The Financial Advocate: Spring 2024

“Sell in May?”

Sell in May and go away!

There is an old Wall Street adage which says, “Sell in May and go away!” This phrase relates to the tendency of stock prices to rise in the beginning of the year and fade into “summer doldrums” before beginning their rebound and move higher in November through year-end. This year, that would have been bad advice. While we at VWM are looking at much longer trends and concepts, selling in May would have put investors out of the market during a strong period which moved equity markets to all-time highs. Thinking back to the late nineties, when the books Stocks for the Long Run by Jeremy Siegal and Dow 40,000 by David Elias were published, people scoffed at the idea that the Dow Jones would hit 40,000 in a reasonable timeframe. Jeremy Siegel was then the head of the Wharton School of Finance and is still there as Chairman Emeritus. His concepts were straightforward and thought-provoking. Just this year, in mid-May, the Dow Jones did in fact hit 40,000! Since the publishing of these books, we have had wars, financial crises, stock market routs, and a pandemic. Still, “stocks for the long run” returned 400% over the past two decades.

Inflation Pressures

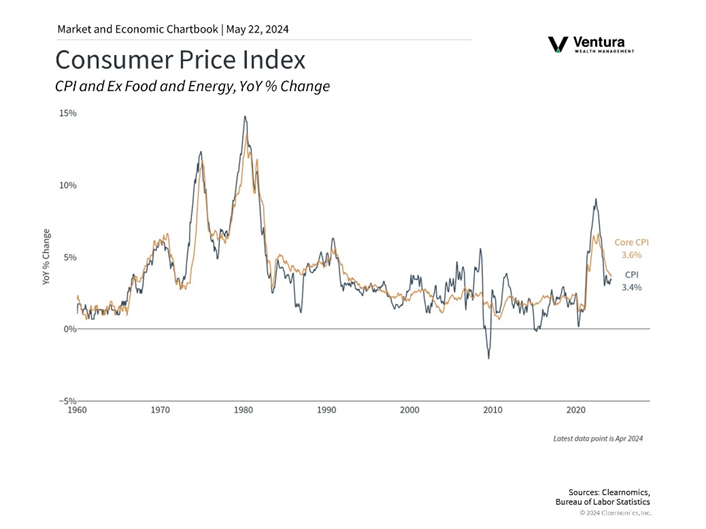

What we see now is that the earnings of American companies’ stocks are quite strong, and the general economy is in pretty good shape, despite high interest rates imposed by the Federal Reserve to control inflationary pressures. We have a general expectation that inflation should start to cool a bit, (maybe happening as you read this), leaving room for the Fed to do some interest rate cutting this year. It remains to be seen how many interest rate cuts we may see in 2024. Wages and housing expenses are big inflation drivers, and we believe that the wage hikes of the past two years are largely behind us. It’s interesting to note that shelter costs account for one-third of the Consumer Price Index. If the Federal Reserve cuts interest rates and shelter becomes more affordable, it will show up in the inflation numbers as cooling inflation. The cooler the better – rates need to come down for people to live more comfortably with more affordable housing. The Fed is targeting 2% inflation; we will see if they can stick to that number.

There are forces in the market preventing some prices from moving lower. Russia is a very large oil producer and that supply, while moving through black markets, is currently disrupted. Ukraine is a very large food producer, but it is difficult to ship food supplies while ports are being bombed. One example is the recent shipping attacks in the Strait of Hormuz. A large quantity of the world’s exporters use that waterway for global trade. Again, think of the disruptions. These are just a few examples of why inflation could be around longer than anyone, especially the Federal Reserve, wants.

Yielding Opportunities

With interest rates higher, investors should lock in higher yields while the opportunity exists. We are actively purchasing bonds for our long-term investors. Bond yields have not been this attractive for many years. It’s nice to see higher returns on money market funds and high-yield savings accounts. But, as inflation cools, yields will fall. Don’t forget that bonds, in an environment of falling interest rates, will appreciate as well. This potentially allows for the compounding effect of locking in higher yields AND bond value appreciation.

