The Profit Margin: December 16, 2024

Statistic of the Week

A recent study by the Pew Research Center tried to gain better insights into why American workers do not take full advantage of their paid time off (PTO). 46% of workers say that they take less PTO than they are given. Of those surveyed, 52% said that they don’t need to take any more time off than they already do, while 49% feel as though by taking the offered time, they may fall behind their regular duties. 16% believe that if they took advantage of their allotted time, they would be at risk of losing their job.

Global Perspective

It was a busy week in the American courts for big business. A judge imposed an injunction against the merger of Albertsons and Kroger as a result from an antitrust case brought by the FTC and eight states. Additionally, an appeals court rejected an attempt by TikTok to overturn the Biden Administration order to ban the social media platform.

Market Moving Events

Tuesday: Retail Sales, Industrial Production, Home Builder Confidence

Wednesday: Housing Starts, Building Permits, FOMC Meeting Announcement

Thursday: Initial Jobless Claims, GDP Revision, Existing Home Sales, Leading Economic Indicators

Friday: Personal Income and Spending, PCE Index

Commentary

Even though the Nasdaq hit a fresh all-time high last week,1 it was not the smoothest week on Wall Street. The performance of the major averages was mixed. The Nasdaq was the leader with a 0.34% increase.2 The S&P 500 retreated 0.64%.3 The DJIA was an underperformer on the week. The Dow has now fallen for seven consecutive days and had its biggest weekly drop since the end of October.4 It fell 1.82%.5 There was also substantial volatility in the fixed income markets. The 10-year Treasury finished Friday with a yield of 4.40%, up 0.23% from the prior week.6

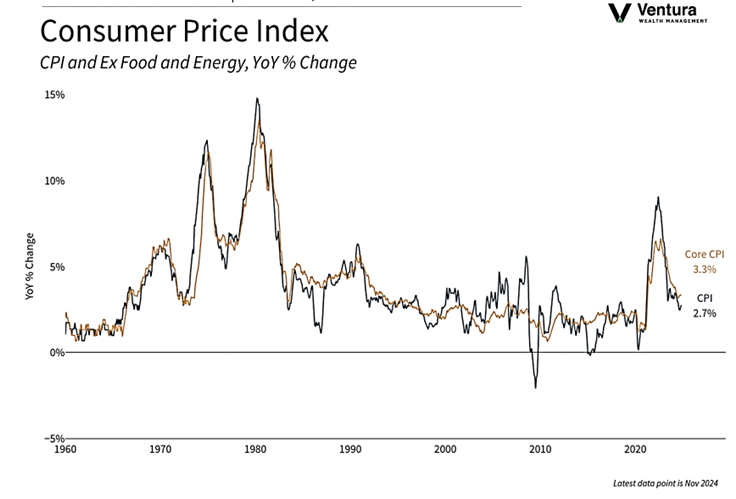

As some investors continue to look for the year-end Santa Claus rally, others remain fixated on inflation and Federal Reserve policy. Last week’s CPI (chart right) and PPI were close enough to analyst expectations to all-but-guarantee a rate cut at this Wednesday’s FOMC meeting. Markets are expecting that the Fed will reduce the target rate by 0.25% to a range of 4.25%-4.50%.7 And while the rate cut appears to be a lock, what Chair Powell says at his press conference is not a certainty. While inflation has cooled from the eye-popping figures we saw in ’22 and ’23, its rate of decline seems to have stalled at a higher level than the Fed would prefer, it has remained above the Fed’s 2% target. Hawkish commentary out of Chair Powell seems likely. The FOMC will also release their Summary of Economic Projections (SEP). Investors and analysts alike will parse the SEP piece to gain potential insights into the Fed’s course of action for 2025. Those announcements, plus Friday’s release of the Fed’s preferred inflation gauge, the PCE deflator, will take center stage in the days ahead.

Chart of the Week

The Consumer Price Index (CPI) readings for the month of November was in-line with analyst expectations. The monthly change was 0.3% and the year-over-year increase was 2.7%

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Harvard Business Review

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. Bloomberg

6. MarketWatch.com

7. Investor’s Business Daily