The Profit Margin: September 9, 2024

Statistic of the Week

Since the Supreme Court cleared the way for states to legalize online sports betting, household balance sheets have been significantly impacted according to a recent study at the University of Kansas. Every dollar that a household spends on sports betting translates into two dollars not being invested into retirement savings according to a report. People are using funds that would have been slated for retirement accounts or they are taping credit cards to make the betting transactions.

Global Perspective

China announced that it is no longer allowing foreign adoptions of the country’s orphans. Moving forward, only Chinese citizens who are relatives of the orphaned children will be able to adopt them. Over the past 30 years, 150,000 Chinese children have been adopted by families living outside of China, with the majority happening in the United States. There are currently hundreds of adoptions in process from China to the U.S.

Market Moving Events

Wednesday: Consumer Price Index

Thursday: Jobless Claims, Producer Price Index, Federal Budget

Friday: Import Prices, Consumer Sentiment

Commentary

Investors came back from summer vacation and started September in a foul mood. Concerns about the employment situation, the tech sector, and the 2024 election weighed on sentiment. All three major equity averages finished the week in the red. The DJIA held up the best, falling 2.93%.1 The S&P 500 had its weakest week of the year;2 it declined 4.25%.3 And the Nasdaq faired the worst, posting its largest weekly decline since January 2022.4 It retreated 5.77%.5 Treasury bond prices had a substantial rally as yields fell. Parts of the yield curve even became un-inverted (normalized).6 The yield on the two-year Treasury fell to 3.65% while the yield on the ten-year Treasury fell to 3.71%.7

There is little doubt that the labor market has cooled. In Friday’s Nonfarm Payrolls report, we learned that the economy added 142,000 jobs in August, well below analyst estimates of 160-165 thousand.8 Additionally, the figures for June and July were revised lower.9 The JOLTS report was also released last week. JOLTS is a report on job openings in the economy. This figure was also well below analyst estimates, and perhaps more significantly, registered at a three-and-a-half-year low.10 The softening of the employment situation will be central to the FOMC’s rate decision to be announced on September 18th. Markets are currently forecasting a 0.25% rate cut.11 Importantly, markets are now expecting a full 1.00% of cuts between now and the end of the year.12 This week we will receive two additional key data points on inflation – the Consumer Price Index and Producer Price Index readings for August. Further volatility is expected. Remember, September is historically troublesome for stocks.

Chart of the Week

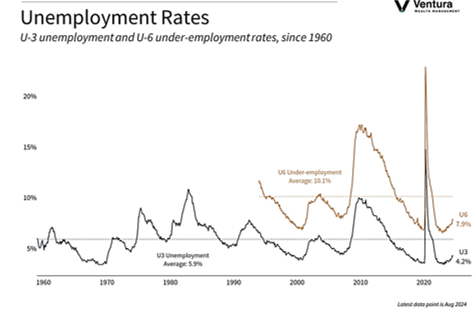

The U3 unemployment rate (blue line) ticked down in the month of August to 4.2% from 4.3% the month prior. The figure was in line with analyst expectations.

Source Materials

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics,

Bureau of Economic Analysis

Statistic of the Week:

401(k) Specialist Magazine

Global Perspective:

BBC News

Commentary:

1. Bloomberg

2. Investor’s Business Daily

3. Bloomberg

4. Investor’s Business Daily

5. Bloomberg

6. Investor’s Business Daily

7. MarketWatch.com

8. Bureau of Economic Analysis

9. Bureau of Economic Analysis

10. Barron’s

11. Investor’s Business Daily

12 .Investor’s Business Daily