The Profit Margin: March 10, 2025

Statistic of the Week

The automobile sector in the United States is highly vulnerable to new tariffs implemented by the Trump Administration. Numerous auto components traverse North American borders several times before the vehicle is completed. Even well-known “American” brands do not have a purely domestic production process. For instance, 35% of the parts used in a Chevy Blazer are sourced from Mexico (where the vehicle is assembled), while 31% originate from the U.S. and Canada, and 34% are imported from other regions. Similarly, the Nissan Rogue is assembled in the U.S., but most of its parts come from Japan and other countries.

Global Perspective

The Trump Administration followed through on imposing a 25% tariff on most goods brought into the U.S. from Mexico and Canada, while allowing a one-month delay for specific sectors, such as the automotive industry. Additionally, a 10% tariff was placed on Chinese imports, raising the total average on over 30%. The administration has indicated its intention to impose reciprocal tariffs on nations with trade imbalances deemed unfair.

Market Moving Events

Wednesday: Consumer Price Index

Thursday: Jobless Claims, Producer Price Index

Friday: Consumer Sentiment

Commentary

The persistent uncertainty surrounding the trade policies of the Trump Administration, particularly regarding tariffs, has created a headline-driven environment in the investment markets. Last week, this anxiety escalated as new tariffs were imposed on China, Mexico, and Canada, resulting in the S&P 500 falling into negative territory for the year.1 Among the major domestic indices, the DJIA is the only one that remains in positive territory thus far in 2025.2 The Nasdaq dropped 3.45%, the S&P 500 fell 3.10% (it did close Friday above the critical 200-day moving average line), and the DJIA dipped 2.37%.3 Notably, after last week’s trading action, the S&P and Nasdaq have erased any gains they had since the election.4 Volatility worked its way into the fixed income markets as well. The 10-year Treasury recorded its lowest yield of the year before finishing the week 0.08% higher from the week prior with a yield of 4.30%.5

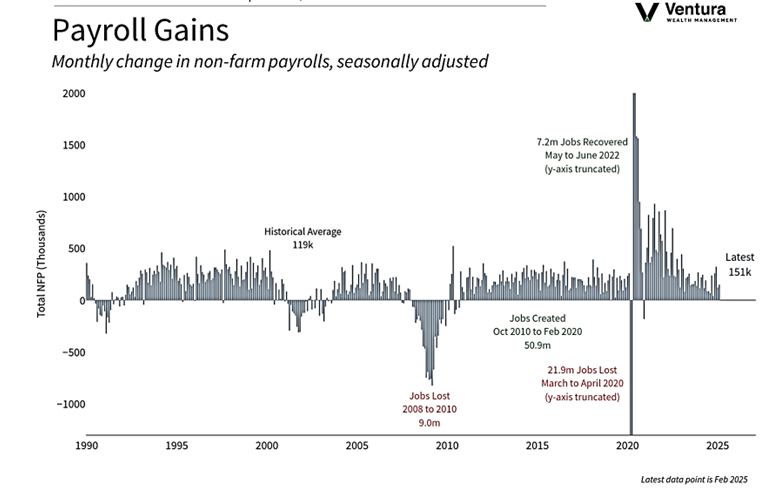

While Canada and China imposed their own retaliatory tariffs on American products,6 Mexico’s response is still pending at the time of writing. In other global developments, the European Central Bank reduced its benchmark rate by 0.25% to 2.50%.7 Analysts anticipate that this may be the last reduction for some time. Comments from Fed Chair Powell regarding the economy and labor markets alleviated some investor anxiety late Friday following the Nonfarm Payrolls report (chart right). Looking ahead, this week will have only a few economic data releases. The upcoming CPI and PPI reports are significant. However, with few scheduled announcements, we expect market movement to again be headline driven.

Chart of the Week

The U.S economy added 151,000 jobs in February, slightly below analyst expectations. Additionally, the unemployment rate ticked up slightly from 4.0% in January to 4.1% in February.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

The New York Times

Global Perspective:

The Economist, Bloomberg Economics

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. The Economist

5. MarketWatch.com

6. The Economist

7. The Economist