The Financial Advocate: Winter 2025

“How Are We Doing?”

We are doing okay! The constant influx of news regarding the new administration, our economy, international affairs, interest rates, and inflation can be overwhelming. First and foremost, as managers of your wealth, we must prioritize capital preservation and growth over personal political preferences. The news is simply the news. Our focus remains on the enduring strength of the American economy, which, by current metrics, is strong. The data supports continued growth, strong labor markets, and rising corporate profits. Let’s break down each component individually, so as not to be overwhelmed.

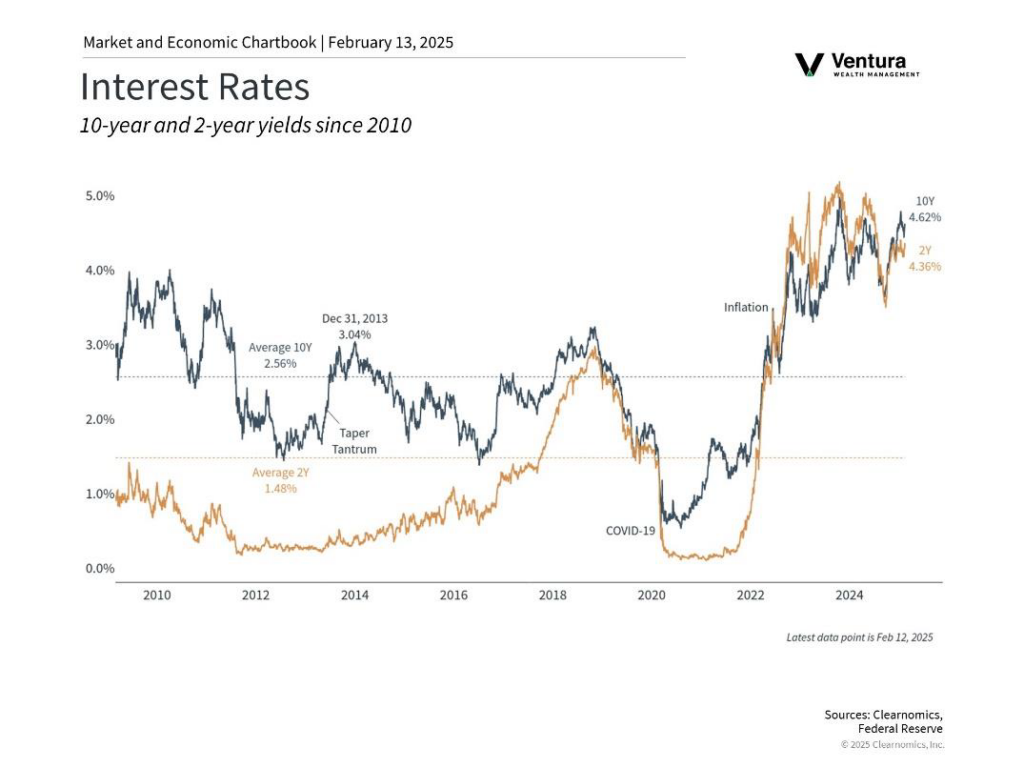

The key topic of the day remains inflation. While significantly down from its 9%+ peak two years ago, it continues to hover around 3%, stubbornly above the Federal Reserve’s 2% target. Government spending has undoubtedly contributed to this inflationary environment. This, in turn, has compelled the Federal Reserve to maintain higher interest rates. Elevated rates impact financing expenses across the board. So, what’s sustaining the markets amidst this sticky inflation and high-interest rate environment? Strong corporate profits! Most publicly traded US companies recently reported their fourth quarter profits. Over 80% of these companies reported better-than-expected fourth-quarter earnings, demonstrating healthy growth. So, in an environment of higher-than-expected inflation and interest rates, we are indeed doing okay.

Our challenge in 2025 is to identify companies and industries poised to prosper in this market environment. We recognize the transformative potential of Artificial Intelligence to boost productivity across the economy. Increased productivity counteracts inflation by reducing costs. Advances in software and computational output will also play a part in this advancement. AI is already impacting a wide range of industries, from drug development, to weather forecasting, and driving advancements in chip technology and software. The number of industries is extensive. Energy companies are already using AI to improve their service and discovery operations. Technology may offer solutions to persistent inflation.

Investments in the bond market are finally yielding the potential for positive returns. After nearly eight years of near-zero interest rates, savers are now being rewarded. While we are cautious with our bond investments, we see opportunities in specific areas of the bond market. First, a well-structured bond portfolio will yield decent returns. Bond quality and portfolio duration are the critical factors. Given the complexities of the current economy, we have been more active in bond portfolios lately. This is not a time to “set it and forget it.” By strategically adjusting maturities and types of bonds, we are achieving positive results. In a market environment like this, we must also mention TIPS – Treasury Inflation Protected Securities. A TIP will adjust its return based on the CPI index. By doing so, it protects the investor from losing purchasing power due to higher inflation. Bonds are critical holdings for those looking to preserve capital.

As we navigate 2025, we will remain mindful of evolving economic trends, geopolitical developments, and news from Washington. It is worth remembering that the US stock market has historically performed well under both political parties. The ingenuity of American corporate leadership is indisputable. We remain committed to protecting and growing your capital with each new development. While the news cycle will undoubtedly be active and noisy, the profit motive remains a powerful force in the American economy.

“Economist’s Corner,” by Roger Klein, Ph.D.

