The Profit Margin: October 7, 2024

Statistic of the Week

As the last of the Baby Boomers are crossing the age 60 threshold, and members of Gen X approach that benchmark age, those that are small business owners are weighing retirement options. Half of America’s small businesses (fewer than 500 employees) are run by a single owner over the age of 50 representing about $10 trillion in value. For younger, entrepreneurial minded individuals, the coming retirement wave of business owners may be an opportunity to purchase existing businesses. For existing business owners, careful planning strategies can help maximize value and critical income streams.

Global Perspective

Dockworkers in the United States went on strike for the first time since 1977 last week, impacting some of the busiest ports in the country. The union rejected a 50% pay increase over six years and eventually agreed to a 62% hike over the same period. While the strike is on a temporary hold until mid-January, each day that the strike was in place cost the economy an estimated $3.8-$4.5 billion according to analysts from J.P Morgan.

Market Moving Events

Wednesday: Wholesale Inventories

Thursday: Jobless Claims, Consumer Price Index

Friday: Producer Price Index, Consumer Sentiment

Commentary

There was a flurry of geopolitical events and significant economic announcements last week, and equity markets… went nowhere. While all three major domestic averages finished in the black, their gains were negligible. The DJIA inched up 0.09%.1 The Nasdaq moved 0.10% higher.2 And the S&P 500 gained 0.22%.3 Notably, the S&P 500 was able to gain 2.1% in the month of September – a month that has averaged a historical decline of 1.1%.4 When the S&P has finished September in the black, it has posted a positive fourth quarter result 79% of the time, with an average return of 5.1%.5 Should history repeat itself, that would carry the S&P 500 to just over the 6,000 level.6 And while equity markets were relatively unchanged, there was significant movement in fixed income markets. With stronger-than-expected labor figures, yields climbed. The 10-year Treasury finished Friday with a yield of 3.99%, up 0.20% from the week prior.7

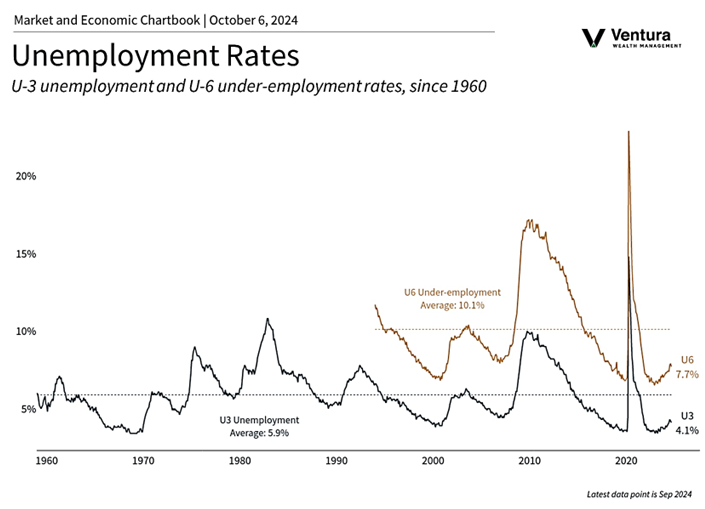

The labor figures released last week were arguably positive across the board. The U3 unemployment rate fell to 4.051% (rounded to 4.1% – see chart).8 The nonfarm payrolls report found that the economy added 254,000 jobs far surpassing expectations of 150,000.9 Private payrolls rose by 100,000 more than analyst forecasts.10 And the employment figures for July and August were revised higher by a combined 72,000 jobs.11 In public comments, Fed Chair Powell noted that future cuts would be smaller than the “jumbo” cut we received in September.12 This week’s CPI and PPI reports, due out Thursday and Friday, respectively, will help inform those decisions. The bottom line remains: labor markets stand on firm footing.

Chart of the Week

The unemployment rate unexpectedly dropped in September from 4.2% to 4.1%. The average U3 unemployment rate since 1960 has been 5.9%.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Labor Statistics

Statistic of the Week:

Business Insider

Global Perspective:

The Economist

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. Barron’s

5. Barron’s

6. Barron’s

7. MarketWatch.com

8. Investor’s Business Daily

9. MarketWatch.com

10. Barron’s

11. Barron’s

12. Investor’s Business Daily