The Profit Margin: September 26, 2022

Statistic of the Week

Financial literacy in the US has been in decline for the past twelve years according to a recent study. The FINRA Foundation National Financial Capability Study surveyed 30,000 US adults and asked them 5 questions. The study found that there has been an approximately 14% drop in financial literacy since 2009. One key problem – those that conducted the survey are having a difficult time finding the cause of the decline.

Global Perspective

The Japanese yen started the year with an exchange rate of 115 to a dollar. This month, the exchange rate had fallen to 146 to a dollar. This prompted the Japanese central bank to step in to defend the currency. In doing so, they sold dollars and purchased yen. This is the first time Japan’s central bank has had to defend its currency since 1998.

Market Moving Events

Tuesday: Durable Goods Orders, Case Shiller Home Price Index, Consumer Confidence, New Home Sales

Wednesday: Pending Home Sales

Thursday: Jobless Claims, Q2 GDP Revision

Friday: PCE Price Index, Consumer Spending and Income, Consumer Sentiment

Commentary

Last week, all three major equity averages moved lower and fixed income yields rose causing a decline in bond prices – this environment provided few places to hide. In the equity markets, the Nasdaq was the week’s worst performer, falling 5.07%.1 The S&P 500 retreated 4.65%.2 The DJIA held up the best, yet still dipped 4.00%.3 Yields in the fixed income markets put in a notable move higher. The 10-year Treasury finished Friday with a yield of 3.70%, up 0.25% from the week prior.4

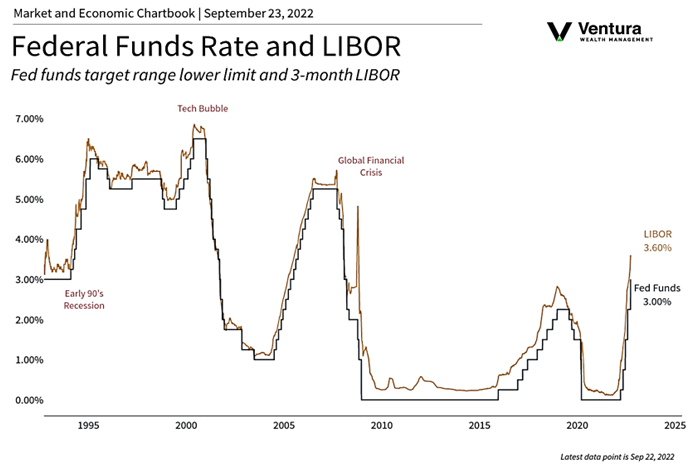

There were many headlines last week that contributed to general investor angst. The Federal Reserve raised the target Fed Funds rate by 0.75% on Tuesday (chart right). In his post-meeting press conference, Chair Powell made no single statement that was particularly hawkish. However, the Chairman’s tone and numerous statements about getting inflation down to 2% were interpreted to mean that Fed policy would remain hawkish for the foreseeable future. This posture is inflating concern that the Fed is on “autopilot” and will raise rates to the point of causing a recession. At the same time the US was signaling more restrictive policy, several other central banks were acting similarly. The Bank of England along with the Swiss and Swedish central banks hiked interest rates last week. The Japanese intervened in currency markets to defend the yen (see “The Global Perspective”). Current market conditions are oversold. It would not take much to spark a rally; however, volatility is very likely to remain in the week ahead.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

The Federal Reserve

Statistic of the Week:

Yahoo! Finance

Global Perspective:

The Economist

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg