The Profit Margin: October 20, 2025

Statistic of the Week

According to Kelley Blue Book, the average price of a new car surpassed $50,000 for the first time. In September, the average transaction price reached $50,080—an increase of 2.1% from the previous month and 3.6% year over year. The recent rise was driven in part by stronger electric vehicle sales, as consumers sought to take advantage of the $7,500 federal tax credit before its expiration, as well as by the impact of new tariffs.

Global Perspective

The trade tensions between the U.S. and China continue to extend across multiple areas of the global supply chain. Both nations have implemented “tit-for-tat” port fees. The United States will impose a $50-per-ton charge on Chinese vessels docking at American ports, while China plans to levy a $56-per-ton fee on U.S. ships and vessels that are at least 25% American-owned.

Market Moving Events

Thursday: Jobless Claims*, Existing Home Sales

Friday: Consumer Price Index, Consumer Sentiment, New Home Sales*

*Denotes data unlikely to be released if federal government remains closed.

Commentary

Despite a challenging backdrop, U.S. equities advanced last week. The Nasdaq led the way, gaining 2.14%—its fifth positive week in the past seven.1 The S&P 500 followed with a 1.70% increase,2 while the Dow Jones Industrial Average trailed slightly, rising 1.56%3. In fixed income, yields were modestly volatile. The 10-year Treasury briefly dipped below the 4.00% mark before ending the week at 4.02%,4 down two basis points from the prior week.

A series of “small problems” emerged last week, each carrying the potential to develop into something larger. As earnings season began, several regional banks reported higher-than-expected credit losses, raising investor concerns about broader economic weakness and potential stress in private credit markets.5 (The major financial institutions that reported posted notably positive results). The Federal Reserve’s Beige Book indicated that economic activity cooled over the past two months,6 adding to the cautious tone. Meanwhile, trade tensions with China continue to simmer—though on Friday, President Trump offered encouraging remarks about progress toward a potential agreement.7

The current bull market just marked its third anniversary, and overall economic conditions remain healthy. The ongoing government shutdown has limited the availability of key economic data, posing a challenge for analysts. Since World War II, markets that experienced a significant downturn in the first half of the year have not seen a correction exceeding 10% in the second half.8 While volatility may rise—currently hovering near its highest levels since April9—the broader backdrop remains constructive.

Chart of the Week

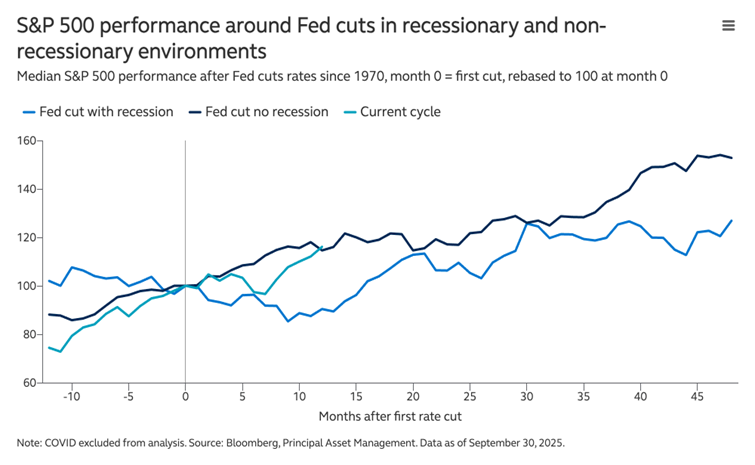

As shown by the dark blue line, equity markets have historically performed best when the Federal Open Market Committee (FOMC) is cutting interest rates and the economy remains out of recession. Since the post–Liberation Day lows, equities have continued to post strong gains, sustaining a solid bull run.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics,

Principal Asset Management

Statistic of the Week:

Car and Driver

Global Perspective:

The Economist

Commentary:

1. Bloomberg, Investor’s Business Daily

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. MarketWatch.com

6. MarketWatch.com

7. Investor’s Business Daily

8. MarketWatch.com

9. Bloomberg