The Profit Margin: September 23, 2024

Statistic of the Week

“Dynamic pricing” is when a company charges more for a good or service when demand increases, and less for the same good or service when demand decreases. A growing number of companies in the U.S. are looking to use dynamic pricing strategies. However, 22% of Americans say that they will not use a company that utilizes dynamic pricing. Members of Generation X, more than any other age cohort, say that they are opposed to patronizing companies that utilize this practice.

Global Perspective

It was a busy week for central banks around the globe. The Bank of England left its benchmark interest rate unchanged at 5.00% after their cut in August. Meanwhile, Brazil started to tighten their monetary policy in their efforts to try to cool stubbornly high inflation. Brazil’s central bank moved their benchmark interest rate up 0.25% to 10.75%. It was their first move in two years, and they indicated more hikes to follow.

Market Moving Events

Tuesday: Consumer Confidence

Wednesday: New Home Sales

Thursday: Jobless Claims, Durable Goods Orders, GDP Revision, Pending Home Sales

Friday: Personal Income and Spending, PCE Index, Consumer Sentiment

Commentary

Reassuring economic data releases coupled with a “jumbo” rate cut from the FOMC buoyed equity markets last week. All three major domestic equity indices finished in the black and the DJIA notched a record high.1 (We should note that the DJIA is trailing its peers by a significant margin on a year-to-date basis).2 Still, of the major averages, the Dow was the week’s leader, popping 1.62%.3 The Nasdaq rallied 1.49%.4 And, the S&P 500 moved up a respectable 1.66%.5 The S&P and Nasdaq are both now positive on a month-to-date basis. Strength in stocks was met by weakness in bond prices driving up longer term interest rates. The 10-year Treasury bond finished Friday with a yield of 3.74% – up 0.12% from the week prior.6

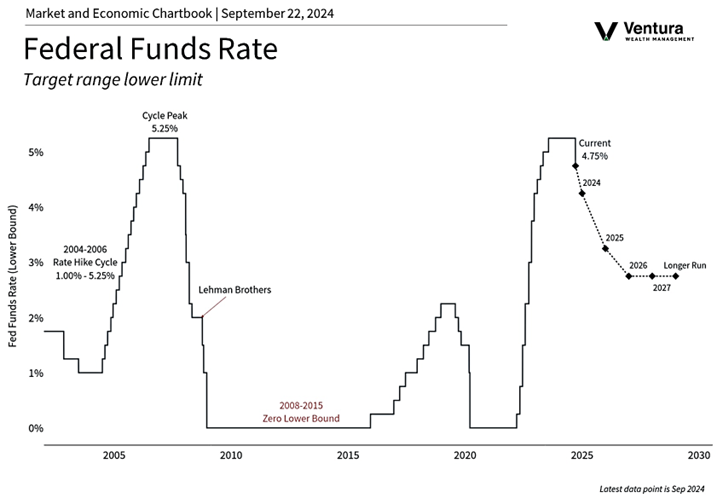

The U.S. consumer continues to demonstrate strength. In the August retail sales report, consumer spending increased 0.1%; analysts had expected a contraction.7 While investors are always watching the health of the consumer, last week’s main story was the FOMC’s cut of the Federal Funds Rate (chart right). In their biggest cut in 16 years,8 Chair Powell emphasized that the Fed was “recalibrating” policy,9 and that the move was meant as “a sign of our commitment not to get behind.”10 Markets are expecting that the FOMC will cut rates 1.00% over the course of 2025.11 This week, several Federal Reserve Governors are slated for public speaking engagements. The hope is that their comments will shed light on the path of monetary policy in the coming months. It is expected that the Fed will vary the magnitude and timing of future cuts. The trajectory of inflation, employment, and the health of the economy will influence the Fed’s course of action.

Chart of the Week

The FOMC cut interest rates for the first time in the U.S since March 2020. The “jumbo” cut (0.50%) reduced the target range from 5.25%-5.50% to 4.75%-5.00%. The Fed indicated that there could be further cuts this year.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Federal Reserve,

The Economist

Statistic of the Week:

Investor’s Business Daily

Global Perspective:

The Economist

Commentary:

1. Investor’s Business Daily

2. Bloomberg

3. Bloomberg

4. Bloomberg

5. Bloomberg

6. MarketWatch.com

7. Investor’s Business Daily

8. Investopedia

9. Barron’s

10. Investor’s Business Daily

11. Investor’s Business Daily