The Profit Margin: August 11, 2025

Statistic of the Week

It is important to consider medical costs in retirement. One-in-five Americans said in a recent survey that they have never thought about what medical costs would be during their “golden years.” 17% say that they have taken no action to plan for these costs. A 65-year-old today can expect to spend $172,500 on healthcare through their retirement years.

Global Perspective

The next deadline in America’s trade war with China comes this week on August 12th. The tariffs, if allowed to go into place, would be at a 145% rate. China’s exports were able to increase 7.2% year-over-year in the month of July, largely helped by the truce in the trade conflict.

Market Moving Events

Tuesday: Consumer Price Index, Federal Budget

Thursday: Jobless Claims, Producer Price Index

Friday: Retail Sales, Import Prices, Industrial Production, Consumer Sentiment

Commentary

Domestic equity prices trended higher last week on a good earnings reports and relatively light economic data releases. All three major U.S. indices finished the week in positive territory. The DJIA rose 1.35%.1 The S&P 500, which finished the week just below a record high and has been positive five of the past seven weeks, rallied 2.43%.2 And the Nasdaq, hitting a record high on Friday, put in the largest move of the indices, climbing just under 4%3 with corporate earnings contributing to the strong performance. Fixed income prices fell slightly on the week as yields rebounded from a three-month low.4 The 10-year Treasury finished Friday with a yield of 4.29%, up 0.6% from the week prior.5

Inflation and tariff policy are likely to be the central themes of the week ahead. On Tuesday, we will receive the much-followed Consumer Price Index, and on Thursday the Producer Price Index will be released. Inflation, as measured by the CPI, is expected to have accelerated in the month of July from a rate of 2.7% to a rate of 2.8%.6 Notably, economists expect that the core reading will register at an annualized rate of 3.1%.7 A reading above 3% will keep inflation hawks on alert at the Federal Reserve. Markets are expecting a cut in September Federal Open Market Committee meeting.

On Tuesday, the 90-day pause on higher Chinese tariffs is set to expire. (See “Global Perspective”). Nevertheless, markets will be looking for either a “deal” or another extension. The other major news event scheduled for this week is President Trump’s meeting with Russian President Vladimir Putin in Alaska.

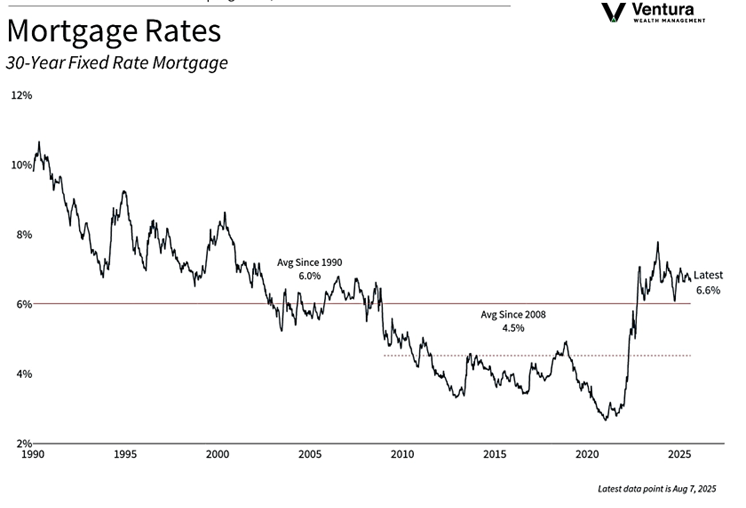

Chart of the Week

While there has been significant volatility in the fixed income markets, 30-year fixed mortgage rates have remained relatively stable, much to the chagrin of homebuyers. According to Freddie Mac, the national average rate is 6.6%.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics,

Freddie Mac

Statistic of the Week:

Barron’s

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. Investor’s Business Daily

5. MarketWatch.com

6. MarketWatch.com

7. MarketWatch.com