The Financial Advocate: Fall 2024

“So It Begins…”

We have much to be thankful for as 2024 comes to a close. Record highs have been reported in the major domestic stock indices. And, the Federal Reserve has turned its attention to lowering interest rates. 2024 is the second consecutive year of 20% gains in the equity markets, as measured by the S&P 500. This is indeed rare and welcome! The future looks promising, too, with the economy continuing to move forward and recession fears fading. Corporate profits remain strong and are poised to strengthen in 2025.

The Republican “sweep” this term is significant. Many political and economic promises have been made. The key implication of this political shift is that we largely see an environment of higher volatility in market returns. Change is not without some level of anxiety, and we will continue to respond to the economic situation as it unfolds. That being said, trends are largely positive. In addition to rising corporate profits, any tax reductions are icing on the cake. However, the stock market currently reflects these expectations and is trading at fairly lofty levels. Stock selection will be key in 2025, as will management of any real or perceived market volatility.

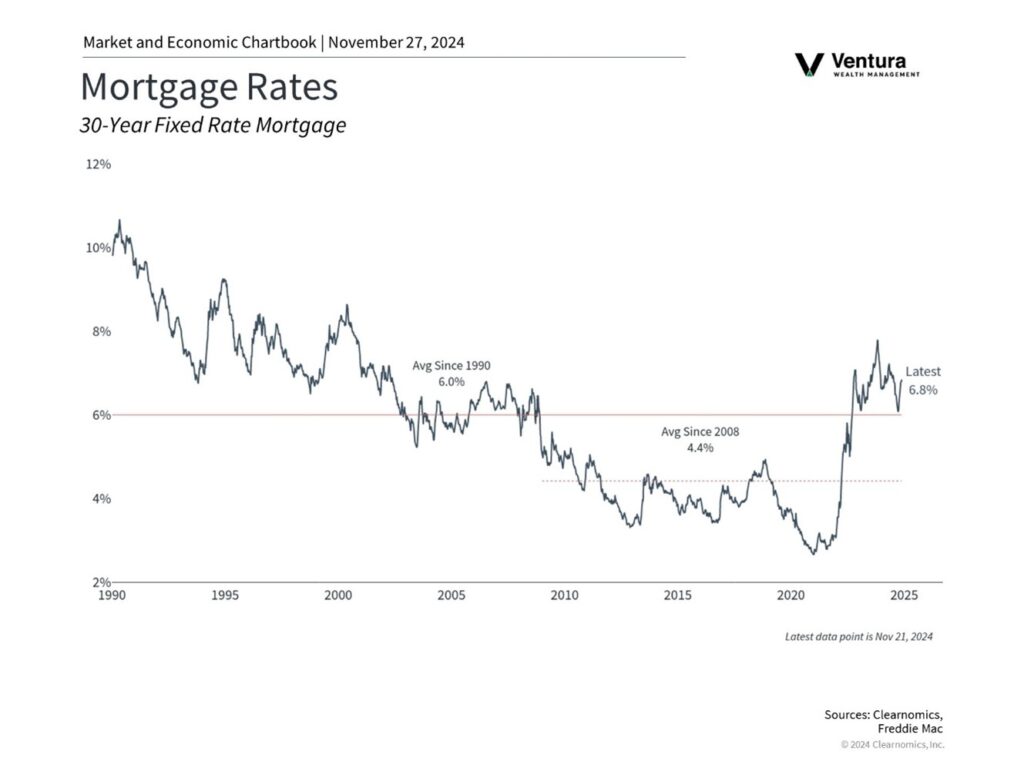

Trends in interest rates are cloudy. As inflation continues to moderate, interest rates have room to come down. However, why haven’t they fallen more? In simple terms, certain Trump policies, while heralded as ‘Good for the economy!’ are potentially inflationary. Tariffs are one example. If the cost of goods increases due to tariffs, the increases become reflected in inflation measures. Another example is the abundance in proposed spending and further tax cuts. It is unclear how much the Department of Government Efficiency (DOGE) can actually cut from the current budget. Until we know more details on these economic plans, interest rates are likely to remain in a range. This is unfortunate for homebuyers. Mortgage rates are currently hanging around 7%, putting new purchases out of reach for many first-time homebuyers. Traditionally, home buying activity picks up when mortgage rates are in the 5-6% range.

Geopolitical issues are of central concern. We would all like to see these conflicts end. Will this happen? The new administration has made promises in this area. Only time will tell. A key factor will be oil sanctions. The Trump administration can reduce the prosperity of Iran and Russia by flooding the market with oil. “Drill, baby, drill” could have a significant impact on the world stage. While we may have hit “peak oil” (in terms of aggregate demand), the world still largely runs on fossil fuels, and unfortunately, fossil fuels are what keep some bad actors flush with money to support war efforts. The task of resolving conflict is daunting. We will simply have to see how these issues unfold.

Lastly, on the geopolitical front, trade and tariffs are center stage. What we hope for is negotiation and “fair play.” Until we know the intentions of domestic trade policies and those of our trading partners, this area is unknown. Trade wars hurt everyone involved. Let’s hope cool minds prevail and trade policy is set in a reasonable, measurable fashion. Again, only time will tell how these issues will ultimately be resolved.

As we move into 2025, it is encouraging to see how well the American economy is doing despite these concerns. There are many strong signals pointing towards continued economic growth. The U.S. economy’s resilience is notable. We remain a global beacon of economic prosperity. Innovations in technology, industrial applications, medical innovations, and communications are happening at “warp speed.” Increases in efficiency, productivity, and wellness are a testament to the vast, deep commitment to technological advancements. So indeed, change is coming at an ever-increasing speed. We will continue to manage it, prosper from it, and enjoy the rewards of economic abundance!

