The Financial Advocate: Fall 2023

“Calling the Fed’s Bluff”

What a Difference a Month Makes

2023 started out with the equity markets in full-recovery mode. The charge was led by the “Magnificent Seven” (the seven largest tech companies) and augmented by solid performance of companies directly benefiting from government spending on infrastructure and manufacturing. Things were looking up through the start of the third quarter. And then… “Good news” became “bad news.”

Most of us have been investing long enough to recognize that there are times when the markets treat “good” news as a positive, neutral, or negative factor. Bad news can be shaded in all three lights as well. As we know, these characterizations, sometimes mischaracterizations, can skew equity markets and frustrate even the most seasoned investors.

So, what “good news” put markets into a bad mood towards the end of July?

Despite never-ending predictions of the demise of spending, the consumer has not slowed down. Why? The labor markets remain strong. Low unemployment (the U6 rate is currently 3.7%), solid wage gains (4% year-over-year), and an upward trending participation rate (62.8%) indicate that the consumer is in relatively good health. (We would be remiss if we did not note that there is some fraying around the edges, but the preponderance of data suggests a good labor market). A healthy labor market should equate to more consumer spending; so far it has. And in this environment, which is still recovering from the pandemic, investors and the Federal Reserve equate more spending with stubbornly high inflation. Investors remained fearful through the summer into early fall that the Federal Reserve was going to use the strength of the consumer as justification to maintain or increase restrictive monetary policy. Investors had good reason to fear further action by the Fed. Why? Members of the FOMC are announcing to markets that they are pursuing a “higher for longer” interest rate policy, and that they may not be finished raising target rates. Additionally, gross domestic product for the third quarter grew at an annualized rate of 5.2%, there were several major labor strikes, the attack on Israel by Hamas fueled concerns of an energy price spike, and Congress seemed unwilling, unable, (sometimes both) to pass bills to keep paying government debt and government employees on the job. These

factors combined to push interest rates higher (the 10-year Treasury bond briefly had a yield of about 5%) and equity markets into a correction (corrections are defined as a move lower of 10%-20% from a recent peak). The third quarter felt miserable for investors across risk categories. And, just when things could not get worse… Good news became good news again.

During the period where interest rates were spiking and the equity markets were falling into correction (end of July into the end of October), the majority of the economic data points that we follow on a regular basis were strengthening. Investors were panicking while corporate earnings looked “good enough” and the U.S. economy was accelerating. Inflation remained a focal point. It was clear that the FOMC’s rate decisions would pivot to a “pause” setting once inflation data stabilized at a reasonable level. That data presented itself in the early days of November, sparking a ferocious recovery rally in both stocks and bonds.

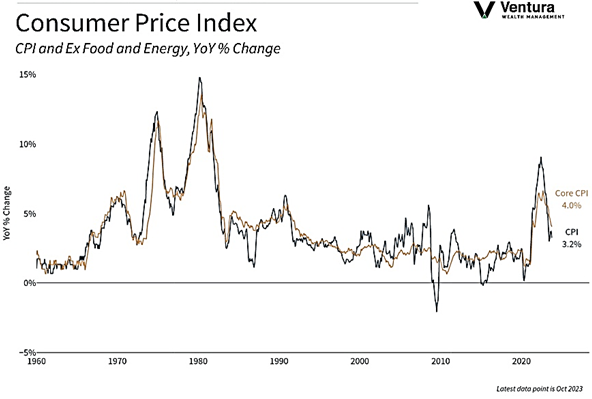

The Consumer Price Index (CPI) reading showed that inflation was flat in the month of October and up 3.2% year-over-year (chart above). The Producer Price Index (PPI) fell 0.5% in October, the largest monthly dip since April 2020, and showed only a 1.3% year-over-year change. And the Personal Consumption Expenditures Price Index (PCE), noted as the “Fed’s favorite inflation gauge,” rose 0.2% in October and 3.5% at an annualized rate. We note these various readings because inflation is extremely difficult to measure, and everyone’s inflation rate is different. Admittedly, this makes the Fed’s job difficult. These readings were either in-line or below analyst estimates. And most importantly, these measures are at levels where it is near impossible for the FOMC to justify further rate hikes. This caused investors to breathe a collective sigh of relief. We expect the FOMC to continue to “talk tough” to the markets as they do have serious concerns that inflation’s ugly head may spring back up. But given the data we are evaluating, we would expect the markets to continue to call the Fed’s bluff.

Opportunities and Threats

Many investors are happy to forget the dismal performance of 2022 and are seeing portfolios recover nicely in 2023. The Federal Reserve, which had been considered a threat to both bond and stock holdings for the past 24 months, is currently viewed as being largely on the sidelines. Historically, the FOMC has started to cut rates nine months after the final rate hike of the cycle. Using history as our guide, that would suggest that the Fed could be cutting rates sometime in the second quarter of next year. (Futures markets, as of the time of this writing, are forecasting the first rate cut in March). Only time will tell if history will repeat itself. Lower rates could help spur equity prices along. In what has been a rally in equities largely led by the technology stocks, lower rates could broaden the rally to incorporate more sectors. Laggards like utilities, staples, health care, and even REITs could better participate in a lower rate environment. More accommodative Fed policy will help the consumer and businesses on both the sentiment and spending fronts. When goods become more affordable (less likely), or financing is perceived as being more reasonable (more likely), there is little doubt that Americans will step up and spend.

