The Profit Margin: January 17, 2023

Statistic of the Week

An outbreak of avian flu is causing a spike in egg prices. In last week’s CPI report, the price of eggs were shown to have increased 11.1% from November to December and logged a 59.9% year-over-year rise. This increase was the largest annual change in the price of eggs since September 1973. The US egg-laying flock fell by about 10% (or 40 million hens) as a result of the outbreak.

Global Perspective

17 elements compose the group of “rare earth” minerals that are used in a variety of high-tech devices including cell phones, green technology, and defense systems. Sweden has reported that it has discovered Europe’s largest deposit of rare earth minerals. This is a potential gamechanger as Europe currently mines none of its own rare earth minerals and imports them almost exclusively from China

Market Moving Events

Monday: US Markets Closed

Tuesday: Empire State Manufacturing

Wednesday: Retail Sales, PPI, Industrial Production, NAHB Home Builder’s Index, Beige Book

Thursday: Jobless Claims, Building Permits, Housing Starts

Friday: Existing Home Sales

Commentary

Continued optimism bolstered by declining inflation rates helped push stocks higher and yields on fixed income positions lower last week. All three major indices finished the week in the black. The Nasdaq was far and away the week’s best performer, rallying 4.82%.1 The S&P 500 rallied 2.67%.2 And last year’s best performer, the DJIA, was last week’s laggard, moving 2.00% higher.3 In the fixed income markets, the yield on the 10-year Treasury declined 0.06% and finished Friday at 3.51%.4

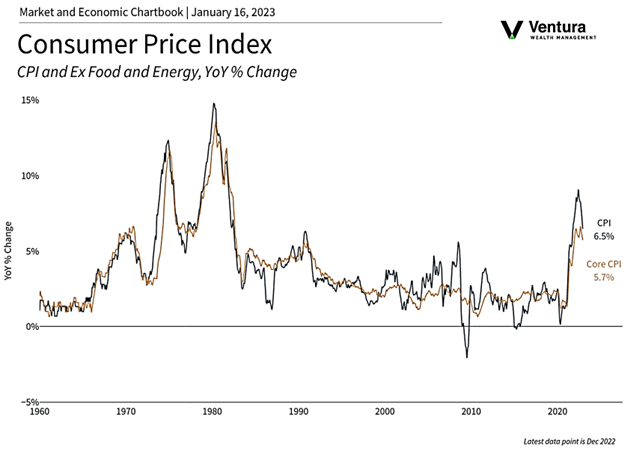

Last week’s big news item was the CPI reading (chart right). Headline inflation cooled from an annualized rate of 7.1% in November to 6.5% in December.5 Multiple Fed officials including Chair Powell gave public remarks last week (more are scheduled to do so this week), and none said much to sour market sentiment. It is apparent that Chair Powell is emphasizing the Fed’s focus on wage and services inflation at this juncture.6 This week’s PPI reading on Wednesday will hopefully confirm that inflation is continuing its descent throughout the economy.

In the week ahead, earnings’ season continues. The health of the consumer will be in focus with the retail sales report for December. Investors are hoping to see more positive data points on the consumer and inflation situations. These data points will help bring clarity around the “will we / won’t we” debate around recession.

Chart of the Week

Sources

Market Moving Events:

MarketWatch.com

Chart of the Week: Clearnomics, Bureau of Labor Statistics

Statistic of the Week:

Yahoo! Finance

Global Perspective:

BBC.com

Commentary:

1.Bloomberg

2.Bloomberg

3.Bloomberg

4.Bloomberg

5. Investor’s Business Daily

6. Investor’s Business Daily