The Profit Margin March 13, 2023

Statistic of the Week

The failure of Silicon Valley Bank is the second-largest bank failure in American history. A run on the bank, coupled with a failed capital raise, forced regulators to take over the bank. The FDIC has said that all depositors will have access to their insured funds on Monday morning. The bank was the 16th largest in the country with approximately $209 billion in assets.

Global Perspective

Mondelez, the food manufacturer that owns the chocolate brand Toblerone, outsourced some production from Switzerland to Slovakia in June 2022. The move ran-afoul of Switzerland’s branding laws which came into effect in 2017 – effectively negating the “Swissness” of the chocolate bars. As such, the Swiss flag and iconic Alp’s imagery are being removed from Toblerone’s packaging.

Market Moving Events

Tuesday: Consumer Price Index (CPI)

Wednesday: Retail Sales, Producer Price Index (PPI)

Thursday: Jobless Claims, Housing Starts

Friday: Industrial Production, Leading Economic Indicators (LEI), Consumer Sentiment

Commentary

It was an ugly week on Wall Street. Hawkish comments by Fed Chair Powell, coupled with the untimely collapse of Silicon Valley Bank, pushed all three major domestic indices firmly in the red. The DJIA fell 4.44%, the S&P 500 retreated 4.55%, and the Nasdaq sank 4.71%.1 The significant weekly moves pushed the DJIA into negative territory for the year.2 The S&P 500 is more or less flat on a year-to-date basis.3 Drastic price swings were not confined to the equity markets. The yield on the 10-year Treasury sank 0.27% to close Friday at 3.69%.4 It was just a couple weeks ago where the yield was flirting with 4.00%.

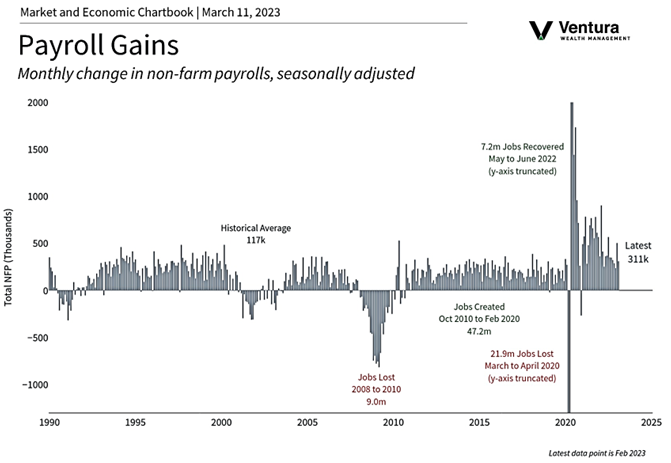

Early in the week, during Chair Powell’s testimony, focus was centered on the pace and magnitude of future rate hikes. The Chairman indicated that the Federal Reserve may have to pick up the pace of the hikes to combat inflation. That was until the collapse of Silicon Valley Bank (see the “Statistic of the Week”). There have been fears for the past year that the Fed would keep raising rates until something “broke.” The demise of the nation’s 16th largest bank likely qualifies as something breaking. As a result, the odds of a 0.50% rate hike on March 20th fell from 80% pre-SVB to 60% post-SVB.5 February’s payrolls report (chart right) was a “Goldilocks” figure. Payrolls increased, wage growth was tame, and hours worked contracted slightly.6 This may give the Fed enough of a reason to only raise rates 0.25% this meeting. This week’s CPI and PPI reports will be key.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Bureau of Labor Statistics, CNBC.com

Statistic of the Week:

The Wall Street Journal

Global Perspective:

Yahoo! Finance

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Barron’s

6. Inventor’s Business Daily