertainty causes a pause in financial spending plans for many. Therefore, we are studying every piece of news for clues about the impact these conditions are having on your portfolio.

On the good news front, it appears that we are working on a trade plan with our third largest trading partner – China. China has advanced so far as a manufacturing hub that it may not be in our best interest to try to reshore manufacturing. For one, the United States does not have enough people to staff so many manufacturing sites. We certainly should consider producing more of our critical medical products, including pharmaceuticals, in our own country, in addition to defense and technology products, software, semiconductors, etc. These are critical products for the functioning of our country. However, we cannot reshore everything we use in this country. Therefore, trade deals are essential.

We believe that the risks presented in the news regarding Social Security, Medicare, Medicaid, and tax policy are largely overblown, and most benefits will remain in place. All of us would like to see fraud and abuse removed from the system. This makes simple financial sense. But the risks that are exaggerated in our communication channels should be taken with a grain of salt. Settling this political noise can only help the economy. The tax code decision alone will provide some certainty to households and businesses, and certainty allows for decisions to be made with clarity. We further believe that the tax policy issues will be resolved this summer. This is important as it allows strategists, portfolio managers, and financial planners to provide advice that is based on facts. It also allows companies to make plans for 2026. At this time, we believe 2026 will be a significantly better year for businesses, households, and the markets in general.

