The Profit Margin: August 1, 2022

Statistic of the Week

According to data collected by the Census Bureau, more than 91 million American adults are finding paying for typical household expenses “somewhat difficult” or “very difficult.” That figure accounts for approximately 40% of survey respondents. One year ago, the number of survey respondents answering in the same manner was 27%.

Global Perspective

German power prices reached a record level last Tuesday as the Russians continue to manipulate natural gas supplies to the West. The futures prices have skyrocketed past historic highs and are pushing towards 400 euros per megawatt-hour. Exorbitant energy prices are stoking fears of a recession in the eurozone.

Market Moving Events

Monday: ISM Manufacturing Index

Wednesday: ISM Services Index, Factory Orders

Thursday: Jobless Claims, Trade Deficit

Friday: Nonfarm Payrolls, Consumer Credit, Unemployment Rate

Commentary

A mix of economic data, earnings reports, and Federal Reserve commentary created a “risk on” environment last week. The Nasdaq was the week’s leader, up 4.70%.1 The S&P 500 rallied 4.26%.2 And, the DJIA notched a gain of 2.97%.3 Bond values also rose as yields fell. The 10-year Treasury yield fell -0.14% to close Friday at 2.64%.4

Earnings’ reports continue to be predominately positive. Last week was the busiest of the season. While there continue to be notable misses, well-executing firms are maintaining guidance through the end of the year. Adding to positive sentiment around earnings was the passage of the CHIPS Act by Congress.5

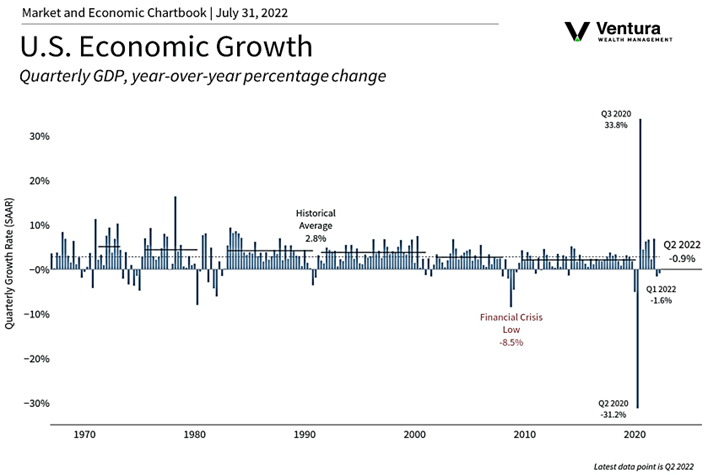

It would be difficult to say that the Federal Reserve’s rate hike of 0.75%, Fed Chair Powell’s commentary (interpreted as somewhat dovish), and the second quarter GDP report (chart right) were not the main stories of the week. Second quarter GDP was undeniably weak. It showed a broader erosion than first quarter data. We believe that slowing economic data allowed Chair Powell to present a more dovish picture (he said current rates are at “neutral”)6. While investors like the idea of more accommodative monetary policy, it is important to remember that the Fed does not have another formal meeting until the end of September. It’s still very early to bet that the Fed has the finish line in sight. We expect volatility to persist.

Chart of the Week

Following a 1.6% decline in the first quarter, GPD contracted -0.9% in the second quarter. Analysts had been expecting an increase of 0.6%. Slimming inventories was a significant factor in the slowdown

Sources

Statistic of the Week:

Money Magazine

Global Perspective:

Bloomberg.com

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Haver,

Bureau of Economic Analysis

Commentary: 1.Bloomberg 2.Bloomberg 3.Bloomberg 4.Bloomberg 5. Barron’s 6. Barron’s