The Politics

So far in 2024, markets have been fairly calm despite a storm of poor geopolitical news. We should warn that the remainder of the year is not likely to be as pleasant. We unfortunately see no swift end to the violence across the globe and pray there won’t be any other flare ups! In the same vein, Taiwan and China are always on our minds. And, it is a presidential election year. The debates, conventions, mudslinging, and endless media trash talking will be front and center for the next five months. Since neither candidate is a fiscal conservative, spending will continue rising under either candidate. Spending must be monitored for the inflationary effects it may have on the overall economy. In the years ahead, entitlement plans will also need regulatory reform. Will either candidate be able to do it? Only time will tell.

The “Boomer” Wealth Transfer

The Baby Boomer generation, born between 1946 and 1964, are retiring en masse. The following statistic is no joke – they own about 50% of the nation’s wealth! No other living generation even comes close, and that wealth will transfer to younger generations as time passes. No other demographic has as much wealth, spends as much money, and enjoys the fruits of America as much as the Boomers. The second thought, and a nuance of the Boomers, is that unlike generations before them, they are transferring wealth while they are still living. This helps families enjoy transfers to younger generations which help with expenses of education, housing, and child raising. The Boomers, their money and wealth transfers, and spending are a big underpinning of today’s strong economy.

“Economists Corner,” by Roger Klein, Ph.D

Investors and policy makers, including the Federal Reserve, live in a data driven world. The Federal Reserve has a dual mandate: (1) price stability (the 2% inflation target) and (2) a high level of employment (a low level of unemployment). The Fed has a dual mandate and only one policy tool, its federal funds target interest rate. The Federal Reserve can control short-term interest rates, but it cannot control long-term interest rates, and in April, long-term interest rates increased, while the Fed maintained its target federal funds rate between 5.25% and 5.5%.

Long-term interest rates are determined by a real interest rate and inflation expectations. The real rate component is determined by the pace of economic activity. The U.S. economy has been in an economic expansion for 48 months. There was a two-month COVID recession in February and March of 2020. The annualized growth in real GDP since the COVID recession low is 4.6%. Much of that outsized growth is due to the measurement from the COVID lows. If we look back over the past five years, beginning before the COVID recession, real GDP has increased at a 2.4% annualized rate, which is in line with the previous economic expansion (June 2009 to February 2020).

The most recent GDP report for Q1 2024 showed a growth rate of 1.6%. That was the slowest growth rate since Q2 of 2022. Q2 GDP growth will probably reaccelerate. The initial report for GDP NOW from the Federal Reserve Bank of Atlanta is for a reacceleration of GDP growth in Q2 to 3.6%. It is still early in Q2, so we do not know if the 3.6% growth rate will prevail, but there were some negative factors in the Q1 GDP report that will be reversed in Q2.

Accompanying the slowdown in GDP growth in Q1, was a reacceleration in the inflation rate. The Q1 inflation data is a disappointment for the Fed and for bond investors. Measured year-over-year, the Personal Consumption Expenditures (PCE) deflator for the month of March came in hotter than expected, increasing from 2.5% to 2.7%, while the core PCE deflator held firm at 2.8%. The recent trend is especially problematic for the Fed, as the core PCE deflator has moved up to an annualized rate of 4.4% over the past three months.

The combination of strong economic growth and a reacceleration in the inflation rate is keeping Fed policy on hold. The current expectation is that the Fed will reduce its target interest rate just once in 2024. At the start of the year, the expectation was for six interest rate cuts. Higher short-term interest rates are beneficial to investors holding cash. The opportunities for bond investors have improved. The yield on long-term Treasury bonds is now reasonable. The ten-year Treasury note is trading in a range between 4.4% and 4.7%. If inflation can be contained below 2.75%, that represents a real inflation- adjusted yield of about 2%. That’s much higher than we have seen for many years.