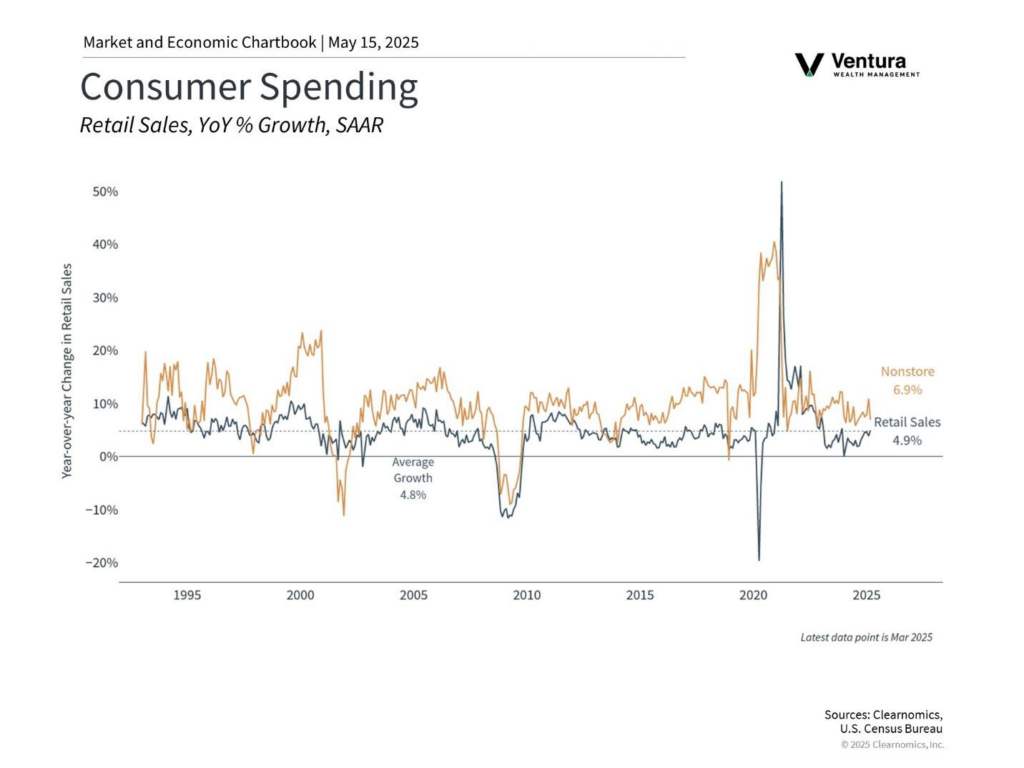

The initial panic created by “Liberation Day” is largely behind us. In fact, at the time of this writing, equity markets are slightly higher than they were before the announcement. The sell-off was scary, but defensive moves were made for our investors. Now we are turning carefully toward a more likely positive economy. Strategists are lowering their expectation of recession. We are seeing investment firms increasing their expectations of higher market levels by year-end. And we as consumers are hoping not to see empty shelves in our stores this summer. When looking at the consumer directly, the rhetoric is 100% opposite the actual economic numbers. People say the economy feels awful but somehow continue to spend money without slowing down. Incomes are up and unemployment is low and stable. Inflation remains stubborn, currently sitting above the Federal Reserve’s target number.

Then we have the uncertainty of the impact of tariffs on prices. Housing remains the most difficult area of consumer spending. The housing market has been chronically underbuilt during the past 17 years. The Financial Crisis of 2008 was largely blamed on a speculative real estate market. Builders cut back, regulators made building more difficult, and consumers were afraid of the market. Now, we are short thousands of living units! Interest rates are high, adding to the difficulty of affordability. And, many of our building products are imported, further adding to this conundrum. The Baby Boomers are living longer and either own their homes outright or have them financed at significantly lower interest rates than are available today. Lastly, Boomers are increasingly comfortable “aging in place,” slowing turnover in the housing market.

Ventura Wealth Management’s investment strategies have served investors well during this volatile period. By focusing on high-quality companies with “wide moats,” we avoided the extreme impact of the most recent market correction. We continue our constant vigilance regarding corporate earnings, balance sheets, leadership, and strategic plans. Every week, we monitor 38 asset classes, the S&P 500 industry groups, and macroeconomic numbers with obsession. Today’s economy is continually growing, creating opportunities all around us. Lastly, now that interest rates are closer to historical averages, we have the opportunity for diversification into the bond market. We haven’t seen such an opportunity since the Financial Crisis of 2008.

Although we find uncertainty as unwelcome as anyone, we are proactively managing it to allow portfolios to emerge strong and ready to leverage the unfolding opportunities within the ever-growing and dynamic American economy.

“Economist’s Corner,” by Roger Klein, Ph.D.

Here we are now, one hundred days into the Trump second term and one month since “Liberation Day”. What have we learned?

(1) Trump will soften his position on tariffs and his rhetoric about firing Federal Reserve Chair Jay Powell if there is a large negative financial market reaction. The S&P 500 dropped 10% in the two trading days after “Liberation Day” and within a week, Trump announced a ninety-day pause on reciprocal tariffs. The total decline from the S&P peak on February 19, 2025, to its current low was 21.34%.

(2) The economy is doing okay. We are not in a recession. Private economists put the odds of a recession this year to be between 40% and 60%. It is generally believed that two consecutive negative quarters of real GDP growth is a technical recession. We just had one quarter of negative GDP growth. The official arbitrator of the business cycle is the National Bureau of Economic Research (NBER). The NBER is looking for pervasive economic weakness over an extended period of time to make their determination.

(3) According to the Bureau of Economic Analysis (BEA), real gross domestic product (GDP) decreased at an annual rate of 0.3 percent in the first quarter of 2025. In the fourth quarter of 2024, real GDP increased at a 2.4 percent annual rate. The reason for the negative print for the growth rate of real GDP in the first quarter of this year was due to the surge in imports and the resulting large trade deficit. There was also a small decrease in government spending. These were partially offset by an increase in real final sales to private domestic purchasers, which is the sum of consumer spending and gross private fixed investment.

(4) The labor market is strong. In April, total nonfarm payroll employment increased by 177,00 and the unemployment rate remained unchanged at 4.2 percent, according to the Bureau of Labor Statistics (BLS). The unemployment rate has remained in a narrow range of 4.0 percent to 4.2 percent since May 2024. The unemployment rate will be an important statistic for the Federal Reserve in their consideration of monetary policy. High and rising unemployment will require the Federal Reserve to reduce its target interest rate.

