The Profit Margin: April 14, 2025

Statistic of the Week

President Trump enacted a 145% tariff on imports from China, although various products are subject to different tax rates. For instance, children’s books are exempt from tariffs, while aluminum foil faces a 75% tax, and lithium-ion batteries are taxed at a rate of 173%. The administration has clarified that the overall 145% tariff consists of 125% in retaliatory tariffs and an additional 20% related to the production of fentanyl in China.

Global Perspective

In light of recession concerns, crude oil prices have fallen significantly, reaching their lowest point in four years. Brent crude began the year priced at $75 per barrel, but at one stage last week, it fell below $60 per barrel. By the end of Friday, it settled around $65 per barrel. For consumers, this drop in energy prices offers a silver lining amid ongoing uncertainty, as it will also help mitigate other inflationary pressures.

Market Moving Events

Tuesday: Import Prices, Empire State Manufacturing

Wednesday: Retail Sales, Industrial Production, Business Inventories

Thursday: Jobless Claims, Housing Starts, Building Permits

Commentary

Last week, the trade war kept investors alert as there were notable fluctuations in equity, fixed income, currency, and commodity markets. Underscoring the dangers of market timing and panic selling, equities surged on Wednesday after a multi-day route. The Nasdaq recorded its second-largest daily percentage increase ever, and the other major indices soared after President Trump announced a 90-day halt on certain reciprocal tariffs.1 All three major U.S. equity indices ended the week with sizable gains. The Nasdaq jumped by 7.79%, the S&P 500 rallied 5.70%, and the DJIA rose by 4.96%.2 While stock prices climbed, bond prices declined. The 10-year Treasury experienced its worst weekly performance since 2001.3 It closed Friday with a yield of 4.49%, an increase of 0.49% from the week prior.4 In the currency markets, the dollar reached its lowest point in three years.5 Meanwhile gold prices ended the week near record highs.6

The upcoming week is light on economic reports but is packed with earnings announcements. Several officials from the Federal Reserve are set to make public remarks. Over the weekend, it was initially announced that certain electronic items, such as cell phones, would be exempt from tariffs. However, this was quickly countered by administration officials who indicated that this would not be the case and that additional tariffs are on the horizon.7 Any developments regarding new tariffs, exemptions, delays, or reciprocal actions are likely to influence market movements. On Wednesday, the retail sales report is expected to provide insights into whether poor consumer sentiment is resulting in reduced spending.

Chart of the Week

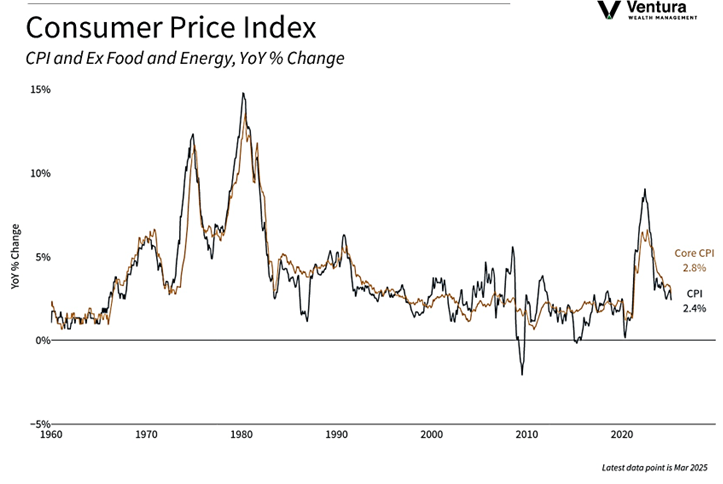

In March, the CPI index dropped to its lowest level in six months, while the core reading reached its lowest point in roughly four years. Economists expressed concern that these figures might represent a temporary low for inflation, as tariffs are expected to push consumer prices upward.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

MarketWatch.com,

The New York Times

Global Perspective:

The Economist

Commentary:

1. Investor’s Business Daily

2. Bloomberg

3. MarketWatch.com

4. MarketWatch.com

5. MarketWatch.com

6. Barron’s

7. The Wall Street Journal