The Profit Margin: May 5, 2025

Statistic of the Week

Warren Buffett, the CEO of Berkshire Hathaway and widely regarded as one of the greatest all-time investors, announced his retirement this past weekend. Currently 94 years old, his net worth is estimated at $168.2 billion, making him the world’s sixth-richest person. Buffett has committed to donating 99% of his fortune to philanthropic efforts and has already contributed $43.3 billion to various causes.

Global Perspective

In the first quarter, the American economy contracted by 0.3%. This decrease in GDP is linked to a significant increase in imports as businesses sought to stockpile inventories ahead of impending tariffs. Imports are subtracted from gross domestic product. Nevertheless, the fundamental elements of the GDP data still indicate a relatively healthy U.S. economy. The duration and magnitude of the tariffs will likely sway GDP in the quarters ahead.

Market Moving Events

Tuesday: Trade Deficit

Wednesday: FOMC Meeting Announcement, Chair Powell Press Conference

Thursday: Jobless Claims

Commentary

Last week, equity markets continued their recovery amid a flurry of economic and earnings reports. The Nasdaq led the week with a rally of 3.42%.1 The DJIA increased by 3.00%.2 The S&P 500 recorded a gain of 2.92%,3 bringing up the rear. Notably, the S&P 500 has seen a rally for nine consecutive days, marking the longest streak in over two decades.4 Furthermore, the index has fully rebounded to levels seen before Liberation Day.5 In the fixed income sector, yields experienced a slight uptick over the week, with the 10-year Treasury yield rising by 0.07% to finish at 4.31%.6

The Fed’s preferred inflation gauge, the core PCE index, was flat in March and up 2.6% from a year ago. This figure was above analyst estimates and is the last of the pre-tariff data points.7 We will hear from the FOMC on Wednesday followed by a press conference with Chair Powell. Currently, the market is pricing in three rate cuts in 2025.8 We also received the first quarter’s GDP report last week (see Global Perspective). While the figure was negative, massive pre-tariff imports (a record $162 billion in March) skewed the figure.9 Already, we have seen a sharp decline in deliveries from China. It has been reported that there is a 45% reduction in the number of cargo container bookings from this time last year.10 And, this week will be a busy earnings’ week. Last quarter, only 2% of companies used the word “recession” in their reports. So far this quarter, 25% of those having reported have use the “r-word.”11 Corporations are concerned. Remember, the economy can slow without dipping into a recession. Volatility is expected to continue.

Chart of the Week

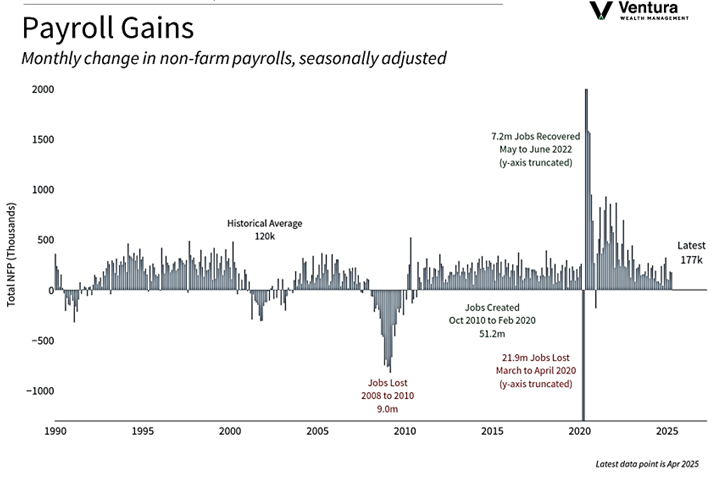

In April, the U.S. economy saw an increase of 177,000 jobs, significantly exceeding economists’ projections of 138,000. The unemployment rate remained steady at 4.2%, while hourly wages experienced a 0.2% rise for the month and a 3.8% increase compared to the previous year.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Forbes, Reuters

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. Investor’s Business Daily

6. MarketWatch.com

7. Morningstar

8. MarketWatch.com

9. Barron’s

10. Barron’s

11. Barron’s