And with the “Fed as the Boogeyman” story pushed aside, many notable analysts are suddenly becoming more bullish in their estimates for equity market performance in the year ahead. As always, there are predictions ranging from “doom and gloom” to “pie in the sky.” Yet, there are a fair number of well-respected analysts using 5,000 as their S&P 500 target for year-end 2024. The 5,000 level would be a new record high and would account for about a 12% advance from current levels. The analysts in this camp are citing steady and improving earnings, cooling inflation, fading geopolitical risks, the end of the Fed rate-hike cycle, and stockpiles of unused investor and consumer cash as contributing factors. We do not know if this will come to fruition. But, the surge in equity prices in the month of November (the S&P 500 rallied just under 6%) hints that cash in the wings may be looking to come back into the markets more quickly than the bears anticipated.

And while we look at the bull case, we must also examine what could work against us as investors

Of course, we expect the 2024 presidential election, now less than a year out, to be a dominant story. At this stage, we do not know who the candidates will be. We do believe there will be a fair amount of fireworks, and these fireworks will agitate investors of all stripes. In presidential election years since 1933, the S&P 500 has returned an average of 11.0%. This is better than in midterm election years, where the average annual S&P 500 return is 9.8%. If we remove 2002 and 2008, two years where equity markets were in the midst of savage bear markets, the average presidential election year return jumps to 13.0%. While we do not expect the year to be smooth, we should not move into “panic mode” as investors just because we will be having a presidential election accompanied by attack ads, partisan bickering, and endless political theater.

In presidential election years since 1933, the S&P 500 has returned an average of 11.%.This is better than in midterm election years, where the average annual S&P 500 return is 9.8%

While we are not worried about the election per se, from an investment perspective, we do have concerns about the ongoing disfunction of the Federal Government. As you know, U.S. debt was downgraded by Fitch from AAA to AA+ in August. They are the second of the three major ratings agencies to have done so. Their rationale? “There has been a

steady deterioration in standards of governance… including on fiscal and debt matters. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. In addition, the government lacks a medium-term fiscal framework.” This is a problem. The lack of cohesive policy on federal budgets, tax policy, and the debt ceiling are likely to nag investment markets. While American businesses will find ways to navigate choppy political waters, these factors may contribute to extra, unnecessary volatility in the fixed income markets.

Geopolitical conflict unfortunately remains a central concern as we head into the New Year. We cannot help but be horrified at the attack on Israel by Hamas and the humanitarian crisis that followed. The conflict created by Russia’s invasion of Ukraine continues to destabilize the global community. And, while there has been some recent thawing of tensions between the U.S. and China, there is still very much a cold war between the two nations with Taiwan at the center. The toll of these conflicts in human terms is incalculable. As investors, however, we are aware that war tends to create profits for U.S. corporations. And, assuming energy prices remain stable, the U.S. consumer is likely to continue spending their way forward into 2024, even if they have a dismal outlook on the state of the world.

Cautious Optimism

How do we end 2023 and peer to 2024? Cautiously optimistic. The impact of the Federal Reserve finishing its rate hike cycle should not be understated. This should help with confidence, planning, and spending at both the consumer and corporate levels. Foregoing any surprise inflation figures to the upside, markets will continue to “Call the Fed’s Bluff.” Corporate earnings held up very well this year (much better than the nay sayers had forecast) and are likely to post modest gains for ’23. Most analysts project that growth rates will be “more normal” in 2024. American consumers say that they feel terrible about the economy, the state of the country, their future prospects, etc. (And they may have good reason to be concerned). Yet, what they say and how they behave are widely disparate. As they have since the pandemic, the consumer is likely to continue to practice “retail therapy.” This will ultimately keep the U.S. economy moving forward. Investment themes centered on “best of class” companies have the potential to outperform. There is rarely a bad time to own companies with solid balance sheets and seasoned management teams participating in exciting areas of the economy while demonstrating consistent sales growth. With investment grade bonds now yielding near 5.5%, fixed income allocations should boost the performance of diversified portfolios. Just like 2023, 2024 may not be the smoothest year. But, for the disciplined investor, it has characteristics we believe can present positive outcomes.

“Economists Corner,” by Roger Klein, Ph.D.

