The Profit Margin: October 24, 2022

Statistic of the Week

The IRS is making adjustments to many key thresholds for the 2023 tax year. 401(k) limits are being adjusted higher from $20,500 to $22,500 and IRA contribution limits are moving to $6,500 from $6,000. These are the largest contribution limit increases since increases became linked to inflation adjustments in 2007. The standard deduction will increase by 7% in 2023 as well. For a married couple filing jointly, the standard deduction ticks up $1,800.

Global Perspective

Liz Truss served as Prime Minister of the United Kingdom for 44 days before resigning. She beat the previous record for shortest tenure in the job held by George Canning who passed away on the job a little over 100 days in. She is the fifth prime minister since the Conservative Party came to power 12 years ago and the fourth since the Brexit referendum six years ago.

Market Moving Events

Monday: S&P Manufacturing and Services PMI

Tuesday: Consumer Confidence, FHFA Home Price Index

Wednesday: New Home Sales

Thursday: Jobless Claims, GDP, Durable Goods Orders

Friday: PCE Price Index, Disposable Income and Spending, Consumer Sentiment, Pending Home Sales

Commentary

Domestic equity indices surged higher from oversold conditions last week, logging their best weekly performance since June. All three indices finished firmly in the black. The Nasdaq was the week’s leader, rallying 5.22%.1 The DJIA rose 4.89%.2 And the S&P 500 brought up the rear, moving 4.74% higher.3 Fixed income yields also jumped during the week as investors appear to be pricing in higher-than-normal inflation for a longer period than previously expected. The 10-year Treasury finished Friday with a yield of 4.21%;4 this marked the first time that the 10-year Treasury closed with a yield above 4% since October 2008.5 For fixed income investors, opportunities are beginning to reveal themselves.

While indices rose sharply last week, the path higher was bumpy indeed. We would expect volatility to remain high this week as well. From Tuesday to Thursday, 25% of the companies in the S&P 500 will report third quarter earnings.6 It’s a bit too soon to give a firm statement on the quality of earnings for the quarter – but it should be noted that the earnings’ Armageddon some were predicting does not appear to be materializing. Many market participants believe that we are in the midst of a “bear market rally.” As such, we should be careful not to become too overconfident while equities head in the right direction. Beyond earnings, we will receive the initial GDP reading for the third quarter and the Fed’s favorite inflation gauge, the PCE Price Index, this week.

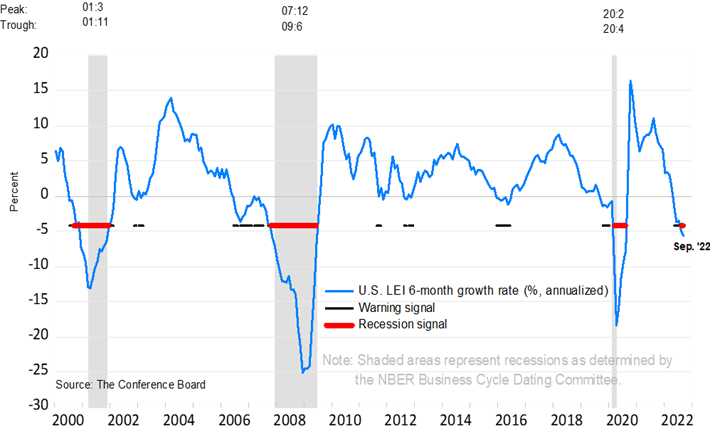

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

The Conference Board

Marketwatch.com

Statistic of the Week:

Yahoo! Finance, The Wall Street Journal

Global Perspective:

The Financial Times

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s

6. Barron’s