The Profit Margin: December 23, 2024

Statistic of the Week

With the uptick in climate disasters hitting populated areas, there is a growing homeowner’s insurance crisis in the U.S. The crisis has spread beyond the coasts. Nonrenewal rates rose in 46 of 50 states in 2023. Minnesota had the lowest non-renewal rates in the country, while California, Florida, and the Carolinas were among the highest.

Global Perspective

Brazil’s currency, the real, had its biggest decline in percentage terms in over two years and hit a record low against the U.S. dollar last week as the government tries to negotiate a severe budget deficit through a new spending plan. The cost of insuring Brazilian bonds rose to a 14-month high. Investors are monitoring the situation for hints of contagion across emerging markets.

Market Moving Events

Tuesday: U.S. Markets and VWM Close at 1PM EST

Wednesday: U.S. Markets and VWM Closed

Thursday: Initial Jobless Claims

Commentary

Federal Reserve Chairman Powell said in his press conference Wednesday that the coming adjustments to interest rate policy in 2025 would be like “driving on a foggy night.”1 While the announced 0.25% rate cut matched expectations, changes to the FOMC’s forecast was greeted with significant volatility. The S&P 500 had its worst “Fed Day” performance since 2001.2 And, the DJIA completed a 10-day losing streak – the longest in 50 years.3 All three major indices finished the week in the red. The Nasdaq performed the best, dropping 1.78%.4 The S&P retreated 1.99%.5 And the Dow fell 2.25%.6 Yields spiked on the news. The 10-year Treasury yield finished the week 0.12% higher, closing Friday at 4.52%.7

The Federal Reserve releases its Summary of Economic Projections four times per year. The report is the Fed’s mechanism to deliver individual and consensus projections of key data points like unemployment rates, inflation, and GDP growth. It also contains the fabled “dot plot” which shows how FOMC members see interest rate policy progressing. Previously, the market had been expecting a full 1.00% cut in 2025. Stubbornly high inflation figures caused investors to believe that the Fed would shift projections to a 0.75% reduction. Instead, the report showed projections of only a 0.50% reduction next year. This, along with the circus in Washington regarding the continuing resolution caused distress in the markets. At this point, that distress appears to largely be resolved and investors are again looking for the resumption of a “Santa Claus Rally.” There will be no edition next week. Happy Holidays!

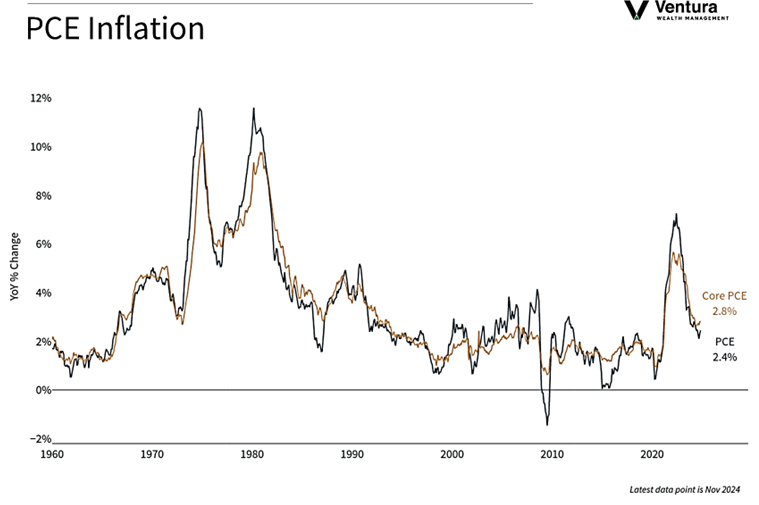

Chart of the Week

The Federal Reserve’s preferred inflation gauge, the PCE price index, rose less than expected from October to November. The index rose 0.1% for the month and at an annual rate of 2.4%. Both readings were below analyst estimates.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

The New York Times

Global Perspective:

Reuter’s

Commentary:

1. Investor’s Business Daily

2. Barron’s

3. MarketWatch.com

4. Bloomberg

5. Bloomberg

6. Bloomberg

7. MarketWatch.com