What happened in November to turn around the financial markets? A headline in the December 1 issue of the Financial Times read, “Investors rush for risky assets in the belief rate rises are over.” Investors were encouraged by the statements of Federal Reserve officials. Christropher Waller, one of the most hawkish Federal Reserve Governors, said he was “increasingly confident that monetary policy was in the right place.” If inflation continued to fall, “you could then start lowering the policy rate just because inflation is lower.” And inflation is continuing to fall. In October, measured month-over-month, the increase in the PCE deflator was zero and the increase in the core-PCE deflator was 0.2%. Measured year-over-year the PCE inflation rate is 3.0% and the core-PCE deflator inflation rate is 3.4%. The Fed’s inflation target is 2% for the core-PCE deflator. Can the Fed achieve its target inflation rate? Of course, nobody knows, but thus far, the inflation trend is moving in the right direction. The Federal Reserve Bank of Cleveland’s inflation nowcasting is projecting another zero increase in the PCE deflator in

November and a 0.33% increase in the core-PCE deflator. If these month-to-month projections are correct, the core-PCE deflator measured year-over-year will still be too high at 3.46%. The move to a core-PCE deflator target of 2% is going to be difficult.

What will the Fed do? Unless inflation turns around and accelerates, the Fed is finished with raising its target interest rate. How long does the Fed keep its target rate at 5.5%? That depends on what happens to the economy and inflation. If inflation continues to move lower the Fed will lower its target interest rate. The futures market expects the first rate cut to occur in March. Interest rates are not going back to zero. The neutral target interest rate is between 2.5% and 3%.

Important Year-End Tax Note

As we head into year-end, please let us know if you have any special requests you would like us to consider as we adjust portfolios for tax purposes. In some scenarios we may harvest extra gains or extra losses to balance an event happening in other areas of your financial life. We traditionally attempt to move the portfolios close to a “flat” position to minimize your capital gains tax exposure. In 2022, in many portfolios, we purposefully created a “bank” of realized losses that can be used against future gains on your Federal return. If you have any questions about the current tax status of your portfolio, or any special requests for the portfolio management team, please contact the team as soon as possible.

Managed Model Strategy

Global Alpha

Global Alpha has experienced a sizeable rebound on a risk-adjusted basis in 2023. Returns continue to extend in technology: artificial intelligence, cloud computing, software, cyber security, and semi-conductor fabrication are standout performers. We are seeing contributions to results from traditional industries as well. Building products and select industrials are adding to results. Our investments in GLP-1 (anti-obesity treatments) through Eli Lilly has opened a new era in medical care possibilities. An area of interest continues in the care of our pets; both IDEXX Laboratories and Zoetis are helping our results. Investments in what has come to be known as the “Magnificent Seven” – Microsoft, Google, Apple, Amazon, Meta, Tesla, and Nvidia round out a solid, theme-based portfolio

Global Balanced

“Quality” and “moving supply chains” are the dominant themes in the Global Balanced strategy. The portfolio continues to outperform its benchmark in 2023. The fixed income component of the strategy is well-diversified and has performed nicely. Individual bonds were added over the previous 12-month period. We centered these purchases on U.S. Treasuries maturing within seven years. In this slice of the bond market, we believe we can be well-compensated without taking undue risk. The alternative sleeve of the portfolio has benefited from an allocation to gold, which has been a strong performer this year and should benefit from a decline in interest rates. Domestic equities are focused on companies with high-quality balance sheets, seasoned management teams, and consistent earnings growth. Companies that are benefiting from government spending (infrastructure and manufacturing spend (this includes tech)) are emphasized. On the international equity front, the movement of supply chains from China to other Pacific Basin countries continues to unfold and present investment opportunities in both developed and emerging segments.

Moderate Allocation

Despite the volatility asset markets experienced from July to October, the Moderate Allocation Portfolio remained positioned for upside heading into the end of the year. The recession that has been anticipated for over a year has not arrived. The economic data currently does suggest a slowdown from the rapid pace of growth in the third quarter. However, the current data does not look recessionary. As always, we will continue to monitor the economic and financial statistics closely. As we head into the end of the year, several of the high-quality holdings that suffered significant sell-offs are beginning to rebound. Examples include Disney, Nike, and Accenture. Non-core positions in gold and emerging market bonds continue to add to performance. We anticipate extending the duration of our fixed income allocations as the circumstances present themselves.

Milestone360

This quarter’s Milestone360 topic is the Trusted Contact Person or TCP. Recently, we sent all our individual clients a letter in the mail discussing the importance of adding a Trusted Contact Person to your portfolio. While it is not required, adding a TCP helps keep your portfolio safe. The Trusted Contact Person does not make any decisions on your behalf, and we do not discuss your personal financial situation with them. In the majority of cases, it is unlikely we would ever speak with this person. But, we would keep their information on file to confirm or make inquiries about any of the following:

- Your current contact information

- The identity of any legal guardian, executor, trustee, or other personal representative

- Concerns about your mental capacity as it relates to making financial decisions

- Possible financial exploitation affecting you or your investments

The easiest way to add a trusted contact person to your accounts is to call our office. Sue Pasqualone or Katie Parker-Kramli on our team would be happy to assist you. Either may be reached at 866-899-0068.

As always, we appreciate your support of our firm and thank you for placing your trust in us. 2023 was not the smoothest of years, but we appear to be finishing on a strong note. We look forward to continuing to serve you in 2024.

Best Wishes for a Happy and Healthy Holiday Season!

Nick Ventura

Founder and CEO