(5) Inflation continues to move lower but remains above the Federal Reserve 2.0 percent target. In March, the year-over-year increase in the PCE price index was 2.3 percent and the year-over-year increase in the core-PCE price index (excluding food and energy) was 2.6 percent.

Managed Model Strategy

Global Alpha

The Global Alpha model has done two pivots in the past six weeks. First in early April, we took large defensive actions such as adding gold, crypto, and raising cash levels. If the market continued to fall, we would have been able to profit from a decline in the markets. Now, we are pivoting back to growth. Many stocks have fallen too far and more clarity from the government is opening opportunities again. We believe retail had fallen too far and have added new positions in the consumer discretionary area. We see continued strength in the aerospace area and have increased our investment in this sector. There is continued strength in finance, technology, and industrials. We are optimistic that a return to growth is upon us.

Global Balanced

The Global Balanced strategy remains on solid footing and has weathered the turbulence of 2025 well thus far. The strategy’s mandate for global diversification has helped negate weakness in American equity markets. Our investments in gold, commodities, hedge funds, and managed futures have shown strong results. We have also recently increased our cash position for either opportunistic purchases or further defensive actions. Domestic equities have been reduced slightly and we are evaluating further purchases in the international markets. We capitalized on April’s weakness by adding to long-term holdings. The bond segment of the portfolio remains focused on “quality” across asset sub-classes.

Moderate Allocation

The Moderate Allocation Portfolio took advantage of the significant fall in stock prices in April by going overweight equities. The rapid recovery in prices and continued uncertainty surrounding trade policy caused us to reduce our equity holdings back to a neutral allocation. We also rearranged some of our fixed income holdings by selling our positions in Treasuries and emerging market bonds and purchasing inflation-protected securities. If tariffs lead to a pickup in inflation these bonds will likely outperform straight Treasuries. Economic growth appears to be slowing but is not currently recessionary. However, the course of the economy and Federal Reserve policy is highly dependent upon the outcome of trade negotiations. We are monitoring the situation closely.

Milestone360

Studies in the field of Behavioral Economics tell us that when investors experience periods of high volatility and uncertainty, they are more likely to make decisions that adversely impact their overall financial situation. This quarter, our Milestone 360 topic is called “Volatility Playbook.” Here are five items many households should consider in periods of higher-than-normal volatility:

1. Review Your Budget and Emergency Fund – Knowing that you have “just in case” funds at the ready can help alleviate immediate stress

2. Avoid Panic Decisions – From an asset allocation perspective, very rarely do decisions need to be made right away. Consult with your VWM Wealth Manager before making major shifts in your investments

3. Look for Diversification – Money is always in motion, meaning funds are always flowing between asset classes, creating opportunity. Diversified accounts have performed well thus far in 2025

4. No Market Timing – Market timing is one of the riskiest strategies an investor can pursue. “All in” or “all out” maneuvers can be devastating if improperly deployed

5. Evaluate Risk Tolerance – After a dip in the market, it is a good time to ask yourself how you felt while values were under pressure. If you were stressed or were unable to pass the “sleep at night” test, it would be a good time to discuss your overall risk profile with your Wealth Manager.

As always, we are happy to discuss these items with you in your quarterly reviews. If you have immediate questions, please reach out to your Wealth Manager.

VWM Update

On March 31 of this year, Faye Hart retired as a Wealth Manager from VWM. She worked with the team for over 15 years, consistently bringing a positive attitude and a professional depth of knowledge. Her warmth and dedication to her clients will be greatly missed. Faye will still be helping some clients with specific insurance-related issues. Please join us in wishing Faye a very happy and healthy retirement!

Ivy Storaci was recently hired as a Client Service Associate. Ivy previously worked in banking. On our team, Ivy will be helping with account opening, cash management, and account operations. She has a great attention to detail and a positive “can do” attitude. We are happy to welcome her aboard.

Enjoy the summer,

Nick Ventura Founder and CEO