The Profit Margin: January 13, 2025

Statistic of the Week

The tragedy and magnitude of the devastation caused by the Southern California wildfires are difficult to comprehend. The Palisades Fire alone burned over 17,000 acres in two days. The entire island of Manhattan is about 14,600 acres. Across the five fires that have impacted the area, greater than 37,000 acres have burned, at least 10,000 structures have been destroyed, and sadly, at least 24 people have died with many more still missing. Our hearts go out to those impacted.

Global Perspective

Global bond markets started the year in a patch of turbulence. High levels of government borrowing are largely to blame. In the United Kingdom, government bond yields spiked. The 10-year government bond hit its highest level since 2008. Higher bond yields threaten the British government’s “fiscal stability rules” which could ultimately cause higher taxes and reduced government spending.

Market Moving Events

Tuesday: Producer Price Index, Beige Book

Wednesday: Consumer Price Index, Empire State Manufacturing

Thursday: Initial Jobless Claims, Retail Sales, Import Prices, Home Builder Confidence

Friday: Housing Starts, Building Permits, Industrial Production, Capacity Utilization

Commentary

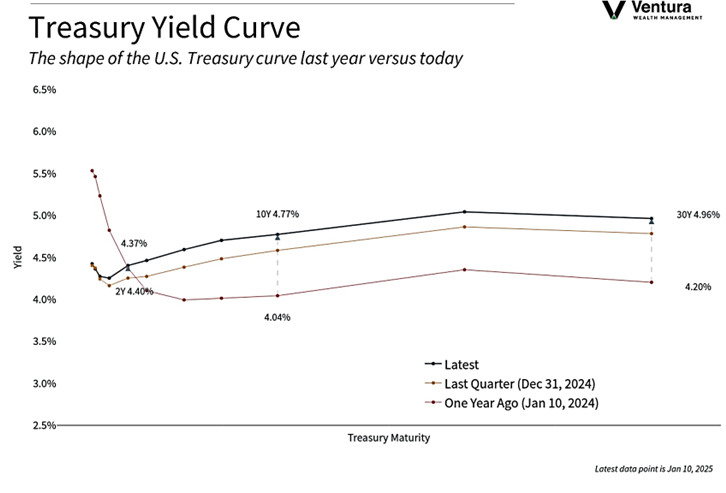

After relatively smooth trading in 2024, volatility is now front and center. The start of 2025 has been defined by rising yields in the fixed income markets and back-and-forth trading in equities. All three major domestic equity indices finished the week in red and are now negative on a year-to-date basis. The Nasdaq was the week’s worst performer – it dropped 2.34%.1 The S&P 500 retreated 1.94%.2 And the DJIA fell 1.86%.3 All three closed Friday trading below their critical 50-day moving average lines.4 The yield on the 10-year Treasury rose 0.17% on the week and closed Friday with a yield of 4.77% (chart right).5

Investors interpreted last week’s Nonfarm Payrolls report negatively. The stronger-than-expected report showed that the economy added 256,000 nonfarm jobs in the month of December.6 (Analysts had been expecting the report to have shown the addition of 157,000 jobs).7 Additionally, the unemployment rate dropped from 4.2% to 4.1%.8 These positive data points make further interest rate cuts from the Federal Reserve less likely. Currently, the futures market has no additional rate cuts priced-in through June.9 Higher interest rates make it difficult for the multiples used to value equities to expand. That means that corporate earnings must deliver in 2025 for stocks to appreciate.

Earnings season is poised to kick off this week with many of the major banks reporting. We will also receive both the PPI and CPI inflation figures along with the retail sales report. As equity markets trade below key support levels, this week’s action will be carefully monitored.

Chart of the Week

Volatility in the Treasury Yield Curve is translating into volatility in the domestic equity markets. The 10-year Treasury note closed Friday with a yield of 4.77%, up from 4.04% one year ago. Higher rates impact many areas of the economy including housing and vehicle purchases.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

Business Insider, Investor’s Business Daily

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. Bloomberg

5. MarketWatch.com

6. MarketWatch.com

7. Investor’s Business Daily

8. Barron’s

9. Barron’s