The Profit Margin: November 4, 2024

Statistic of the Week

There has been endless talk about the weakness of the dollar over the past year. Someone, however, forgot to tell the dollar. The ICE U.S. Dollar Index (DXY) is up 2.94% on a year-to-date basis. This index measures the dollar against a basket of six major rivals. Over the past three years, the DXY is up 11.12% and over the past five years it has rallied 16.94%. The dollar could move relative to its peers as Tuesday’s election results are tallied.

Global Perspective

New tariffs from the European Union went into effect last week on Chinese-manufactured electric vehicles. These tariffs are in addition to a levy of 10% which is already in place. The range of the tariffs is from 7.8% to 35.3%. The move has caused the Chinese to impose a retaliatory anti-dumping measure on European brandy. Other retaliatory tariffs from the Chinese are expected.

Market Moving Events

Tuesday: Trade Deficit, ISM Services

Thursday: Jobless Claims, FOMC Interest Rate Decision, Consumer Credit

Friday: Consumer Sentiment

Commentary

It was a bumpy week on Wall Street as investors deciphered earnings reports and major economic data releases while pondering the economic and market implications of Election Day. All three major averages finished the week in negative territory. The Nasdaq was the week’s worst performer, dropping 1.50% and snapping a seven-week win streak.1 The S&P 500 dipped 1.37% and swung October’s performance from positive to negative territory.2 The market dipped 1.9% last Thursday, its worst daily performance since April.3 The weakness on Halloween contributed to the S&P 500 breaking a five-month win streak.4 And, the DJIA was mostly flat. It finished down 0.15%.5

The bond market has been telling us an interesting story. The yield on the 10-year Treasury had its highest closing level in four months.6 It finished Friday with a yield of 4.40%, up 0.15% from the week prior.7 Longer term yields are creeping higher while it is expected that the FOMC will cut rates by 0.25% to a range of 4.50-4.75% Thursday.8 Why? The proposed policies of both presidential candidates are likely to increase an already elevated deficit (currently running at 6% of GDP)9 and have the potential to stoke inflation figures that are finally settling down. (The PCE reading for September, released last week, showed the inflation gauge with an annualized reading of 2.1%).10 The flurry of economic data points that came in last week pointed to an economy that is fairing well. Unemployment remains low. Wage growth is outpacing inflation. Consumer spending is robust. Whomever wins the presidential election will be inheriting a U.S. economy on firm footing.

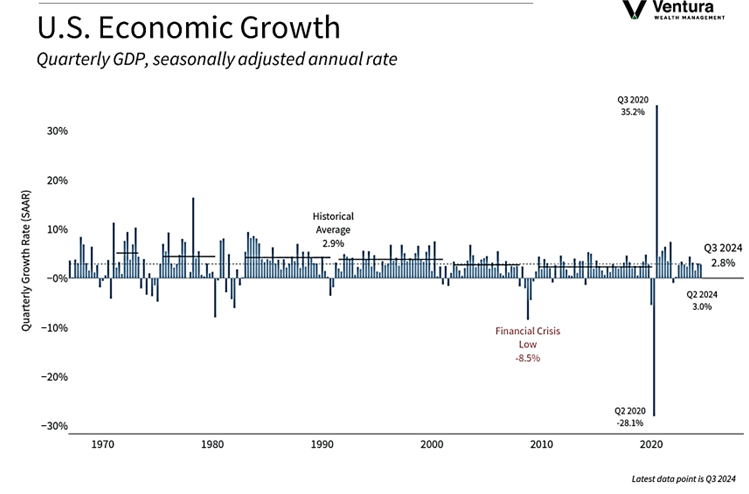

Chart of the Week

The U.S. economy grew at a seasonally adjusted annual rate of 2.8% in the third quarter. The measure, while still strong, was below analyst estimates. The rate for the fourth quarter is currently projected by the Atlanta Federal Reserve at 2.3%.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, U.S. Bureau of Economic Analysis, Atlanta Fed

Statistic of the Week:

MarketWatch.com

BarChart.com

Global Perspective:

The Economist

Commentary:

1. Bloomberg, Investor’s Business Daily

2. Bloomberg

3. Barron’s

4. Barron’s

5. Bloomberg

6. MarketWatch.com

7. MarketWatch.com

8. Investor’s Business Daily

9. Barron’s

10. MarketWatch.com