The Profit Margin: September 30, 2024

Statistic of the Week

Consumer confidence continues to remain depressed as individuals worry about jobs and inflation. The Conference Board’s Index of American Consumer Confidence dropped considerably in September to 98.7 from 105.6 in August. This represents the largest monthly decline in three years.

Global Perspective

The equity markets in China posted their best week since 2008. The Chinese central government moved forward with a series of stimulus measures which included $114 billion of direct equity investments to boost their stock market. This, among other measures, are designed to help support all of China’s capital markets, boost domestic consumption, and stabilize the beleaguered property market.

Market Moving Events

Tuesday: ISM Manufacturing, Construction Spending, Job Openings

Wednesday: ADP Employment

Thursday: Jobless Claims, ISM Services, Factory Orders

Friday: Nonfarm Payrolls

Commentary

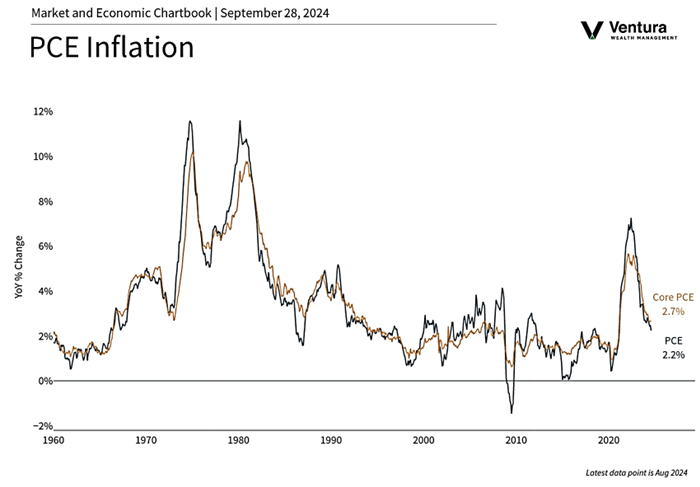

Stimulus measures in China (see the Global Perspective) and better-than-expected inflation figures (see chart) helped to push the DJIA and S&P 500 to fresh records last week, while the Nasdaq came within striking distance of its old high. All three major averages finished the week in the black, despite some weakness on Friday. The Nasdaq was the week’s leader, rallying 0.95%.1 The S&P 500 rose 0.62%.2 And the DJIA brought up the rear, moving 0.59% higher.3 Fixed income yields were largely unchanged. The 10-year Treasury finished Friday with a yield of 3.75%.4

With only one trading day remaining, it looks like investors will be able to get through the notoriously volatile month of September unscathed. October (another notoriously volatile month) looms. For those feeling anxious, a research piece was recently released noting that since 1920, the average return for the S&P 500 has been 35.8% in the 18-month period starting October 1st for years “ending in 4.”5 Equity markets are trading at higher-than-average valuations, so companies will need to continue to perform at or above expectations to maintain momentum.

The week ahead has several key economic releases. Investors will be watching both ISM Manufacturing and Services. Friday’s Nonfarm Payrolls report is the most anticipated release of the week. Analysts expect that the economy added about 145,000 jobs in September.6 It is also projected that the unemployment rate will remain steady at 4.2%.7 Importantly, there are numerous public remarks by Federal Reserve officials which could move markets.

Chart of the Week

The Federal Reserve’s preferred gauge of inflation, the core PCE Deflator, came in below analyst estimates for the month of August. The measure rose 0.1% on the month and 2.7% year over year. The “core” reading excludes food and energy prices.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis, CNBC.com

Statistic of the Week:

Investor’s Business Daily

Global Perspective:

The Financial Times

Commentary:

1. Bloomberg

2. Bloomberg

3. Bloomberg

4. MarketWatch.com

5. Barron’s

6. MarketWatch.com

7. MarketWatch.com