The Profit Margin: May 30, 2023

Statistic of the Week

San Francisco is an expensive city to live in – it is even more expensive if you are planning on raising a child there. The average annual cost of raising a child in the Bay Area is a little less than double the national average, and highest of the 381 cities across the country studied. The average annual cost is $35,647 in San Francisco. Morristown, Tennessee registered the least expensive city to raise a child.

Global Perspective

Microsoft recently issued a warning that the company believes that Chinese hackers, in a state-sponsored group, have gained access to and attacked critical U.S. infrastructure. The areas believed to be impacted include cyber framework across industries “with a focus on gathering intelligence.” Their efforts were primarily to impact communication capabilities between the U.S. and Asia.

Market Moving Events

Monday: US Markets Closed

Tuesday: Consumer Confidence

Wednesday: Beige Book

Thursday: Jobless Claims, Construction Spending, ISM Manufacturing

Friday: Nonfarm Payrolls

Commentary

With investors on edge, anxiously awaiting a debt ceiling deal all week, domestic equity averages had mixed performance. (The debt ceiling deal came over the weekend. It has not passed through Congress yet and it sounds like the leadership on both sides of the aisle have some work to do to get it across the proverbial “finish line”). The DJIA finished the week down 1%.1 That result put the Dow in the red on a year-to-date basis.2 The S&P 500 logged a moderate move higher of 0.32%.3 And the Nasdaq, fueled by the possibilities of an artificial intelligence (AI) boom, jumped 2.51%.4 That index is having its best start to a year since 1991.5 Bond yields jumped on high inflation and spending figures. The 10-year Treasury finished Friday with a yield of 3.82%, up 0.13% from the week prior.6

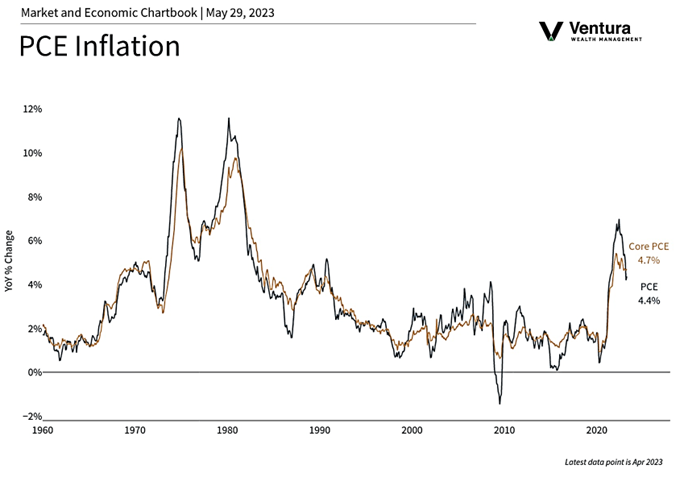

The stronger-than-expected PCE report (chart right), coupled with personal spending rising 0.8% in April (double expectations),7 contributed to the jump in bond yields. It also caused the odds of a 0.25% rate hike in June to rise substantially, from 17.4% a week earlier to 66.5% on Friday’s close.8 It is important to remember that, just as inflation did not go up in a straight line, it is unlikely to come down in a straight line. This week’s Nonfarm Payrolls report on Friday, which is expected to show the economy added 188,000 jobs, is a key piece of data on which the ultimate “hike or pause” decision may rest.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week:

Clearnomics, Bureau of Labor Economic Analysis, The New York Times

Statistic of the Week:

CNBC.com, SmartAsset.com

Global Perspective:

CNBC.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s

6.Bloomberg

7. Investor’s Business Daily

8. Barron’s