The Profit Margin: December 12, 2022

Statistic of the Week

Elevated rent prices pushed millions of young people into moving back home in 2022. A recent survey found that 25% of millennials are living with their parents, totaling approximately 18 million people between the ages of 26 and 41. Of these individuals, nearly half moved back home in the past year.

Global Perspective

The labor shortage is not confined to the United States. In Japan, labor shortage is so severe that local-government officials are being sent to help farmers with crop harvests. When working in the fields, the officials earn $6-$7 per hour, less than half of their normal hourly wages. With half of Japan’s population over the age of 65 and extremely strict immigration policies, the problem is expected to worsen.

Market Moving Events

Monday: Federal Budget

Tuesday: Consumer Price Index

Wednesday: Import Prices, FOMC Meeting Announcement, Chair Powell Press Conference

Thursday: Jobless Claims, Retail Sales, Industrial Production

Commentary

Domestic equity markets retreated last week, giving up some gains from the recent rally. All three major indices finished the week in the red. The DJIA fared the best, falling 2.77%.1 The S&P 500 declined 3.37%.2 And the Nasdaq had the week’s worst performance, sinking 3.99%.3 Fixed income investors were also subject to losses as yields rose. The 10-year Treasury yield increased 0.07% to finish Friday with a yield of 3.57%.4

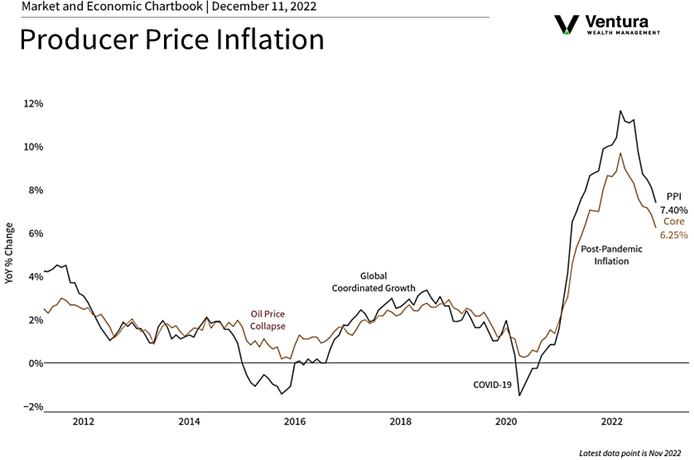

Last week’s economic data pointed to continued declining inflation. While inflation has peaked, it remains too high – far above the Fed’s 2% target. The Producer Price Index (chart right) for the month of November was stronger than expected. That does not bode well for this week’s Consumer Price Index reading due on Tuesday. The PPI and CPI readings together will help inform the Federal Reserve’s meeting announcement on Wednesday. The CPI reading and the FOMC meeting announcement, followed by Fed Chair Powell’s press conference, have the potential to be market-moving events. The retail sales figure will also be closely watched. While the markets are currently pricing in a terminal (or peak) Fed Funds rate of 5.00%,5 hints from the announcement or statement that the terminal rate could be higher (due to stubbornly high inflation) are likely to further sour sentiment. A perception of a tilt towards dovishness could help spur on a Santa Claus rally.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Haver, Bureau of Labor Statistics

Statistic of the Week:

Bloomberg Business

Global Perspective:

The Wall Street Journal

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s