“Economist’s Corner,” by Roger Klein, Ph.D.

Over the last ten years, large cap domestic stocks produced extraordinary returns. The annualized total return for the S&P 500 was 13.4%. Over that same ten-year period, bonds performed poorly. The annualized total return for the Bloomberg U.S. Bond Index was just 1.4%. The real, inflation-adjusted return to bonds was negative. Bonds did not beat inflation.

As long-term interest rates increase, bonds are more attractive. At the same time, the historically high valuations for stocks reduces the expected future returns to stocks. Recent published projections from Goldman Sachs and the Leuthold Group forecast the future ten-year annualized return for the S&P 500 at approximately 3%. The argument for low future returns to stocks rests on the idea that a large part of the recent outperformance comes from higher price/earnings multiples. Investors are now paying 25.8 times peak S&P 500 earnings, the highest valuation we have seen since 2000 and 50% above the historical median. A decade ago, this same ratio was 17.2, right at the historical median.

Treasury bonds come in two varieties, nominal bonds and inflation-adjusted bonds. The current yield on the nominal ten-year Treasury note is 4.25%. If you purchase this bond at par, you will receive a coupon payment of 4.25% annually and you will receive your principal back at maturity. One of your risks is inflation. The real value or purchasing power of your bond is reduced by the annual inflation rate. The inflation-adjusted, ten-year Treasury note provides protection from inflation. The current inflation-protected ten-year Treasury note has a real yield of 2.02%, but it provides inflation protection by increasing the principal value of the security by the monthly change in the consumer price index (CPI).

If the Goldman Sachs and Leuthold projections are reasonable, then the ten-year Treasury note is beginning to provide an attractive, risk-free alternative to owning a portfolio of large cap domestic stocks. The future is always uncertain, but the Treasury inflation-adjusted security will provide real yield certainty and principal protection from inflation.

Managed Model Strategy

Global Alpha

Global Alpha enjoyed a very good year with commitments to investments in Artificial Intelligence (AI), GLP-1 weight reduction medicines, software, communications and domestic industrial production. We believe that these areas will continue to prosper in 2025. We also believe the “second inning” of AI has started with the widespread application of AI to software tools. As such, we are invested in companies that will bring AI to the home and workplace. Our commitment to AI hardware producers (“first inning”) and now to AI software (“second inning”) is a cornerstone to our model. We see AI entering the industrial complex (to enhance productivity and the drug complex) to speed drug development and testing. The applications are just beginning and there are countless more to come. We are committed to power generation for our data centers (including nuclear and hydrogen applications), cutting edge medical innovations, and technological advancements across the technological spectrum. New areas of investment under the new administration include financial companies (less regulation), and widespread acceptance and continuing investment in consumer discretionary goods, as we do not see a recession. There is much to come in areas such as quantum computing, synthetic biology, precision medicine, and space investment, which are all under consideration.

Global Balanced

The Global Balanced strategy is well positioned and has been outperforming its respective benchmark on a net-of-fees basis. In keeping with the philosophy, “The best offense is a good defense,” the portfolio’s quality focus has bolstered both opportunistic and defensive characteristics. The portfolio is centered on high-quality American stocks, diversified international equities, unique alternative assets, and an array of fixed-income holdings. The international equity component includes economies benefiting from shifting supply chains in the post-pandemic world. We believe that China’s efforts to stimulate their economy in advance of any trade action taken by the incoming Trump administration should help emerging markets. The alternatives sleeve remains in a “hedged” posture. We recently added the Postal Realty Trust – a REIT that primarily owns the real estate that houses local post offices. (Talk about boring! And … a consistent performer with a nice yield). The bond component of the portfolio continues to be repositioned to take advantage of volatility in this asset class.

Moderate Allocation

The Moderate Allocation Portfolio has continued to benefit from its close-to-benchmark weightings in equities. Many of our core holdings have done exceptionally well this year including Walmart, Netflix, and American Express. Additionally, our patience with other holdings which have been out of favor is starting to pay off. Disney and Starbucks, for example, seem to be turning a corner. Interest rates are currently stuck in a wide trading range. As such, the duration of our fixed income allocations is near neutral. Should the opportunity present itself to shorten or lengthen duration significantly, we will respond accordingly. Although our focus remains on high quality companies with growing dividends, we will be vigilant about sell-offs in other asset classes heading into the new year. With the economy performing solidly, corporate earnings growing, and the Federal Reserve cutting interest rates, we are hopeful in the quarter ahead.

Milestone360

The yield on money market funds is likely to head lower over the next 12-18 months. As the Federal Reserve continues to cut their benchmark target rate, banks will in turn decrease the rate that they are paying Americans in their savings accounts. The same applies to CD and fixed annuity rates. Now is a good time to consider the best allocation for your reserve funds. Too often we see clients not receiving enough yield (read: compensation) for the assets they are keeping in their checking and savings accounts.

Just because money market yields are heading lower and the Fed is cutting rates, does not mean that there are not opportunities in other places in the bond market. When we head further out the yield curve, taking a longer-term perspective, we can currently “lock in” Treasury rates in the 4.20% to 4.40% range. Should yields continue to fall across the entire curve, these bonds would likely also have the benefit of capital appreciation. These rates would stay in place over the full life of the bond – two, three, five, seven years out. This is called “yield to maturity.” Even if the Fed cuts rates on short-term bonds, you can maintain higher levels of income for a longer period through the bond market.

For clients holding excessive levels of cash, or who have CDs maturing, now is a good time to consider adding fixed-duration bonds to your portfolio. Talk to your wealth manager about what is appropriate for you and your portfolio.

As always, we want to say “Thank You” for your business. We appreciate your trust in our firm. Happy Holidays and a prosperous New Year to you and your family!

Nick Ventura

Founder and CEO