Managed Model Strategy

Global Alpha

Things are looking bright for Global Alpha investors. Investments in AI, cloud computing and security, robotics, and software continue to generate above average returns. On the other hand, capitalizing on various economic policies of the current Administration, investments in the industrial, power generation, and reshoring of industries, as well as basic materials, are generating solid results. We continue to favor our “bricks to semi’s” philosophy while remaining overweight materials and industrials on one end of the barbell, with technology and communications on the other end.

Global Balanced

We believe that Global Balanced is well-positioned for the current macro-economic environment. The portfolio remains focused on high-quality American stocks, diversified international equities, unique alternative assets, and fixed-income holdings (primarily U.S. Treasuries). The strategy continues to incorporate stocks with good market share and consistent earnings’ growth. International equities are focused on capturing the movement of supply chains – specifically targeting the Asian basin (ex-China) and the old NAFTA, now USMCA. The alternatives sleeve remains in a “hedged” posture. A basket of commodities, liquid hedge funds, gold, and oil are all incorporated. The oil position is a specific response to geopolitical tensions and is not considered a long-term hold. The bond component of the portfolio has been repositioned in an attempt to capture higher yields for a longer period of time. There are several key defensive positions in place should volatility creep up during the summer months and as we near the election.

Moderate Allocation

The Moderate Allocation portfolio performed in line with its 60/40 benchmark in the first quarter. We continue to be neutral with regard to weightings in equities and fixed income. The position in gold has generated significant profits as the precious metal has climbed to an all-time high. As always, the equity holdings are focused on high-quality dividend paying companies. The Federal Reserve is still expected to cut interest rates a couple of times this year. Should that happen, the portfolio’s allocations to stocks and bonds should both benefit. With regard to the economy, it is slowing but does not appear headed into a recession in the near-term. Inflation continues to be sticky but we expect it to ease further in the quarters ahead.

Milestone360

This quarter’s financial planning topic is “Financial Scam Awareness.”

Financial scams are a persistent threat to your wealth. As scammers often prey on emotions, they find ways to hoodwink even the most savvy of us. Falling victim to a financial crime does not make you “stupid” or “inferior.” These criminals are very good at exploiting people – sadly, it is what they do “for a living.” If you discover that you have been a victim of a financial scam, please notify our office. We want to work with you to protect your financial assets.

In 2023, the dollar amount lost to financial fraud increased 14% to a record high. According to the Federal Trade Commission, Americans lost over $10 billion to these schemes. While investment fraud was the leading cause of financial loss in dollar terms (think Ponzi schemes), imposter schemes were the category with the most victims. Fraud relating to online shopping, business and job opportunities, and lottery / sweepstakes are all on the rise.

There are several ways you can help protect yourself from financial fraud:

- Stay informed and educated on the latest types of scams. Fraudsters are routinely developing new tactics.

- Use strong and unique passwords for your online accounts and enable multi-factor authentication.

- Monitor your financial accounts regularly.

- Be cautious when giving out personal information and about what you post online or on social media platforms.

- Be skeptical of unsolicited communications.

- Shred documents that are no longer needed – do not just throw them away.

- Verify charitable organizations before making donations.

There are things that a scammer will ask you to do that someone from a trusted financial institution will not:

- Lie to a financial institution about why you are withdrawing a large sum of cash.

- Change your monthly deposit instructions.

- Pay a stranger through gift cards or a cash transfer application like Venmo or CashApp.

- Send money to a romantic acquaintance you have not met.

- Withdraw large amounts to purchase crypto assets.

Our team is here to help you navigate these waters. If you are contacted or receive a notification from VWM or one of our custodians that looks suspicious, we will help you verify its authenticity.

As always, we want to say “Thank You” for your business. We appreciate your trust in our firm. Enjoy the start of Summer!

Nick Ventura

Founder and CEO