The U.S. economy is doing okay. President Trump is inheriting an economy that is in good shape. Real GDP grew at an annual rate of 2.3% in the fourth quarter of 2024. The Atlanta Federal Reserve’s GDPNOW is projecting a GDP growth rate of 2.3% for the first quarter of 2025. In all of 2024, real GDP grew at a rate of 2.8%. The unemployment rate at 4.0% is historically low. Inflation is slowly decelerating. In December, the year-over-year increase in the PCE price index was 2.6% and the year-over-year increase in the core-PCE price index was 2.8%. The Federal Reserve’s inflation target is a core PCE inflation rate of 2%.

The broad macroeconomic picture looks good. There are some signs of weakness in the labor market. The unemployment rate at 4.0% is above the cycle low unemployment rate of 3.4% which occurred in January and April of 2023. Unemployment at 3.4% was the lowest reading in 55 years. Job openings in December fell by 556,000 to 7.6 million. At its recent peak, there were more than 12 million job openings. New hires also fell in December, and the number of workers who quit their jobs fell by 242,000 to 3.2 million. Finally, the number of workers receiving unemployment benefits has remained elevated.

The future of the Trump trade policy is an unknown. Recent trade data from the Census Bureau and the Bureau of Economic Analysis (BEA) show that the trade deficit in 2024 was $918.4 billion, up $133.5 billion from $784.9 billion in 2023. The trade deficit is a subtraction of GDP, yet GDP growth in 2023 and 2024 were above trend. So, what is the problem? There is no problem. Starting a trade war will not be good for anybody. Foreign trade is not a huge part of the U.S. economy. But it is large. In 2024, total exports were $3,191.6 billion and total imports were $4,110.0 billion. Reducing these numbers will have a negative impact on thousands of producers and millions of workers.

Since the November election, there has been an increase in financial market volatility. The Trump trade policy is an unknown and so is monetary policy. For now, the Federal Reserve is on hold. Last year, the Fed reduced its target interest rate by 100 basis points to a range between 4.25% and 4.5%. The next meeting of the Federal Open Market Committee is scheduled for March. The financial markets are pricing in one rate cut of 25 basis points in December. The path forward for the Fed will be determined by inflation and unemployment. If these remain well-behaved, there will be little reason for the Fed to act.

Managed Model Strategy

Global Alpha

Global Alpha is a high-growth portfolio. Therefore, expectations of its holdings are highly scrutinized for delivering results. We maintain that we are entering a new world in technology, biomedicine, drug discovery, and human productivity, all aided by AI. Capital expenditures are very high for infrastructure, data centers, power creation and delivery. The consumer is fine, and discretionary spending is alive and well, especially in travel related industries. As growth investors, we see huge wins when our companies report solid results; conversely if our companies disappoint, they are punished. We monitor every position, every day and will let our winners compound and we will use any losers for tax loss purposes. Confucious said, “May you live in interesting times.” Well, we certainly are in interesting times. Volatility is higher than normal, but results are still solid.

Global Balanced

The Global Balanced strategy has begun the year on a solid note. The recent increase in volatility has not adversely affected the portfolio’s performance. Alternative assets have been instrumental in this success. Our investments in gold, commodities, hedge funds, and managed futures have shown strong results. However, the possibility of a trade war poses risks to certain aspects of the portfolio, necessitating ongoing vigilance. In the equity component of the strategy, we have been gradually reducing our international holdings and redirecting our attention towards domestic companies. We have broadened our investments in the health care and financial services sectors. These sectors are expected to benefit from a rise in mergers and acquisitions coupled with a more lenient regulatory framework. The bond segment remains focused on “quality.” Recently, we reduced emerging market bonds and allocated those funds to inflation-protected Treasuries.

Moderate Allocation

The Moderate Allocation portfolio remains offensively positioned as we enter the new year. We expect more than usual daily volatility due to the news flow surrounding trade negotiations, geopolitics, and Federal Reserve policy. However, we will continue to focus on high-quality, dividend paying companies and use market weakness to upgrade the holdings in the portfolio. For now, expectations are for the U.S. economy to grow about 2% this year and corporate earnings to advance near 10%. If inflation continues to decelerate, and the Federal Reserve maintains or lowers policy rates, it should provide a generally supportive backdrop for equities in 2025. We expect bonds to be mostly range bound and maintain a focus on investment-grade corporate issues. If inflation were to accelerate, we will consider adding exposure to commodities or other asset classes as a hedge.

Milestone360

The start of a New Year is a good time to “go back to basics.” For our Milestone360 topic this quarter, we will be discussing basic financial planning metrics. What is your savings rate? What is your withdrawal rate? Do you have enough in an emergency fund? While these items frequently come up in our reviews, this is a good time to “level set” and ensure that we are on the right track while identifying any potential soft spots in your overall financial condition.

For those that are still actively employed, now is also a good time to look at your employer sponsored retirement plan deferrals and investment allocations. Taking advantage of benefits like employer matches is a key goal in retirement savings.

Total deferral amounts were increased this year. For 401(k) and 403(b) accounts, the elective deferral limit is now $23,500. There is a $7,500 catch-up allowance for those ages 50-59 or 64+. Some plans are allowing an additional $11,500 for those ages 60-63. Please speak with your payroll and HR departments if you are interested in changing your deferral amounts. Typically, they do not adjust automatically. For IRA and Roth IRA accounts, the contribution limit is now $7,000. For those over 50, there is a $1,000 allowable catchup contribution.

As always, we are happy to discuss these items with you in your quarterly reviews. If you have immediate questions, please reach out to your Wealth Manager.

Nick Ventura Founder and CEO