The Profit Margin: May 12, 2025

Statistic of the Week

In all U.S. states except Minnesota, fewer than half of individuals under 35 own homes. In 16 of those states, this percentage falls below 40%. The states with the highest home ownership rates among those aged 35 and younger are Minnesota (50.8%), West Virginia (49.9%), and Michigan (49.3%). Conversely, the states with the lowest home ownership rates in this demographic are California (27.8%), New York (27.5%), and Hawaii, which ranks last at 24.5%.

Global Perspective

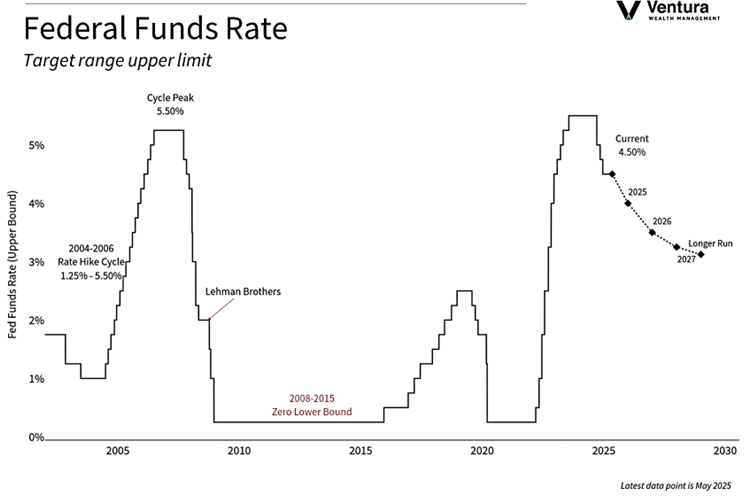

Last week, the FOMC’s choice to maintain the U.S. benchmark interest rate was significant news (see “Chart of the Week”), but it wasn’t the only central bank making waves. The Bank of England decreased its benchmark rate from 4.50% to 4.25%. Meanwhile, the People’s Bank of China lowered its benchmark rate from 1.50% to 1.40%. The PBOC also reduced the reserve requirements for banks operating in China.

Market Moving Events

Tuesday: Consumer Confidence, CPI

Thursday: Jobless Claims, Retail Sales, PPI, Industrial Production

Friday: Import Prices, Housing Starts, Building Permits, Consumer Sentiment

Commentary

Markets finished the week relatively unchanged after another bumpy week on Wall Street. All three major domestic equity indices retreated. The S&P 500 faired the worst. It dipped 0.47%.1 The Nasdaq fell 0.27%.2 And the DJIA performed the best, sliding 0.16%.3 Bond values also declined as yields inched higher. The yield on the 10-year Treasury rose 0.08% on the week to finish Friday at 4.39%.4

The market’s attention is largely focused on two main stories: central bank decisions and trade negotiations. In its announcement last week, the FOMC left its benchmark interest rate (see chart) unchanged. This matched market expectations. In its commentary, the Fed noted, “Uncertainty about the economic outlook has increased further.”5 It is difficult to see a path where the Fed changes its posture without seeing labor force deterioration, a seizing-up of credit conditions, or a shift in inflationary conditions. This week, we will receive both the CPI and PPI reports. Core CPI and PPI readings are expected to have risen 0.3% during April6 – if these readings arrive “in line” with analyst estimates, they would be less than ideal. Of particular interest will be how automobile prices and components are impacting the figures.

The announcement of a trade deal with the U.K. last week set the tone for the other deals to follow. Commerce Secretary Lutnick said that the 10% minimum would be in place for the “foreseeable future.”7 The U.S. and China agreed to a separate “pause” – U.S. tariffs on Chinese goods fall to 30% from 125%. Chinese tariffs on U.S. goods move to 10% from 125%.8

Chart of the Week

The FOMC left the target range for the Fed Funds Rate unchanged last week. The current target rate is between 4.25% and 4.50%. The target rate has remained unchanged since December.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

The Federal Reserve

Statistic of the Week:

The New York Times

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. CNBC.com

6. MarketWatch.com

7. CNBC.com

8. The Wall Street Journal