The Profit Margin: December 5, 2022

Statistic of the Week

The foreign aid department of the European Union spent approximately $400,000 developing their metaverse platform in an effort to engage with younger constituents. The department had a virtual “gala” on November 29th to launch the platform. The problem? Only six people showed up.

Global Perspective

The 27 European countries that agreed to a ban of Russian crude oil starting on December 5 have been struggling to finalize details. The EU has been debating a $62/barrel price cap. There are several countries arguing that the cap price is too high. . Irrespective of what the EU decides, there is little doubt that China and India will continue to purchase from Russia.

Market Moving Events

Monday: ISM Services, Factory Orders

Tuesday: Trade Deficit

Thursday: Jobless Claims

Friday: Producer Price Index, Consumer Sentiment

Commentary

Domestic equity markets continued their rise last week. All three major averages finished the week higher. The Nasdaq led the pack, rising 2.09%.1 The S&P 500 increased 1.13%.2 And the DJIA was able to inch out a gain, finishing the week 0.24% higher.3 The rally in equities was mirrored by an increase in bond prices and dip in bond yields. The 10-year Treasury finished Friday with a yield of 3.50%, down 0.20% from the week prior.4

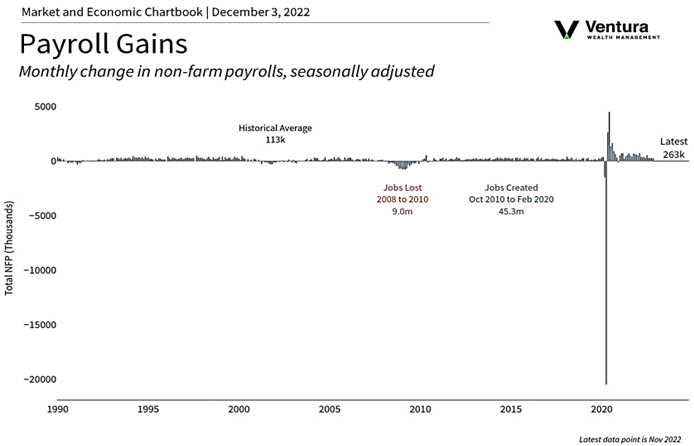

The week’s rally was spurred by comments by Fed Chair Powell. He indicated that future rate hikes would likely be driven by wage growth and that “jumbo” rate hikes were largely behind us.5 The S&P 500 was able to reclaim a critical level (the 200-day moving average) on the news and held it through Friday’s close. Sentiment was further buoyed when the Fed’s favorite inflation gauge, the PCE deflator, was lower than expected.6 The rally was challenged, however, when the Nonfarm Payroll’s figure (chart right), came in higher than expectations. Not only did the economy add more jobs than analysts forecast, but wage growth came in hotter than expected.7 (The very thing Chair Powell said would drive Fed rate hike decisions). While the market rally has been allowing some to breathe a sigh of relief, and the retaking of the 200-day moving average is a show of strength, the market is still in a defined downtrend. It’s not yet time to sound the “all clear.”

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Haver, Bureau of Labor Statistics

Statistic of the Week:

Fortune Magazine

Global Perspective:

CNBC International

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s

6. Investor’s Business Daily

7.Bureau of Labor Statistics